Per CapitolTrades.com, a platform providing data related to politicians’ trades, Debbie Dingell, the U.S. representative for Michigan’s 6th Congressional District, recently bought the shares of BlackRock (NYSE:BLK) and Corteva (NYSE:CTVA).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As per the data, Dingell bought these stocks on April 10 and recently reported the purchases. Moreover, the trades had a transaction size range of $15-$50K.

While Dingell bought BLK and CTVA stocks, let’s check what’s on the horizon for these stocks by leveraging TipRanks’ data.

What’s the Prediction for BlackRock Stock?

Economic weakness and rapid rate hikes have weighed on the financial performance of the world’s leading asset management company, BlackRock. Its Q1 revenues fell 10%, reflecting lower markets, dollar appreciation, and subdued performance fees. However, its long-term net inflows increased, reflecting 5% annualized organic asset growth, which is positive.

Wall Street analysts remain cautiously optimistic about BLK stock amid macro uncertainty and a slight moderation in organic base fee growth. It has received nine Buy and four Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $757.31 represents 8.75% upside potential from current levels.

While analysts are cautiously optimistic, insiders sold BLK stock worth $35.9M last quarter. On the other hand, hedge funds accumulated 91.9K shares of BlackRock during the same period. Overall, BLK stock has a Neutral Smart Score of seven on TipRanks.

Is CTVA Stock a Buy, Sell, or Hold?

Corteva is a seed and agricultural chemical company. It is benefitting from favorable pricing and product mix, which are driving its sales. Meanwhile, productivity savings support its bottom line. CTVA’s management remains upbeat and expects its top line, margins, and earnings to improve in 2023.

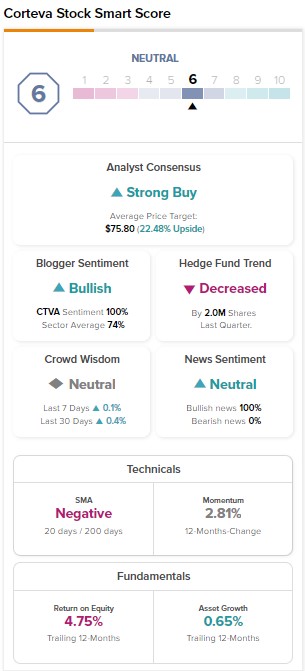

Thanks to the resiliency of its business, analysts are bullish about CTVA stock. It has received 10 Buy and one Hold recommendations for a Strong consensus rating. These analysts’ average price target of $75.80 implies 22.48% upside potential.

While analysts recommend a Buy, hedge funds sold 2M shares of CTVA last quarter. At the same time, Corteva stock carries a Neutral Smart Score of six on TipRanks.

Bottom Line

Following the trades of politicians could help investors make informed investment decisions. Along with that, retail investors can use TipRanks’ Experts Center tool to trade more confidently. As for the BLK and CTVA stocks, Corteva has a higher upside potential than BlackRock. CTVA also sports a Strong Buy consensus rating, which is better than BLK.