Typically, the reputation that the options market carries centers on risky speculative ventures. While that’s one angle, these derivative trades can also provide income opportunities on otherwise boring stocks like Colgate-Palmolive (NYSE:CL). Indeed, the boring and predictable nature of the consumer goods giant makes it an interesting idea for options trading. I am bullish on CL stock because it offers a little something for everyone.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CL Stock Can be So Much More Than a Recession-Resistant Play

For much of last year, most investors likely earmarked a select few enterprises that offered recession resistance. That’s not much of a controversial statement. Early in 2023, the regional banking crisis shook the market, causing even the most bullish investors to rethink their approach. Anyone interested in staying in the market during this tumultuous cycle may have turned to CL stock for obvious reasons.

Fundamentally, the underlying business offered permanently relevant products. No matter what’s going on with the economy, people won’t give up their oral care routine. As well, basic hygiene is a must for personal and business endeavors. Therefore, CL stock made sense no matter what the situation. And with the Federal Reserve hinting at lower interest rates later this year, Colgate could see a relevance lift.

Basically, should borrowing costs decline, then newly-issued government bonds (with lower yields) won’t be as attractive. Stated differently, bonds will compete less with publicly-traded securities that offer dividends. Still, the Fed would have to be extremely dovish for CL stock to look resoundingly attractive on a passive income basis.

Instead, Colgate is arguably most attractive for its predictable, recession-resistant business. However, the act of lowering rates implies that the Fed is satisfied with wider economic conditions. So, a good chunk of CL’s relevance has been moderately diminished.

At the same time, this is where options trading can come in handy. At the elementary level, retail investors can choose to take directional bets on CL stock with bought calls or puts — calls if you anticipate higher prices or puts if you anticipate lower prices.

However, looking at its performance since 2020, CL stock has been arguably net flat for the most part. Yes, it gyrates, but the price action tends to revert to the mean. That makes selling (writing) options quite attractive.

Underwriting (Limited) Risk for Income

Generally, the concept of buying options is intuitive. In exchange for the right to buy (call) or the right to sell (call) the underlying security at the listed strike price, you pay a premium (the price of the option). Selling options is the same principle but in reverse. In exchange for underwriting the risk that shares can rise (sold calls) or fall (sold puts), you receive a premium.

That’s where the income part comes into play. For example, someone may want to place a bet with you that a certain security will rise above a defined price by a predetermined date. You believe otherwise. However, as the seller of the options (in this case, call options), you’re obligated to fulfill the terms of the contract under exercise; that is, sell 100 shares of the target security per each contract.

Of course, that’s a big risk to underwrite. To agree to the deal, you require an upfront payment (i.e. the premium). By logical deduction, the likelier it is that an option contract will be in the money (ITM), the higher the premium.

Now, in volatile securities, writing options – especially uncovered call options where you don’t already have the underlying security to cover the obligation under exercise – can be wildly risky. However, for something like CL stock, the risk is significantly mitigated. Currently, CL features a 60-month beta of only 0.44, far lower than the volatility of the benchmark equities index.

Therefore, astute investors can write options with a high degree of confidence that their positions won’t get blown up by unforeseen extreme volatility. For instance, on October 26 of last year, options flow data recorded 2,000 contracts of the CL Jan 17 ’25 80.00 call being sold by a major trader (or traders). The premium received for this transaction came out to just over $1 million.

At the time of the trade, CL stock exchanged hands at around $73.16. Now, shares are at $81.41. Sure, Colgate shares rose, but not nearly enough to cause the call writers severe anxiety.

Financials Support the Risk Underwriters

While writing call options is generally a high-risk proposition due to the potential for uncapped losses (if the position is uncovered), Colgate’s financials represent another reason why such a trade could be appealing for CL stock. In particular, shares trade at a lofty trailing-year earnings multiple of 42.1x. That’s well above the household and personal products sector’s average multiple of 26.6x.

In fairness, Colgate’s multiple is rich in large part because of the underlying predictability. If you’re seeking a stout enterprise that can tackle recessionary storms, CL stock is it. It’s a great idea for conservative, risk-averse investors. However, because it’s so appropriate for such types, CL is ironically useful for market gamblers wanting to scalp some income.

Basically, Colgate probably won’t shoot to the moon. However, it also likely will not leave a massive crater should it encounter turbulence. Such consistency can be exploited – and that’s exactly what the smart money is doing.

Is CL Stock a Buy, According to Analysts?

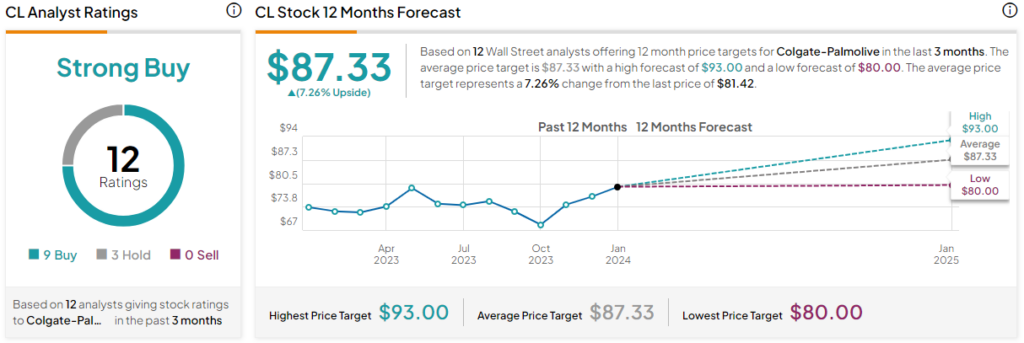

Turning to Wall Street, CL stock has a Moderate Buy consensus rating based on eight Buys, three Holds, and zero Sell ratings. The average CL stock price target is $87.33, implying 7.3% upside potential.

The Takeaway: There’s More Than One Way to Invest in CL Stock

Typically, the approach to an enterprise like Colgate-Palmolive is to acquire shares as part of a reliable holding that can withstand various economic pressures, and that’s reasonable. However, with options trading, investors can also leverage the underlying predictability to generate income for relatively limited risk. Therefore, CL stock has something for everyone.