Colgate-Palmolive (NYSE:CL) is a Dividend Aristocrat due to its impressive track record of increasing dividends for 60 consecutive years. The company’s strong brand name and dominant position across multiple product categories support its capital deployment activities. Besides for offering a steady income stream, CL stock is currently loved by Wall Street analysts, as it sports a Strong Buy consensus rating.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s What Analysts Are Saying About CL Stock

In a research note to investors on December 15, BofA analyst Bryan Spillane upgraded the stock’s rating to Buy from Hold. Also, he raised the price target to $90 (implying 16.4% upside potential) from $75.

The analyst believes that Colgate-Palmolive’s dominant market position, diverse global reach, and aggressive growth plans position it well for any economic downturn. Furthermore, Spillane raised estimates for 2024 and 2025 on new product introductions.

Another analyst, Andrea Teixeira of J.P. Morgan, maintained a Buy rating on CL stock and raised the price target to $88 (13.8% upside) from $83. The analyst noted that the company is on the right track to either meet or exceed the estimates. Moreover, Teixeira is optimistic about the company’s organic sales growth, volume recovery, and acceleration in gross margin improvement.

Is Colgate-Palmolive Stock a Buy?

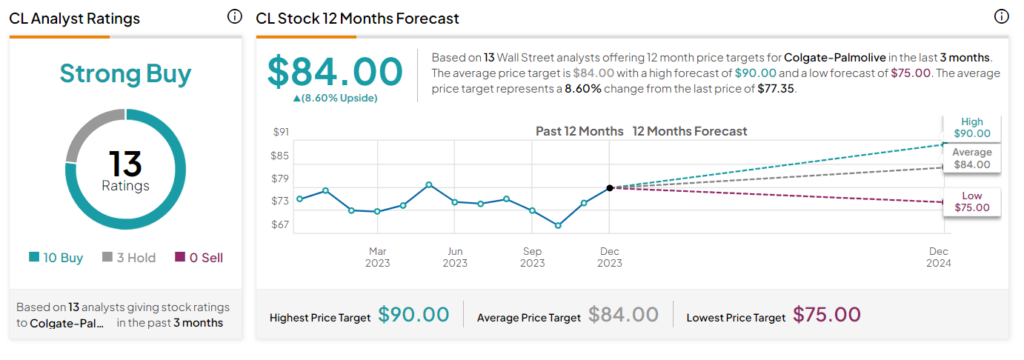

Overall, CL commands a Strong Buy consensus rating based on 10 Buy and three Hold recommendations. Also, the average CL stock price target of $84 implies a 8.6% upside potential from current levels.

Ending Thoughts

Colgate-Palmolive’s strong presence in the Consumer Staples sector positions it well for the future. In addition, the company’s commitment to enhancing shareholders’ value makes it an attractive choice for those seeking both income and stability in their investment portfolio.