Clorox (NYSE:CLX) is a textbook example of a safe, consumer-defensive sector stock for cautious investors. You can expect dividends from Clorox this year, but I am neutral on the stock because the company doesn’t present compelling reasons for growth seekers to take a position.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Clorox sells an array of cleaning products, including bleach. In addition, Clorox provides various household goods, such as drain cleaner, cat litter, trash bags, and even salad dressing.

Even if there’s a severe recession this year, people will continue to use these types of products. Therefore, CLX is a “steady Eddie” type of stock, and perhaps a retiree or a very fearful investor might hold this stock along with some Treasury bonds and cash. That’s fine, but keep your expectations low and consider assets with greater profit potential.

Clorox’s Financial Stats Aren’t Great

It’s not difficult to understand why there’s a lack of excitement about CLX stock. Clorox offers a decent dividend, but sensible investors should conduct research on the company’s other financial facts. Frankly, after taking a deeper dive, you’ll probably be unimpressed.

First of all, take a look at CLX stock’s performance in 2022. That was supposed to be the year when consumer-defensive stocks outperformed. Yet, Clorox stock actually declined from a high of ~$180 to a low of ~$120. The company’s 3.2% dividend yield certainly didn’t make up for investors’ share-price losses last year.

Perhaps you’re looking for deep value, but Clorox’s stats don’t indicate a must-buy. For example, Clorox’s P/E ratio of 44.7x is somewhat elevated, as investors should want to see 30x or less, and preferably 20x or less (in line with the sector), in this category due to its low growth. Heck, even some formerly high-flying technology stocks have better multiples than 44.7x nowadays.

Also, Clorox’s beta of 0.39 indicates that CLX stock moves much slower, in both directions, than the stock market overall. This suggests that holding Clorox stock is likely to give you low returns, kind of like government bonds. Essentially, don’t anticipate much growth if the stock market rallies in 2023. Besides, a 10-year Treasury bond yields 3.49% per year – better than Clorox’s 3.2% dividend yield. Hence, fearful investors might actually be tempted to just stick with government bonds, which are effectively risk-free.

Don’t Look to Clorox’s Earnings Results for Inspiration

Now, let’s dig a little deeper. Clorox does have well-known name brands in its portfolio. Shouldn’t this have resulted in power-packed earnings results for the company? Don’t get your hopes up, as Clorox didn’t knock it out of the park, and a few financial experts have very muted expectations.

As we’ll discover, analysts on Wall Street aren’t particularly enthused about Clorox. For example, JPMorgan (NYSE: JPM) analyst Andrea Teixeira maintains an Underweight rating on CLX stock along with a $135 price target; the current share price is higher than that, so don’t expect much upside from here, if any. Furthermore, Teixeira anticipates “weak” earnings performance, and that’s understandable since Clorox’s most recently released financial figures were less than stellar.

Clorox has earnings coming up on February 2. There’s no way to predict exactly how that will turn out, but we can certainly examine Clorox’s performance during its most recently reported quarter, Q1 FY2023, which ended September 30, 2022.

Again, that was supposedly a time when defensive names outperformed. However, as it turned out, Clorox’s net sales decreased 4% on a year-over-year basis, “driven largely by lower volume.” That’s just a fancy way of saying Clorox wasn’t selling as many products. Clorox also didn’t make as much money per product, as the company’s gross margin decreased 110 basis points from 37.1% to 36%.

Clorox’s bottom-line results weren’t any better. During the most recently reported quarter, Clorox’s diluted net earnings per share decreased 40% to $0.68, while the company’s adjusted EPS declined 23% to $0.93. Among the culprits, according to Clorox, were “lower gross margin” and “lower volume” – not positive signs for the company.

Is CLX Stock a Buy, According to Analysts?

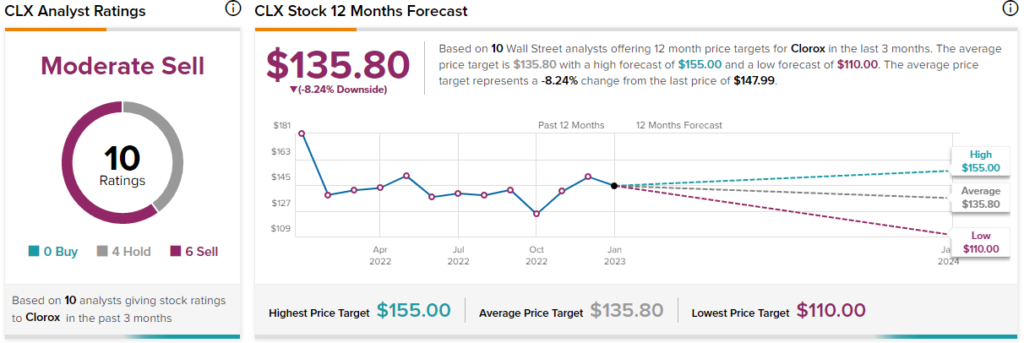

Turning to Wall Street, CLX stock is a Moderate Sell based on four Holds and six Sell ratings. The average Clorox price target is $135.80, implying 8.2% downside potential.

Conclusion: Should You Consider Clorox Stock?

To be honest, a case could actually be made that government bonds are preferable to Clorox stock. At least, we can say that bondholders don’t have to worry about Clorox’s upcoming earnings event. All in all, Clorox offers a decent dividend payout but not much growth potential with the company or its share price. There’s no need to panic-sell your CLX stock if you already own a few shares, but unless you’re extremely risk-averse, it’s perfectly fine to seek out a more interesting stock to invest in this year.