Microsoft’s (NASDAQ:MSFT) most recent quarterly results showed strength across the board, offering plenty of fodder for the bulls. Azure growth accelerated, commercial bookings and RPO both jumped, and the guide was raised not just for revenue, but for margins and EPS too.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, as Morgan Stanley analyst Keith Weiss points out, shares have been largely flat since the readout, lagging both the broader market and software peers. That begs the question, “’what has been weighing on shares’?”

Weiss, who ranks amongst the top 3% of Street stock experts, has identified three main concerns: Microsoft’s “evolving relationship” with OpenAI, the sustainability of Azure’s momentum, and the outlook for its Productivity apps amid the rise of Agentic computing. According to Weiss, these worries are largely misplaced.

As for the OpenAI issue, the $300 billion deal with Oracle has raised questions about Microsoft’s GenAI strategy – especially since Microsoft has a Right of First Refusal on OpenAI infrastructure. Why would the company pass on such a massive contract? Yet, Weiss sees the contract as an “incrementally positive data point.” Microsoft appears focused on directing its limited GPU and data center resources to enterprise clients, which helps reduce concentration risk, supports stronger margins, broader software adoption, and more durable revenue given the long life cycle of enterprise applications.

As for Azure’s growth story, it is “more than just GenAI.” After a period of cloud optimization, enterprise migrations are picking up again, and Microsoft appears “best positioned to benefit from this inflection.” Weiss has argued that Azure could eventually overtake AWS, and the thesis still holds: enterprises are shifting from CapEx replacement to OpEx efficiency, which favors PaaS and plays to Azure’s strengths, CIOs consistently rank Microsoft as the top IT budget share gainer, early AI integration boosts workloads, and Microsoft’s enterprise relationships and neutral market position give it an edge. Meanwhile, CIOs report that 44% of workloads are already in the cloud, up from 40% last year, and they expect this to reach 68% by 2027. PaaS is set to see the fastest growth, SaaS continues to dominate overall shifts, and on-prem workloads are declining.

Finally, there’s the question of Agentic AI tools threatening Microsoft’s productivity apps. The data suggests that’s not a concern. According to the 2Q25 CIO survey, Microsoft still holds strong mind share with both CIOs and information workers, and its productivity suite remains “strong and stable.” In fact, Weiss says recent trends point to “further durability,” suggesting AI upstarts are unlikely to displace Microsoft anytime soon.

With these factors in mind, Weiss has “confidence in a path to shedding those weights,” and given its “broadening set of growth drivers,” he now considers MSFT a Top Pick.

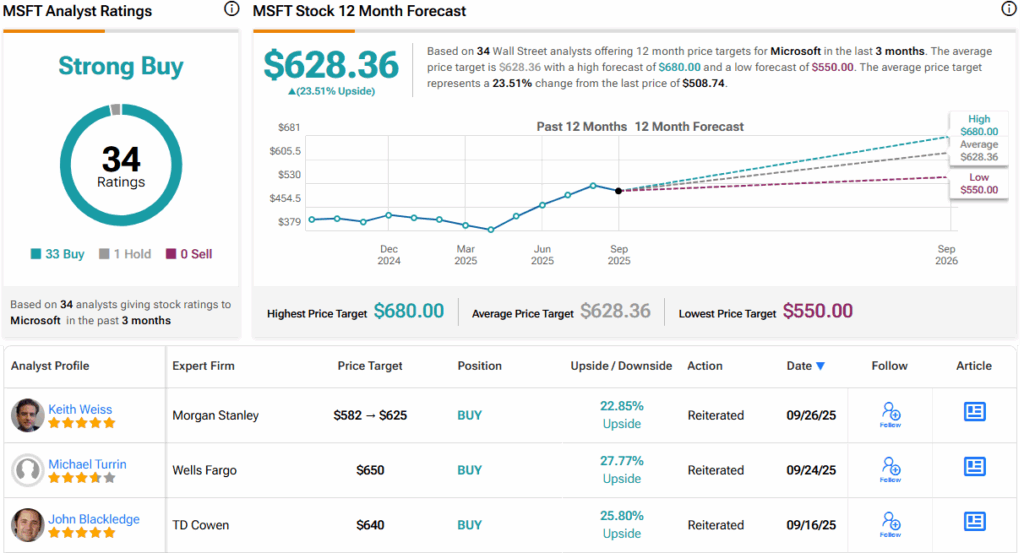

Accordingly, the 5-star analyst raised his price target from $582 to $625, implying the stock will gain 23% over the one-year timeframe. Hardly needs mentioning, but Weiss’ rating stays an Overweight (i.e., Buy). (To watch Weiss’s track record, click here)

While on the Street one analyst remains an MSFT skeptic, all 33 other recent reviews are positive, making the consensus view here a Strong Buy. The forecast calls for 12-month returns of 23.5%, considering the average target clocks in at $628.36. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.