Investors looking for a steady income stream can consider investing in Dividend Aristocrats, i.e., companies with a track record of increasing dividends for at least 25 consecutive years. Colgate-Palmolive (NYSE:CL) and Albemarle (NYSE:ALB) are two such stocks that can be seen as reliable for income-oriented investors. Also, hedge fund managers have expressed confidence in both stocks by increasing their holdings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Therefore, let’s delve deeper into these two Dividend Aristocrat stocks.

Colgate-Palmolive Company

Colgate-Palmolive, a consumer products company, has raised its dividend payout for 60 consecutive years, likely making it a good choice for income investors. Also, the company’s strong brand keeps it well-positioned to counter inflation impacts through price adjustments.

Furthermore, robust demand for its Oral care and Hill’s Pet Nutrition products should support the company’s top line in the medium-to-long term.

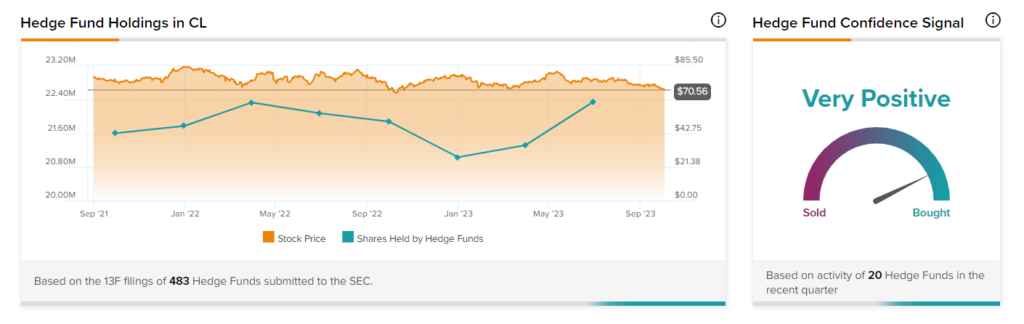

Meanwhile, CL stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought one million shares of the company in the last quarter. Our data shows that Morningstar Investment Management’s Kunal Kapoor and Gotham Asset Management’s Joel Greenblatt were among the hedge fund managers who increased their exposure to Colgate-Palmolive stock.

Is CL Stock a Buy, According to Analysts?

CL stock has received five Buy and five Hold recommendations in the past three months for a Moderate Buy consensus rating. The average CL stock price target of $84.70 implies 21.9% upside potential from current levels.

Also, CL has an Outperform Smart Score of 9 out of 10 on TipRanks, which suggests that it can beat the overall market from here.

Albemarle Corp.

ALB has increased its dividend for 29 consecutive years. The company has a strong position in the lithium market with access to top assets. These factors keep ALB well poised to benefit from the high demand for lithium.

Furthermore, ALB stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. As per the tool, hedge funds bought 665,100 shares of this lithium producer last quarter. Coatue Management’s Philippe Laffont and David S. Gilreath from Sheaff Brock Investment Advisors are among the popular hedge fund managers who increased their positions in the stock.

Is ALB Stock a Buy, According to Analysts?

ALB stock has received 13 Buys, three Holds, and one Sell recommendation in the past three months for a Moderate Buy consensus rating. Meanwhile, the average ALB stock price target of $262.53 implies 71.5% upside potential from current levels. The stock has a “Perfect 10” Smart Score on TipRanks.

Ending Note

Dividend stocks, especially those with impressive dividend growth track records, can be considered a safe option for investors during times of market volatility. Moreover, the positive sentiment from hedge fund managers and analysts adds to the overall confidence in CL and ALB shares.