We’re down to the wire now, in the final week of 2022, as the days count down, and it’s time to find the last good stock buys for the year. While the bearish trend of the past year has made cheerful holiday stock shopping more difficult this time around, there are still enough sound stocking-stuffers out there.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

To start with, even though the main market indexes are down, that doesn’t mean that every individual stock is down. It’s important to remember here that the indexes are averages, put together using a selected cross-section of the market. While they give a good representation of the macro picture – the S&P 500 is down roughly 19% this year – they can’t drill down to show the finer details.

And the finer details show that there are sound stocks that have delivered some decent returns despite the bear. That’s news to bring some holiday cheer to your portfolio. Dipping into the TipRanks data, we’ve found three stocks boasting more upside potential and Strong Buy consensus ratings while leach one has that proven record of outperformance in a troubled time. Here are the details, along with comments from the Street’s analysts.

Halliburton Company (HAL)

We’ll start with a well-known name in the oilfield services business, Halliburton. This company is a $35 billion industry giant, making it one of the largest oilfield service firms in operation, and it has a presence in more than 70 countries around the world. Halliburton’s services touch the full lifespan of a hydrocarbon drilling project, from well construction and completion through regular production phases to abandonment and plugging of the wells. This is a massively profitable business, comprising essential services to an essential industry, and Halliburton has seen both revenues and earnings increase steadily for several years now.

In the company’s most recent reported quarter, 3Q22, Halliburton showed a top line of $5.4 billion, up 38% year-over-year and edging over the forecast by a half-percent. Bottom-line earnings, at 60 cents per diluted share, came in even stronger, with a 114% y/y increase and a 7% beat of the 56-cent forecast.

Halliburton offers two avenues for return-minded investors. The first is the stock’s proven share appreciation; HAL is up approximately 73% this year, even after highly volatile trading in mid-year. The company also pays out a regular dividend, with a long history of reliability. The current dividend, of 12 cents per common share, annualizes to 48 cents and yields a modest 1.22%; they key point here is that reliability – Halliburton has not missed a quarterly payment since 1973.

Despite the stock’ ample 2022 gains, James Rollyson, in coverage for Raymond James, notes that Halliburton shares are undervalued compared to peers, writing, “In sorting through Street estimates for the diversified oilfield service companies, we note that Halliburton leads the pack in terms of expected top line and EBITDA growth over the next four years. According to FactSet, HAL’s four-year CAGR top line growth is near 16%, with EBITDA just over 22%, compared to the entire diversified peer group average of 12% and ~20%… HAL’s EBITDA and operating margins rank second yet the company trades for the lowest multiple in the group.”

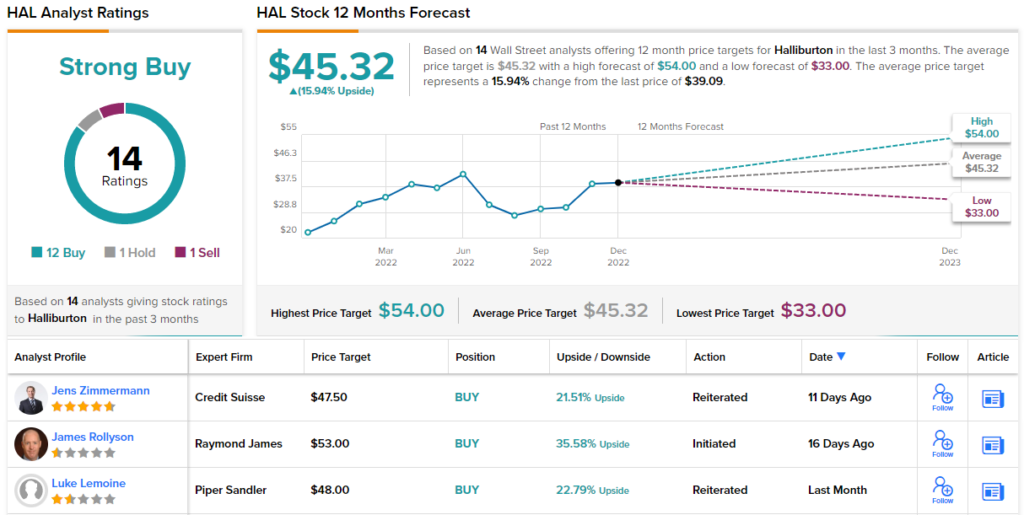

Based on that assessment, Rollyson rates HAL shares as a Strong Buy and sets a price target of $53, suggesting a one-year upside of 35%. (To watch Rollyson’s track record, click here.)

This big-name oilfield support firm has picked up 14 recent analyst reviews, with a breakdown of 12 Buys, 1 Hold, and 1 Sell supporting a Strong Buy consensus rating on the shares. The stock is selling for $39.09 and its average price target of $45.32 implies a 16% upside for the coming year. (See Halliburton’s stock forecast at TipRanks.)

Cabot Corporation (CBT)

For the second stock on our list, we’ll turn to the chemical industry. This is another of the modern world’s essential industrial sectors, and Cabot Corporation holds an important niche in it, producing a wide range of products in numerous vital sectors, including battery materials, consumer and industrial rubber products, adhesives and sealants, surface coatings, inkjet tech, plastics – even tire treads. Product lines include advanced carbons and carbon blacks, aerogels, fumed metal oxides, inkjet colorants and pigments, specialty carbons, and elastomer composites.

Despite a general slowdown in global economic activity and conditions during 2022, all of these remain vital products for numerous essential industries – and Cabot rode that fact to solid revenue and earnings numbers for its fiscal year 2022, which closed on September 30. For FY22, the company reported a total top line of $4.3 billion, or a 26% gain y/y. At the bottom line, adjusted EPS came in at $6.28 for the year, a y/y gain of 25%.

The company was particularly pleased with the growth of its Battery Materials segment. Volume here grew 58% in FY22, and revenue grew 74% to $132 million. Cabot reported making solid commercial sales to 6 of the 8 largest global battery manufacturers, and is on track to triple its battery material capacity by 2024.

During the course of the fiscal year, Cabot paid out $84 million in dividends, and supported share prices with $53 million worth of repurchases. These activities were supported by $395 million in annualized discretionary cash flow. The current dividend yields 2.2% (about average), but as with HAL above, the company has a history of reliable payments going back to the early 1970s.

CBT stock has outperformed the broader markets this year, delivering returns of 20%. Yet Deutsche Bank’s David Begleiter believes that there is plenty of growth potential left in Cabot. “We believe Cabot is one of the more visible and attractive growth stories in chemicals,” the 5-star analyst said. “And with valuation of 6.9x ’23E EBITDA more backward looking, in our view (to the old, more cyclical Cabot) than forward looking (to a more resilient and higher growth Cabot with breakout value in Battery Materials), we believe there is the potential for multiple re-rating as Cabot delivers on our forecast of mid-teens EPS growth over the next 3 years…”

Begleiter quantifies his position with a Buy rating on the shares and a $90 price target that implies room for 34% share appreciation by the end of next year. (To watch Begleiter’s track record, click here.)

All three of Cabot’s recent analyst reviews come down on the Buy-side, making the Strong Buy consensus rating unanimous. The stock has a current trading price of $67.25 and an average price target of $84.67, suggesting that a one-year gain of 26% lies ahead for it. (See Cabot’s stock forecast at TipRanks.)

Special end of year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Corteva (CTVA)

We’ll wrap up with Corteva, a company producing commercial seeds and agricultural chemicals. The firm spun off of DowDuPont’s agricultural sciences division in 2019, taking that segment public as a separate company but building on the parent firm’s long history in the industry. Corteva offers products to help farmers increase output and acre-productivity, including a wide portfolio of high-yield seed brands and a full range of crop protection products such as herbicides, fungicides, and insecticides. Corteva has seen solid success since the spin-off, and last year posted $15.66 billion in total revenues, for a 10% year-over-year gain.

The company’s revenue success has continued this year, with y/y beats in each quarter. The 3Q22 report showed $2.78 billion at the top line, up more than 17% y/y. The company’s results are typically highly seasonal – not uncommon for an agribusiness – and the first half of the calendar year typically shows the higher revenues and earnings, as that is when agricultural concerns make seed and chemical purchases as they prepare for planting. This fact makes sense of Corteva’s Q3 earnings, which came in at a loss of 12 cents per share by non-GAAP measures, however, that figure still beat Street expectations for a loss of 22 cents per share.

The strong earnings results have helped support the stock, which year-to-date is up by 27%.

Joel Jackson, a 5-star analyst with BMO, lays out the bull-case for Corteva. He writes, “We continue to view CTVA as best-in-class among ag/ferts stocks for compelling multi-year double-digit EBITDA CAGR and margin expansion. This as both seeds and crop chems have positive drivers amid movement to a more streamlined operation that has been desired for years. Ample FCF is being generated for sizable buybacks each year.”

To this end, Jackson has an Outperform (Buy) rating on the shares, while the $76 price target implies a 28% upside potential over the next 12 months. (To watch Jackson’s track record, click here.)

Of the 11 recent reviews for this stock, 9 are Buys against just 2 Holds – for a Strong Buy consensus rating. With an average price target of $73.41 and a current trading price of $59.38, the stock has a potential one-year upside of 24%. (See Corteva’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.