Since the onset of 2023, there’s been a shift in sentiment in the crypto space. Following 2022’s treacherous bear and the fallout from multiple crises culminating in FTX’s collapse, bitcoin has staged a rebound, gaining 48% year-to-date. And is customary, the leading crypto has dragged with it other coins out of the mire.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s not only other crypto tokens that reap the benefits of a higher BTC price. Stocks in the crypto ecosystem tend to follow in its steps, not least crypto exchange Coinbase (NASDAQ:COIN). In fact, the stock’s gains have so far completely outpaced BTC this year, having delivered returns of 84%.

At the same time, spot trading volumes have increased significantly. And this, says Barclays analyst Benjamin Budish, demands a recalibration to his Coinbase model.

“Q1 volumes are on track to well surpass our prior estimates for Coinbase, and we are updating our model with this new data (our 1Q23 trading volume estimate comes up ~22%),” said the analyst. “Importantly, our analysis indicates much of this improvement is institutional, not retail, therefore our revenue estimates come up less than our volume estimates (~10%).”

So, what is really behind the shift in sentiment? That is “somewhat less clear,” says Budish, although he notes the renewed appetite for risky assets in general and the strong correlation between BTC/ETH and the tech-loaded NASDAQ. “Over the course of 2022, the r-squared between the Invesco QQQ and BTC was 79%, the strongest r-squared on record, and this has pulled back only slightly this year,” Budish explained.

There could be other reasons, too. Optimism around the next major upgrade (Shanghai) to the Ethereum mainnet – the second biggest crypto asset – that will allow users to un-stake Ethereum, while high short interest in Coinbase might have also played its part.

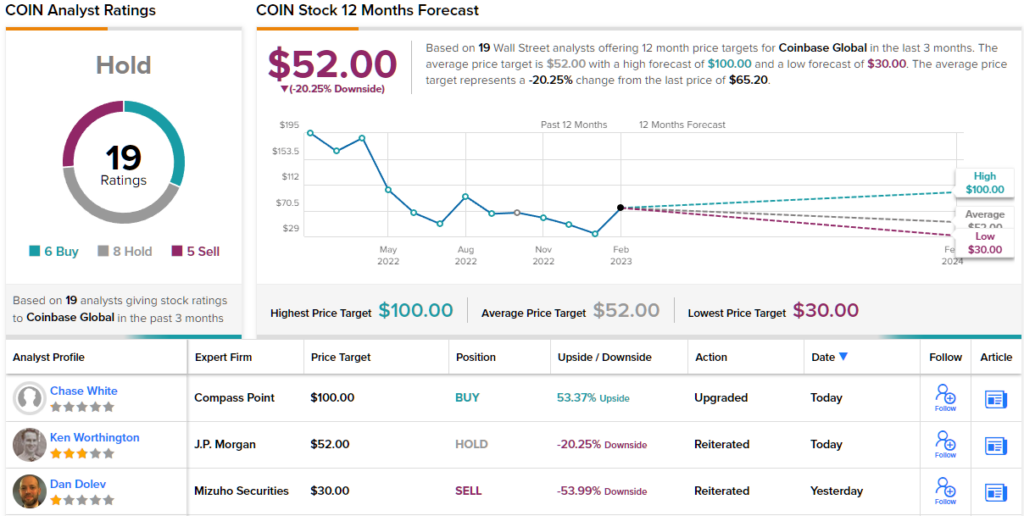

However, ahead of Coinbase’s Q4 report next week (Feb 21), Budish is not quite ready to get on board the bull train. The analyst reiterated an Equal Weight (i.e., Neutral) rating, although he does up the price target from $45 to $57. Still, that target suggests the stock is currently overvalued by ~13%. (To watch Budish’s track record, click here)

Overall, opinions on COIN’s prospects are decidedly mixed; based on a total of 6 Buys, 8 Holds and 5 Sells, the stock claims a Hold consensus rating. At $52, the average target suggests the shares are could drop ~20% over the next `12 months. (See Coinbase stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.