Legendary investor Warren Buffett is known to enjoy Coca-Cola (NYSE:KO) soda, and he has bought and held Coca-Cola stock for years. Yet, in its obsession over the “Magnificent Seven” stocks, the market has practically abandoned Coca-Cola this year. Still, I am bullish on KO stock because the company just served up a two-liter bottle full of Street-beating financial results.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

You know Coca-Cola for its popular non-alcoholic beverage and snack brands. Even if I don’t eat and drink Coca-Cola’s products because I’m trying to monitor my health, I know that plenty of people around the world are loyal consumers.

Buffett also understands this, but I don’t want people to invest in Coca-Cola just because the Oracle of Omaha did. People should look carefully into Coca-Cola’s financials and get the lowdown on the company’s quarterly results, which safety-minded investors will find to be cool and refreshing.

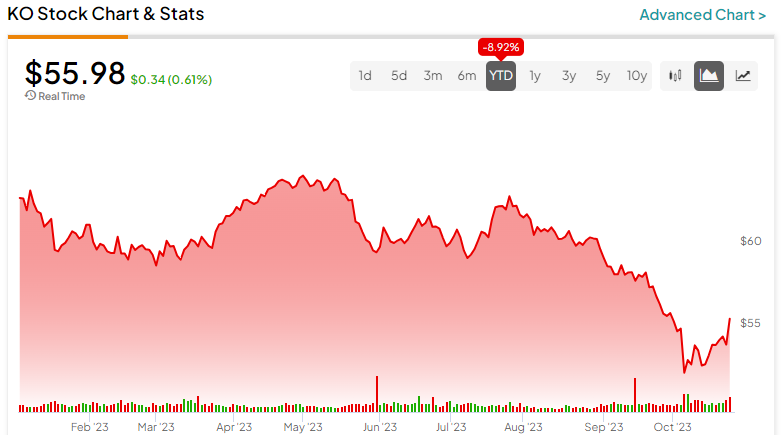

Why Coca-Cola Stock is Down in 2023

Before we pop open a can of financial figures, it’s important to understand why KO stock has been on a downtrend in 2023. How could this Buffett-backed pick perform so poorly when the major stock market indexes are up for the year?

First of all, as I alluded to earlier, Coca-Cola isn’t a technology company, and 2023 has been all about tech stocks. Coca-Cola doesn’t mention generative AI half a dozen times in its conference calls, so the market basically abandoned KO stock.

Second, the market is concerned about high inflation’s impact on Coca-Cola. Will the U.S. consumer continue to buy junk food when prices are elevated? That question was definitely answered by Coca-Cola’s latest round of earnings data – but more on that in a moment.

Additionally, investors have been concerned about the negative impact of foreign exchange rates on Coca-Cola due to the recent strength of the U.S. dollar against foreign currencies. This issue does show up in Coca-Cola’s earnings, but it’s not devastating to the company.

Finally, the market has been worried about how weight loss drugs, such as Novo Nordisk’s (NYSE:NVO) Ozempic and Wegovy, might affect Coca-Cola’s bottom line. However, Coca-Cola CEO and Chairman James Quincey minimized the impact of these weight loss drugs on the U.S. beverage industry, confidently claiming that “there’s very little data on what’s actually happening other than some anecdotal stuff.”

Coca-Cola’s Results Speak for Themselves

Sure, Coca-Cola’s CEO can imply that Ozempic and Wegovy have had a minimal impact on Coca-Cola. Cautious investors should want to see the company’s financial data before making any judgments, however.

As it turns out, Coca-Cola’s results have been pretty impressive. In 2023’s third quarter, Coca-Cola’s net revenue grew 8% year-over-year to $12 billion, beating the analyst consensus estimate of $11.4 billion. Thus, it appears that consumers were still willing to buy Coca-Cola’s products even if prices are high and weight loss drugs are popular now.

Moreover, Coca-Cola reported third-quarter EPS of $0.74, surpassing Wall Street’s call for $0.69. These results prompted Quincey to proclaim, “We delivered an overall solid quarter and are raising our full-year topline and bottom-line guidance in light of our year-to-date performance.”

The company did cite “currency headwinds” as Coca-Cola’s quarterly operating margin declined to 27.4%, versus 27.9% in the year-earlier quarter. However, that’s not a huge decrease, and currency market fluctuations come and go; this is an inevitable by-product of doing business globally.

Is Coca-Cola Stock a Buy, According to Analysts?

On TipRanks, KO comes in as a Strong Buy based on 11 Buys and three Hold ratings assigned by analysts in the past three months. The average Coca-Cola price target is $65.69, implying 17.3% upside potential.

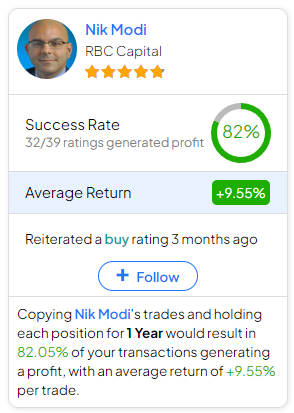

If you’re wondering which analyst you should follow if you want to buy and sell KO stock, the most profitable analyst covering the stock (on a one-year timeframe) is Nik Modi of RBC Capital, with an average return of 9.55% per rating and an 82% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Coca-Cola Stock?

If you really want to be like Buffett, pick stocks representing solid businesses and hold them for a long time. Coca-Cola’s results show that the company, while not a market darling in 2023 so far, is still as solid as a rock.

So, don’t obsess over the impact of inflation, currency shifts, and weight loss drugs on Coca-Cola. Just consider staying calm like Buffett does.