Mexican food restaurant chain operator Chipotle Mexican Grill, Inc. (NYSE: CMG) will release its financial results for the first quarter of 2022 tomorrow, April 26, after the market close. It is engaged in the development and operation of fast-casual, fresh Mexican food restaurants throughout the United States.

With a market capitalization of $41.49 billion, strong sector performance, innovation of new menu items, expansion, promotions and advertisements, and consistent stock price performance, Chipotle has emerged triumphant in the restaurant business. In the current era of digitization and more specifically post-pandemic, digital sales of food have skyrocketed.

In the last quarter, Chipotle posted stronger-than-expected results driven by solid growth in revenues, which represented a 15.2% year-over-year rise in comparable restaurant sales and new restaurant openings.

Most importantly, the company’s digital sales stood at $3.4 billion in 2021, which was about 3.5x pre-COVID levels seen in 2019. Despite tough comparisons, during Q4 2021, digital sales came in at $811 million, up 4% year-over-year, and represented 42% of sales.

Therefore, prior to the Q1 2022 earnings release, with the help of TipRanks’ Website Traffic Tool, we can visualize how the company might have performed in Q1. This new tool measures and analyzes a company’s website visits over a specified time period.

More visits to the website highlight strong prospects of demand for the company’s food. Therefore, Chipotle is strongly correlated to its website’s popularity for digital sales. Rising website traffic for a company demonstrates the fact that it is trending among individuals.

Using the website traffic tool, an uptrend was identified. In Q1 2022, total estimated visits on chipotle.com showed an increasing trend, on a global basis, representing a 41.19% jump from the fourth quarter and a 112.88% rise on a year-over-year basis.

This reflects success in the company’s transitional move towards a sustainable growth base with exceptional in-restaurant and digital experiences, providing beloved food, capitalizing on a post-Omicron recovery, and accelerating new restaurant openings.

For the first quarter, Chipotle expected comparable restaurant sales growth in the mid to high-single-digits range, with the opening of 235 to 250 new restaurants in 2022. Therefore, the company might have recorded strong revenues in the first quarter.

However, wage inflation and elevated prices for beef and avocado, along with freight charges are expected to have marred margins in the quarter. For the quarter, labor costs are expected to be in the low 26% range, while food costs are likely to range between 30% and 30.5%, with marketing costs to be in the high 3% range.

Wall Street’s Take

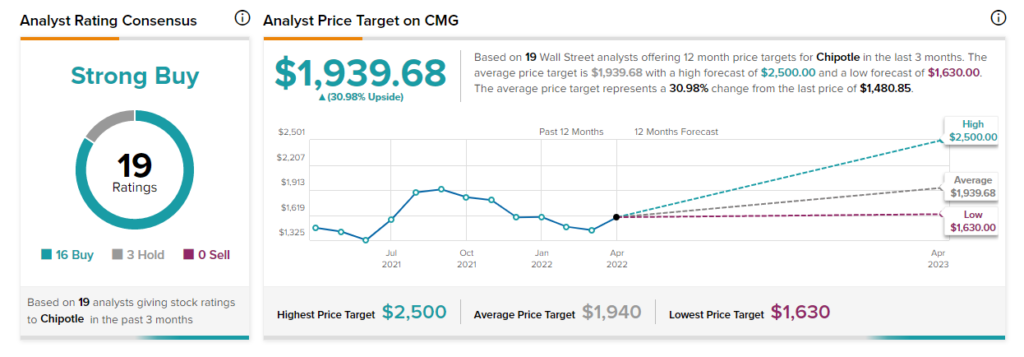

Despite cost challenges, Wall Street analysts seem optimistic about CMG stock ahead of its Q1 print.

Recently, Wedbush analyst Nick Setyan reiterated a Buy rating and a price target of $2,000 (35.06% upside potential) on the stock.

In his recent report, Setyan wrote, “While CMG is not immune to incremental food cost inflation, we believe it remains relatively well positioned to offset the incremental inflation with price increases.” Furthermore, the analyst considers the premium valuation of the stock justified at current levels.

Overall, the stock has a Strong Buy consensus rating based on 16 Buys and three Holds. The average Chipotle price target of $1,939.68 implies 30.98% upside potential. Shares have remained almost unchanged over the past year.

On top of this, Chipotle scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Ending Words

Rising popularity, increased earnings on digital sales, authentic food, technology advancements, improved staffing, and price stability all indicate that Chipotle is trending well among individuals in an improving consumer environment. However, inflationary pressures and cost challenges may have hampered the first quarter’s performance to a lesser extent.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure