In an attempt to cut unwanted administrative costs, Chevron (CVX) has decided to sell its California headquarters. The company will remain in California, but a substantial amount of its office workers will move to Texas as part of the reformation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a company spokesperson: “The current real estate market provides the opportunity to right-size our office space to meet the requirements of our headquarters-based employee population,”

I’m bullish on Chevron stock; here’s why.

Operational Update

Chevron’s CEO, Mike Smith, published an open letter to President Joe Biden earlier this month, which highlighted some of the operational leaps the company’s made since noticeable energy shortages started a year ago.

Smith revealed: “In 2021, Chevron produced the highest volume of oil and gas in our 143-year history. In the first quarter of 2022, our U.S. production was 1.2 million barrels per day, up 109,000 barrels per day from the same quarter a year earlier.”

He added: “In the Permian Basin alone, we expect production to approach 750,000 barrels per day by the end of the year, an increase of more than 15 percent from 2021. And Chevron’s U.S. refinery input grew to 915,000 barrels per day on average in the first quarter of this year from 881,000 in the same quarter last year.”

Although the letter intended to call on less political pressure aimed toward the oil and gas industry, a few valuable inferences can be drawn from a financial vantage point.

For instance, Chevron’s record-breaking production numbers come at a time when the western world is attempting to grapple without Russian trade. Thus, Chevron’s market share is growing substantially, and so is the company’s general valuation.

By producing the amount it has lately, Chevron’s levered free cash flow has surged by 2.48x (year-over-year), and its EBITDA has skyrocketed by 2.19x in the same period. In addition, the company’s managed to reduce its long-term liabilities by 6.38% simultaneously, meaning Chevron has accumulated intrinsic value for its stockholders.

Valuation

Chevron stock is best valued based on its normalized 5-year average price multiples, as it’s a cyclical stock.

The stock’s price-to-earnings multiple conveys that CVX is undervalued by 41.49%. The reason is mainly due to the market’s latent sensitivity to the company’s earnings-per-share growth. Furthermore, Chevron’s price-to-cash flow and price-to-sales ratios are undervalued by 17.18% and 3.27%, respectively, implying that the stock’s undervalued on both an income and cash flow basis.

Lastly, Chevron’s enterprise value to EBITDA multiple is at a 5-year discount of 25.02%, suggesting that market participants haven’t yet priced in Chevron’s company-based value.

Dividends

Chevron doesn’t only provide the potential for capital gains but also total income prospects. The stock pays out more than half of its net income in dividends at a yield of 3.81%. Moreover, Chevron’s dividends seem safe as houses with a dividend coverage ratio of 3.03x and an interest coverage ratio of 33.24x.

Hedge Fund Buying

Hedge funds continue investing in oil stocks, despite some being concerned that commodity price plateaus might cause energy stocks to slump.

Chevron stock has been a popular pick among hedge funds recently, as fund managers increased their net long exposure to the stock by 116.4 million in the previous quarter, with notable names such as Ray Dalio and Warren Buffett adding CVX stock to their portfolios.

Wall Street’s Take

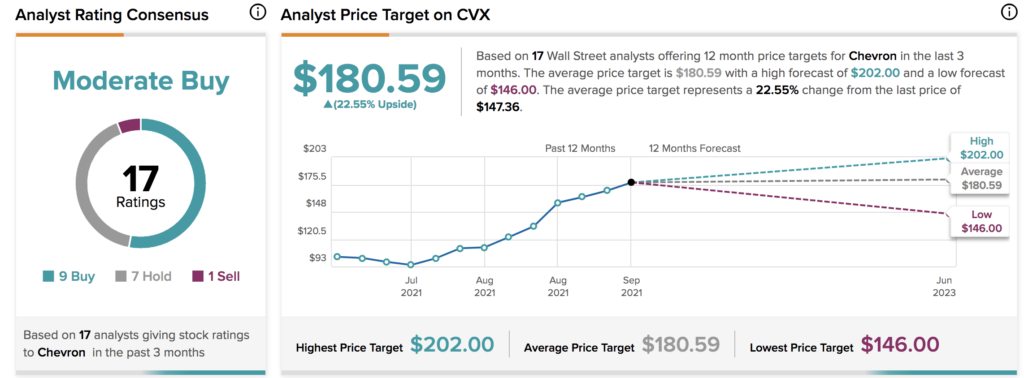

Turning to Wall Street, Chevron earns a Moderate Buy consensus rating based on nine Buys, seven Holds, and one Sell rating assigned in the past three months. The average CVX stock price target of $180.59 implies 22.55% upside potential.

Concluding Thoughts

Chevron’s illustrious output increase and nifty cost-cutting strategies enable it to operate efficiently. Furthermore, Chevron is a severely undervalued stock that provides a sound dividend profile.

Read full Disclosure