As Russia’s war on Ukraine rages on, global stock markets seem to be wrapped in a bear hug. In contrast, commodity markets are surging with oil going past $126 a barrel on Tuesday as fears rose that the U.S. may ban Russian oil imports.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a Reuters report, Russia is the world’s second-biggest exporter of oil, with its shipments of crude oil and related products combined reaching 7 million barrels per day.

However, oil prices rising is only one part of the story. Other commodities like gold, nickel, and other metals are also experiencing a surge. Recently, gold topped $2000 per ounce, while nickel prices jumped more than 20% to surpass $38,000 for the first time since June 2007.

In this environment, where does this leave investors? Can advantage be taken of higher commodity prices?

Using the TipRanks stock screener, we looked at stocks that could stand to benefit from the increase in commodity prices. We further filtered these stocks by analysts’ bullish sentiment, by smart score, and by those which offered a higher upside potential (more than 20%) to its price target.

Here are the stocks that we shortlisted:

Kinross Gold Corp. (NYSE: KGC)

Kinross Gold is a Canadian gold mining company with mines and projects located in the U.S., Brazil, Russia, Mauritania, Chile, and Ghana. The company has operated in Russia for the past 25 years, and its operations are located in the Russian Far East, approximately 7,000 kilometers away from Ukraine.

This year, Kinross anticipates 13% of its gold production to stem from its Russian-based activities. While initially, the company had announced that its operations in Russia will continue, on March 2, the company shifted its tone. KGC stated in its press release that it is going to suspend its Russian operations.

Following this announcement, BMO Capital analyst Jackie Przybylowski has removed all Russian assets from Kinross Gold’s valuation. However, the analyst continues to be upbeat about the stock as she believes that “Kinross shares are oversold.”

Moreover, the analyst assumes that Kinross may permanently discontinue its operations in Russia or pursue a potential sale of its Russian assets.

However, even after removing KGC’s Russian assets, the analyst continues to see “significant value from the remainder of the portfolio — either as a re-rating when the market’s focus returns to Tasiast [mine in Mauritania] and the other growth assets, or if Kinross becomes a candidate for acquisition.”

As a result, Przybylowski is bullish with a Buy rating but lowered her price target from $11 to $10.50 on the stock. This price target is almost double KGC’s closing stock price of $5.50 as of March 7, implying a 92% upside potential.

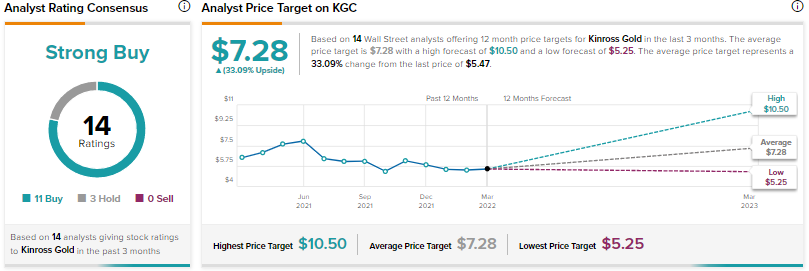

Other analysts on Wall Street echo Przybylowski with a Strong Buy consensus rating based on 11 Buys and three Holds. The average Kinross Gold stock prediction is $7.28, which implies upside potential of approximately 33.9% from Monday’s market close.

Hudbay Minerals (NYSE: HBM)

Hudbay Minerals is a Canadian mining company that primarily produces copper concentrate (containing copper, gold, and silver), zinc metal, and silver or gold doré. The company owns four ore concentrators, three polymetallic mines, and a zinc production facility in Canada and Peru. Besides this, HBM also has copper projects in Arizona and Nevada in the U.S.

In 2021, Hudbay produced 99,470 tons of copper, up 4% year-over-year, while gold production soared 55% year-over-year to 193,783 ounces. In Q4, the company generated revenues of $425.2 million versus $322.3 million over the same period last year.

Last week, copper prices had hit an all-time high of $10,910 per ton before falling to $10,366 per ton on Monday amid fears of metal shortages. It remains to be seen whether HBM will benefit from higher copper prices.

When it comes to its Q4 results, BMO Capital analyst Przybylowski pegged them as “in-line” but remained optimistic about the company’s future growth plans. This includes the progress of Hudbay’s Rosemont and Copper World projects in Arizona.

The analyst added that 2022 could be a “busy year” as the company makes progress on smaller improvement projects including “accelerated development of the 1901 deposit in Snow Lake [Manitoba], continued investigation into tailings reprocessing at 777 [Manitoba], and greenfield drilling in Peru.”

