Cloudflare (NET) will report its fourth-quarter earnings after the U.S. market closes today, February 10.

The company runs a cloud platform that provides organizations all around the world with a variety of network services, including content delivery services. It also provides security solutions and protects websites from malicious attacks.

Given that it’s an online networking organization, more virtual visits to its website equals more demand for its products and solutions, which translates to more subscriptions and revenues for Cloudflare, and vice versa.

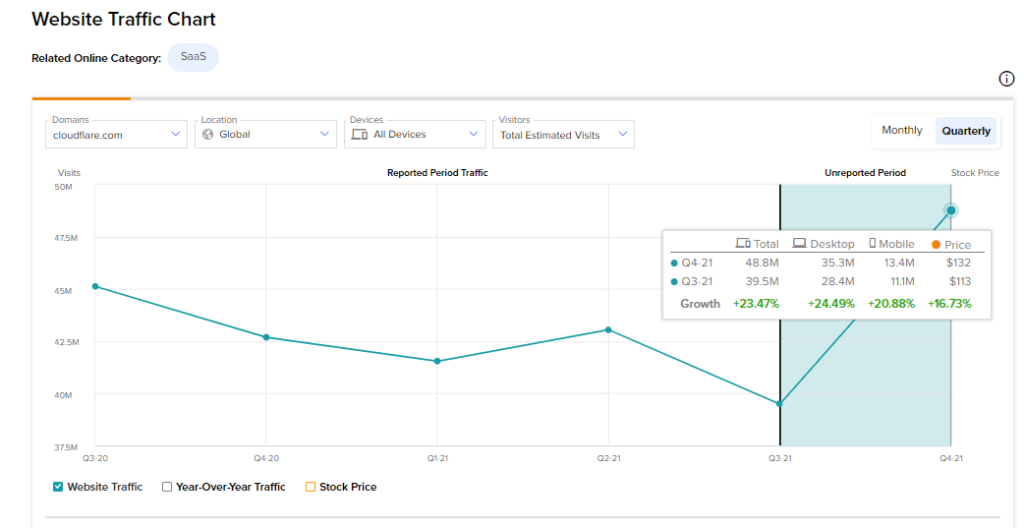

Therefore, in order to figure out what to expect from NET’s earning, we used TipRanks’ new tool to look at the company’s website user statistics. The tool allows us to see online visit counts by quarter, month, and location.

NET’s Website Visits Showed Encouraging Results

Using the tool, we noticed that overall expected visits to the Cloudflare website increased considerably in Q4. The total projected global visits to cloudfare.com increased by 23.5% sequentially from the third quarter.

The above chart shows that Cloudflare’s platform is gaining immense popularity in the face of rising cyberattacks. Given the spike in the monthly usage statistics, the company’s sales and client base are expected to have expanded significantly in the fourth quarter.

Furthermore, according to TipRanks’ new algorithm, website visits to cloudfare.com rose 14.2% year-over-year in Q4 2021 compared to Q4 2020.

The growing demand for security solutions, which is becoming increasingly crucial as a result of increased cyberattacks and work-from-home laws, is driving demand for Cloudflare’s products. In addition, the company’s continual focus on developing innovative goods has proven to be critical to its success.

Wall Street’s Take

Wall Street analysts are cautiously optimistic on Cloudflare, with a Moderate Buy consensus rating based on 9 Buys, 6 Holds, and 1 Sell. The average Cloudflare stock prediction of $155.56 implies upside potential of approximately 35.5% to current levels for this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure