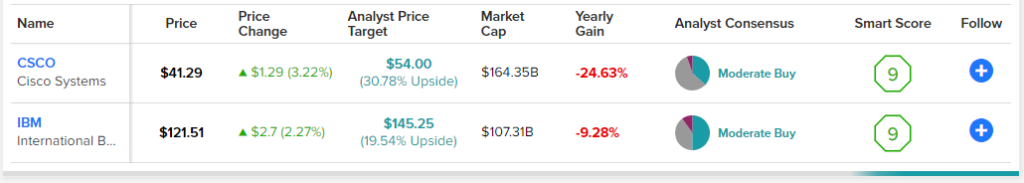

Tech stocks have been obliterated this year, with speculative and unprofitable innovators leading the downward charge. The shockwaves have been felt across the sector, with even profitable stalwarts and tech dinosaurs with high dividends feeling the downside. Nonetheless, in this piece, we used TipRanks’ Comparison Tool to determine which old-school tech stock — CSCO or IBM — is the better Buy, according to Wall Street estimates. Based purely on upside potential, Cisco (NASDAQ: CSCO) looks like the best option, but let’s dig deeper.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This isn’t the first time old-school tech companies like Cisco and IBM (NYSE: IBM) have been through vicious tech-driven bear markets. The dot-com bust of 2000 left “scars” on the share prices of each company. Though this current tech- and rate-driven bear market may be yet to conclude, I do think shares of both companies have over-extended themselves to the downside.

Unlike many companies from the 2000-01 tech bust, Cisco and IBM are both very profitable companies. Though growth prospects have diminished in recent decades, both companies are still better able to power higher in this high-interest-rate environment.

Now, higher rates aren’t good for any firm seeking to reinvest in distant growth projects. However, they have an amplified negative effect on smaller, less-liquid companies that may never reach GAAP profitability.

While a dovish tilt from the Federal Reserve is a possibility over the coming months, investors should be in no rush to overweight unprofitable companies that may never be the same again. Call 2022 the second coming of 2000, if you will, but Cisco and IBM are mature (and profitable) enough to recover from recent damage.

Cisco Systems (CSCO)

Cisco is a networking kingpin that never recovered from the dot-com bust (when not including dividends). Though it came within striking distance in 2021, the stock now finds itself back on the retreat, nearing lows not seen since the depths of 2020. Down around 35% from its all-time high, Cisco is down roughly in line with the Nasdaq Composite exchange.

Unlike its peers in the Nasdaq, Cisco stock is incredibly cheap at just 14.6x trailing earnings and 3.2x sales. With a ~3.7% dividend yield, Cisco is a high-yield value stock that ought to appeal to bargain hunters.

Now, growth may be limited to single digits as networking hardware sales look to slow in a recession. However, with such a wide moat in switching and routing, it’s tough to take a rain check on the stock as it looks to touchdown with a fairly strong level of support at around $35-$36 per share.

Cisco is a networking behemoth that may be less exciting, but it should be viewed as a staple. Like other hardware companies, Cisco is looking to expand its mix in software. Such a move should have a net positive impact on margins, moving forward.

One major knock against Cisco is its risk of falling behind more innovative, higher-growth firms. Undoubtedly, Cisco has aged considerably since the last tech-driven downturn, and its growth prospects are far less exciting than firms a fraction of its size. Cybersecurity is just one area where Cisco needs a jolt.

Networking and security go hand in hand. With rising cyber threats and a growing number of capable cyber rivals, Cisco may need to dip into its sound balance sheet to make a cybersecurity deal while valuations are down.