The analyst remained optimistic about the stock with a Buy rating and a C$14 (or $11.01 USD) price target implying a 40.2% upside potential.

The rest of the Street echoes Przybylowski and is bullish about the stock, with a Strong Buy consensus rating based on an unanimous 6 Buys. The average Hudbay Minerals stock prediction is $10.61, which implies upside potential of approximately 35.2% from HBM’s Monday closing price.

Moreover, the stock commands a high TipRanks Smart Score of 8, supported by positive sentiment by bloggers and investors, as well as increased purchases by hedge funds. All of this indicates that the stock is highly likely to outperform the market.

Steel Dynamics (NASDAQ: STLD)

Steel Dynamics is a large steel producer and metal recycler in the U.S. The company’s product portfolio includes hot roll, cold roll, coated sheet steel, and structural steel beams and shapes. The company’s facilities are located throughout the U.S. and in Mexico.

The company delivered record net sales of $18.4 billion in 2021, with operating income coming in at $4.3 billion. Steel Dynamics steel and steel fabrication shipments hit a record 11.2 million tons and 789,000 tons, respectively.

Moreover, STLD expects demand to persist this year. Mark Millett, Chairman, and CEO of Steel Dynamics commented on the company’s outlook, “Based on domestic steel demand fundamentals and customer confidence, we believe North American steel consumption will experience steady growth, supported by the construction, automotive, and industrial sectors.”

What’s more, J.P. Morgan analyst Michael Glick believes that “higher steel prices going forward… following the dislocation in steel/raw materials supplies out of the Black Sea,” could further benefit the stock.

As a result, the analyst is optimistic with a Buy rating and raised the price target from $86 to $95 per share, indicating a 31.3% upside potential from Monday’s closing price.

However, other analysts on Wall Street are cautiously optimistic about the stock, with a consensus rating of Moderate Buy based on 3 Buys, 1 Hold, and 1 Sell. The average STLD stock prediction is $72, which implies that the stock is priced in at current levels.

What’s more, Steel Dynamics scores a ‘perfect’ TipRanks Smart Score of 10, supported by positive sentiment by bloggers, as well as increased purchases by hedge funds. These metrics suggest that the stock is highly likely to outperform the market.

Chevron (NYSE: CVX)

Chevron Corp. is an integrated chemicals and energy company that engages in the manufacture, development, and transport of crude oil and natural gas. The company’s business segments include Upstream, Downstream, and Chemical Operations.

The company held its Investor Day on March 1 and again reinforced its strategy of improving capital and cost efficiency and reducing its carbon intensity.

For RBC Capital analyst Biraj Borkhataria, while the company’s Investor Day did not contain “many fireworks,” it reinforced CVX’s “continued discipline on opex and capex, and a stable shareholder returns framework.” This argument reiterated his investment case for the stock.

There are several other reasons for Borkhataria to be positive about the stock. The analyst believes that Chevron stands to benefit more than its peers from higher oil prices given the company’s larger exposure to the commodity in its business portfolio than of its peers.

Another positive for the stock is Chevron’s assets in the Permian basin, considered “most valuable” by Borkhataria, which could create production growth at a faster pace for the company.

The analyst is also optimistic about CVX’s strong balance sheet and healthy cash margins, and believes that the company has moved out of “the heavy investment phase and is firmly in the cash harvesting/sustaining phase, which is typically what leads to higher shareholder returns.”

Following the Investor Day, Borkhataria reiterated a Buy rating and raised the price target from $155 to $160 (1.3% downside) on the stock. Due in part by recent geopolitical tumult, the stock has already overshot this valuation with a closing stock price of $162.04 on March 7.

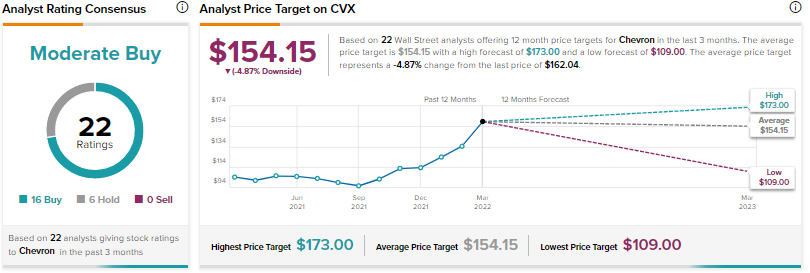

Other analysts are, however, cautiously optimistic about Chevron with a Moderate Buy consensus rating based on 16 Buys and six Holds. The average CVX stock prediction is $154.15, which implies downside potential of approximately 4.9% to current levels for this stock, before the market opened on Tuesday, March 8.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.