Tech titan Apple (NASDAQ:AAPL) is not protected from a potential recession. Recently, the company warned of lower-than-expected shipments of the iPhone 14 this year due to COVID-related lockdowns in China. There are growing concerns on the Street that Apple’s revenue growth in its fiscal year 2023 might take a hit. Nonetheless, JPMorgan analyst Samik Chatterjee remains steadfast with his Buy rating and $200 price target on AAPL stock.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Notwithstanding his long-term bullish view, the analyst acknowledged the inescapable near-term concerns that are staring at Apple in the forthcoming months. So this piece is going to be an unusual one based on a bullish analyst’s report that focuses on the headwinds.

Near-Term Risks Are Rife, but the Long-Term Outlook Is Unchanged

Lockdowns in Zhengzhou are adversely impacting operations at Hon Hai/ Foxconn’s assembly facility for the iPhone 14 Pro and iPhone 14 Pro Max. This facility assembles 60% of the iPhones produced, and an impact on its production capacity is evidently a major concern for Apple.

Being the most sought-after models of the iPhone 14 series, lower production of the iPhone Pro and iPhone Pro Max is likely to hurt revenues. Besides that, the absence of a second manufacturing and assembly source for these models makes the situation more problematic.

The affected supply due to the China lockdowns and other headwinds has also extended the lead times for customer deliveries of the iPhone 14 Pro and iPhone 14 Pro Max by a week. Chatterjee expects delayed shipments to push out into the March-end quarter or later. The analyst also does not anticipate Apple being able to achieve the “supply-demand balance that it usually does every year with lead times dropping to a matter of days by the end of C4Q/F1Q.”

Nevertheless, Chatterjee thinks that rather than canceling their purchases or purchasing an alternative phone, customers will probably decide to wait longer for their iPhones to come.

“We see upside in several aspects of the business as well as financials that remain underappreciated by investors, namely the transformation of the company to Services, growth in the installed base, technology leadership, and optionality around capital deployment—all of which together lead us to expect double-digit earnings growth and a modest re-rating for the shares,” said Chatterjee.

Is Apple a Buy, Sell, or Hold?

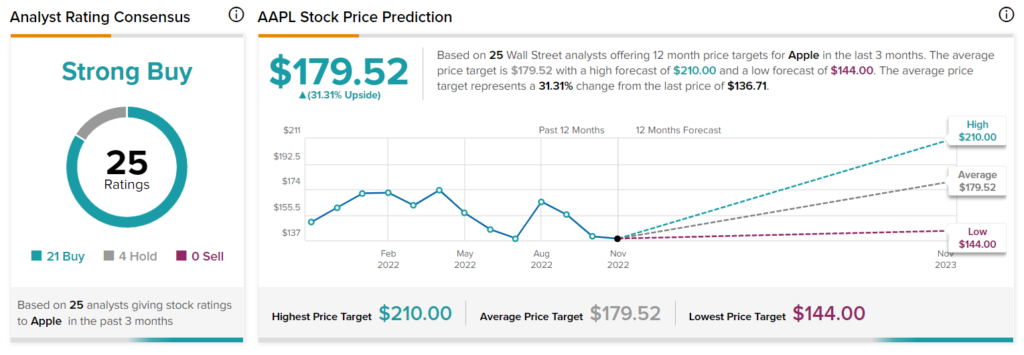

Bulls are running for Apple stock on Wall Street, with a Strong Buy consensus based on 21 Buys and four Holds. Analysts also expect the price to reach $179.13 over the next year, growing 31% from the current level.

Apple Might Be Too Expensive Now but Worthy for the Long Run

At a price-to-earnings (P/E) multiple of more than 20 times the forward 12-month earnings estimates, Apple is trading higher than the Nasdaq 100’s P/E multiple of around 19.7. This makes the stock look expensive. However, this should not divert investors from the company’s long-term prospects.

Chatterjee thinks that the company has “sustainable secular drivers in iPhone and Services with a larger installed base, higher share in 5G smartphones, and better Services monetization—all together turning out to be a strategic advantage for the company.”