Given American households’ love for their furry family members, it’s not surprising that both retail investors and the pros have speculated on the eventual comeback of online pet products retailer Chewy (NYSE:CHWY). However, with an options trade noticeably going awry, the fallout confirms that sometimes, the smart money can get things wrong. I am bearish on CHWY stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CHWY Stock Seems Appealing at Face Value

Without any context, CHWY stock would appear to be a frightening proposition. Since the beginning of this year, shares have fallen by ~46%. However, it’s also understandable that many observers believed Chewy could offer deep value. After all, Americans love their pets, and the data confirms this point.

Most notably, the American Pet Products Association (APPA) reveals that pet industry expenditures in the country surged to $136.8 billion, marking a notable uptick from the previous year’s figure of $123.6 billion. While this indicates a deceleration in growth, it’s essential to weigh in the broader economic picture.

In particular, last year bore witness to significant headwinds, notably severe inflationary pressures. This was further exacerbated by the Federal Reserve’s decision to hike benchmark interest rates, an effort to curb inflation but one that also increased borrowing costs. Consequently, consumer spending felt the pinch, particularly as major corporations rolled out layoffs that continue to this day.

Despite these unfavorable circumstances, the pet sector stood its ground. The APPA data underscores a compelling narrative: even when faced with economic uncertainties, American households remain committed to their pets. This unwavering dedication suggests that Chewy operates within a segment that, despite broader market volatility, holds a significant degree of insulation against external shocks.

Unfortunately, this assumption didn’t quite pan out for tactical (and speculative) traders.

Options Traders Got Burnt on Chewy

As TipRanks reporter Kailas Salunkhe noted in late August, while Chewy reported an earnings beat for the second quarter on both the top and bottom lines, its net margin took a hit, narrowing to a scant 0.7%. Such a margin compression alarmed investors, signaling rising operational costs and increased promotional activities. Still, this development fueled the flames of speculation.

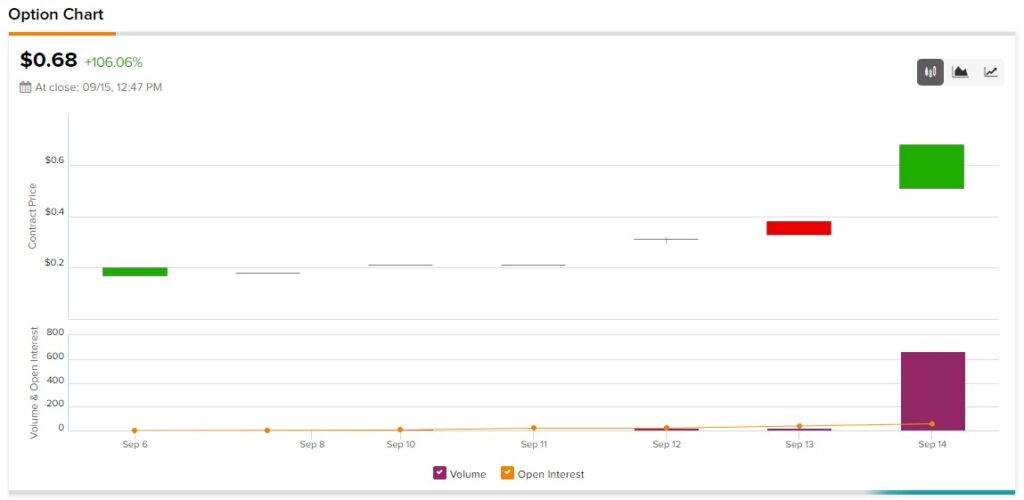

While the disappointing margin may have perturbed traditional investors, the options market told a different story, albeit temporarily. A conspicuous bet was made by a trader who purchased 900 contracts of the September 8 weekly $24 calls at an average price of 70 cents per contract, according to Mike Khouw of Optimize Advisors. This move hinted at an expectation that CHYW stock would rebound by that date. Sadly, the anticipated recovery never materialized.

Indeed, Chewy’s equity performance in recent days underscored the bearish sentiment. Last week, the stock plunged by over 12%. Such developments serve as a cautionary tale for retail investors. A holistic analysis is crucial, which means going beyond immediate indicators like options activity (though options activity is still useful to know). For instance, Chewy saw its revenue grow by over 14% year-over-year in Q2. Yet, its gross margin improved by just 20 basis points.

Salunkhe also pointed out a potential pitfall for Chewy: a focus on promotions might be undermining its margins. While promotional activities can attract customers, they can erode profitability. In a challenging economic environment, companies need to tread cautiously with discounts. Over-relying on such strategies could leave them vulnerable when faced with unforeseen disruptions.

Institutional Traders Have Learned Their Lesson

Despite the recent mishap involving CHWY stock, subsequent trading patterns indicate that institutional players may have recalibrated their strategies, paying heed to past missteps. A notable shift in sentiment can be discerned from the recent big block trades in Chewy options.

Case in point, a significant block trade involving 668 contracts of the CHWY October 27 ’23 19.00 put recently surfaced. This particular trade is logical, given that the average implied volatility (IV) for contracts bearing a $19 strike price stands at a modest 44%. This low IV suggests a tempered expectation for major price fluctuations around this level.

Still, an intriguing anomaly emerges when examining other strike prices. Specifically, the IV witnesses a pronounced uptick as one moves from the $23 strike price, peaking at around the $70 mark. This heightened IV in the higher strike price brackets might insinuate that some options traders are still engaging in speculative bets, potentially overlooking the lessons just learned.

Is CHWY Stock a Buy, According to Analysts?

Turning to Wall Street, CHWY stock has a Moderate Buy consensus rating based on 13 Buys, five Holds, and one Sell rating. The average CHWY stock price target is $37.89, implying 97.3% upside potential.

The Takeaway

At first glance, the robust U.S. pet products industry would seem to imply a strong performance for sector-related enterprises. Therefore, it wasn’t surprising to see the smart money gamble on the long side of CHWY stock. However, this trade failed to pan out, likely due to fundamental vulnerabilities in the business. Therefore, it’s a reminder to conduct a holistic analysis rather than focusing exclusively on options.