After a magnificent 2023 of returns, it’s only prudent to think about rotating towards some of the less-loved consumer defensive stocks to ring in the new year. Undoubtedly, growth-to-value rotations don’t play out in the way many expect them to. Sometimes, they can be gradual, entailing modest pullbacks in the overheated growth plays alongside steady rallies in underrated defensives. Other times, they can be quite sudden and induce a bit of panic.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In this piece, we’ll leverage TipRanks’ Comparison Tool to look at three intriguing consumer defensives that I think could be in for a decent year, even if 2024 isn’t half as impressive as 2023.

Colgate-Palmolive (NYSE:CL)

Shares of household products firm Colgate-Palmolive have been quite sluggish in recent years, delivering some pretty flat returns over the past four years. In recent weeks, the “boring” $65 billion consumer staples stock picked up momentum (up 14% from October 2023 lows) and a new bull rating from a Bank of America (NYSE:BAC) analyst. With an impressive portfolio of recession-resilient necessities and the confidence of Wall Street, I must stay bullish on the name as we enter an uncertain new year.

Why the sudden bullish turn for Bank of America analyst Bryan Spillane? A number of reasons, including the deep portfolio of steady brands and their “geographic depth.” But the biggest factor behind the upgrade, I believe, is the company’s shift towards greater growth. Spillane highlighted the growth potential coming from emerging markets as one of the factors that could help the old-time consumer staple deliver earnings upside in the new year.

I find it tough to argue against Spillane’s thesis. Colgate-Palmolive isn’t just a cherished necessities powerhouse; it’s one that could pick up meaningful traction in India and Latin America. Given the firm offers high-quality, must-have products around the household at fairly reasonable prices, I view Colgate-Palmolive as one of the firms that could really excel in emerging markets, regardless of where the world economy finds itself in a few quarters down the road.

At 22.9 times forward price-to-earnings (P/E), CL stock isn’t exactly a steal, given the household & personal product industry average sits at 20.5 times. Still, if you value terrific managers and best-in-breed recession-resilient brands, it’s tough to not prefer CL over the peer group.

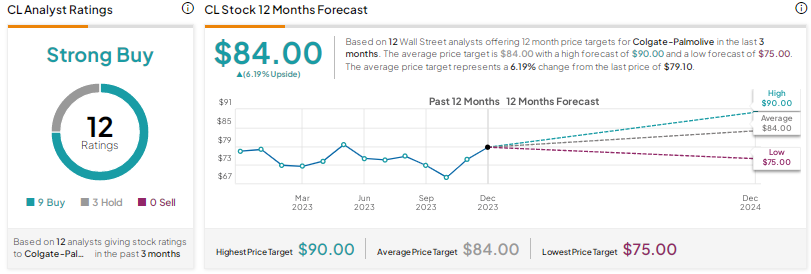

What is the Price Target of CL Stock?

Colgate-Palmolive stock is a Strong Buy, according to analysts, with nine Buys and three Holds assigned in the past three months. The average CL stock price target of $84.00 implies 6.2% upside potential.

Mondelez (NASDAQ:MDLZ)

Mondelez is a confectionary company that also has a management team eager to give its growth profile a good jolt. Shares of Mondelez have pretty much recovered the ground they lost during the GLP-1-induced plunge in food stocks.

Though weight-loss drugs, like Ozempic, could continue to curtail demand for chocolate and biscuits over the near term, I believe such drugs will not make much of a dent in long-term demand. Indeed, the long-term effects of staying on various weight-loss drugs remain a mystery. Many folks going off drugs may stand to gain weight as cravings return to (or even above) baseline.

In the meantime, I remain skeptical as to the effects of GLP-1 drugs. Though too much of a good thing (like chocolate) is not good for you, I simply do not see such drugs acting as a secular headwind for the food firms. My guess is that we’ll all continue to eat chocolate and Oreos 100 years from now. Given Mondelez’s predictability and timely organic growth prospects, I remain as bullish as ever on the stock going into 2024.

As inflation backs down, look for Mondelez to claw back some share at the middle aisle back from generic rivals that some consumers may have traded down to in an effort to save a few bucks. At the end of the day, Mondelez has the sweetest brands out there. And it’s these brands that can help it as management does its best to drive sales and margins.

What is the Price Target of MDLZ Stock?

Mondelez stock is a Strong Buy, according to analysts, with 18 Buys and one Hold assigned in the past three months. The average MDLZ stock price target of $79.59 implies 10.2% upside potential.

Celsius Holdings (NASDAQ:CELH)

Celsius Holdings finished Wednesday’s trading session with a bang, up 5.2%. The red-hot energy drink stock could have even more big days in the new year as it looks to gain more share in a market that remains quite sizeable. Soda drink sales are up 4.2% this year, according to Nielsen. And energy drinks have been even hotter, with Celsius growing sales by 149% year-over-year. That’s some impressive growth that can’t possibly be sustained for too long.

However, just because it’ll be tougher to top year-over-year comparables doesn’t mean Celsius’ best growth days are behind. Many analysts remain upbeat as the energized drink disruptor heads into 2024. For now, I’m inclined to stay bullish, as Celsius’ momentum may not be so quick to come to a halt.

Looking further out, Jefferies sees compound annual growth in the 26% range between 2023 and 2027. Such growth could entail greater gains for a disruptive firm I previously referred to as a “relatively small fish in an ocean where the tide is in its favor.”

What is the Price Target of CELH Stock?

Celsius stock is a Strong Buy, according to analysts, with 12 Buys and two Holds assigned in the past three months. The average CELH stock price target of $71.52 implies 28.4% upside potential.

The Bottom Line

Consumer staple stocks aren’t the most exciting investments, especially as AI continues to draw in more than its fair share of oohs and aahs. With slightly elevated valuations and a trio of rate cuts potentially priced into markets, it seems wise to consider the less economically sensitive plays. Of the trio of staples, analysts see the most upside in Celsius Holdings stock (28.4%) for the year ahead.