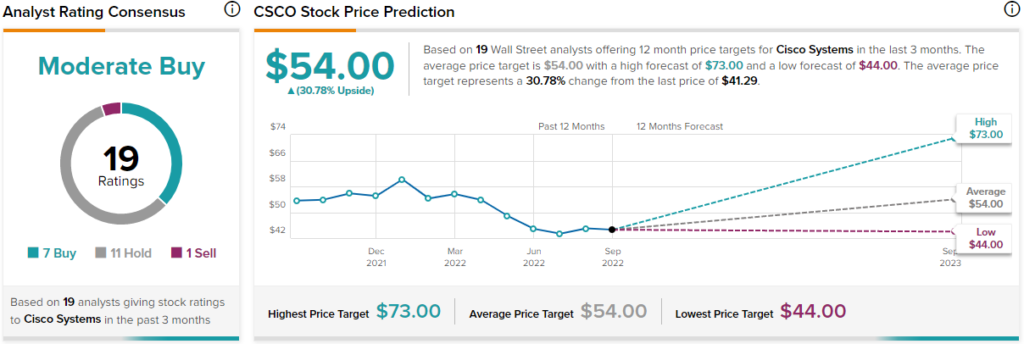

What is the Price Target for CSCO Stock?

Despite the macro headwinds, a lack of exciting growth prospects, and unexciting quarterly results, Wall Street remains upbeat on Cisco. The average CSCO stock price target of $54.00 implies 30.8% upside potential from current levels. With the dividend included, that’s a nearly 35% gain to be had over the year ahead.

IBM (IBM)

IBM is another old-time tech company that’s lost its way. The stock is down more than 40% from its all-time high, not seen since March 2013. That’s nearly a decade-long bear market. It’s been such a slog that even Warren Buffett wanted out of the stock many years ago. Thus far, Buffett’s exit has proven genius.

The company may not have the most attractive growth profile, but it does sport a valuation that’s quite compelling. At 20x trailing earnings and 1.8x sales, IBM is cheaper than most other tech stocks. Though, it is worth noting that the company is cheap for very good reasons.

In the latest quarter, IBM showed tremendous progress, with solid margins and revenue that rose 9% year-over-year (the best top-line growth number in many years). Despite the promising numbers, downgraded cash flow guidance acted as a piece of hair on what was a sound quarter.

Indeed, IBM’s managers are shooting for top-line growth in the mid-single-digit range. However, doing so in a recession year could prove challenging. I think a 4-6% top-line growth range sets the bar pretty high for a firm that’s been known to fall flat.

IBM may not be the same company it used to be, but its customers are still standing by it. Finally, IBM’s Watson AI remains a wildcard that could have a material positive effect on the stock at some point in the future.

With a juicy ~5.5% dividend yield, IBM remains a dividend investor favorite. Though IBM’s turnaround path is hazy, the depressed valuation and dividend do look attractive in an era of rising rates.

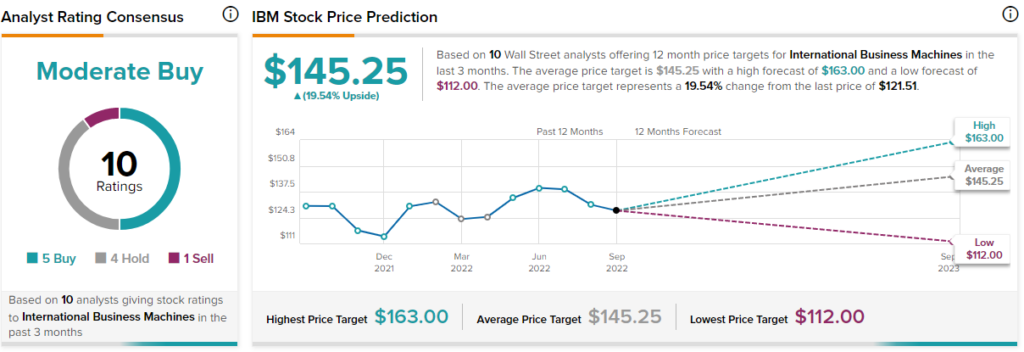

What is the Price Target for IBM Stock?

Wall Street is staying patient with IBM shares, with a “Moderate Buy” rating. The average IBM stock price target of $145.25 implies 19.5% upside potential in the next 12 months.

Conclusion: Cisco May be the Better Bet

While IBM has shown promise with its greatest growth in many years, the stock has given false hope to investors for many years now. Cisco seems to be more capable of breaking out to new highs. Wall Street analysts seem to also think CSCO stock is a better bet, with more year-ahead upside in the cards.