Oil stocks, including Chevron (NYSE:CVX) and Exxon (NYSE:XOM), have rallied this week on expectations of a major production cut by OPEC+ to maintain prices. Oil prices have fallen from the peak levels seen earlier this year due to demand concerns amid fears of an economic downturn and a strong U.S. Dollar. That said, OPEC+ production cuts and the Russia-Ukraine conflict could keep supply tight and support prices. Despite the ongoing volatility, Wall Street analysts’ average price target indicates that integrated oil and gas major Chevron could see further upside even after the year-to-date rally. Moreover, the company offers lucrative dividends.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

There is a Lot to Like About Chevron

The spike in oil prices since the Russia-Ukraine war combined with the strong demand following the reopening of the economy helped Chevron generate strong earnings in the first half of the year. The company’s Q2 adjusted earnings per share skyrocketed 240% year-over-year to $5.82. Chevron’s upstream earnings gained from higher price realizations, while downstream earnings benefited from solid refining margins.

Chevron used the significant cash flows generated in the second quarter to strengthen its balance sheet. The company brought down its debt levels for the fifth consecutive quarter, ending Q2 with a debt ratio of 14.6%. During the Q2 conference call, the company highlighted that its net debt ratio of 8.3% is well below its mid-cycle outlook of 20% to 25%.

Furthermore, Chevron is also using its solid cash flows to enhance shareholder returns. In Q2, the company returned more than $5 billion to shareholders, including dividends of $2.8 billion and share repurchases of $2.5 billion. Chevron also raised the upper limit of its share repurchase guidance to $15 billion from $10 billion.

Looking ahead, Chevron continues to invest in traditional and cleaner energy supplies. The June 2022 acquisition of Renewable Energy Group and the recently-formed joint venture with Bunge (NYSE:BG) to develop renewable fuel feedstocks reflect the company’s initiatives to grow its lower carbon businesses.

Is Chevron a Buy, Sell, or Hold?

As per TipRanks’ Hedge Fund Trading Activity tool, funds look bullish on Chevron stock. Hedge funds increased their holdings by 2.9 million Chevron shares in the last quarter.

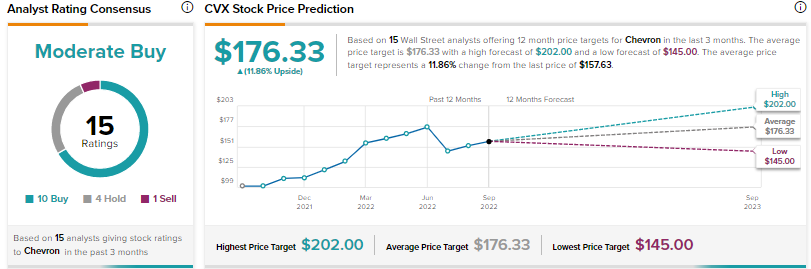

Turning to Wall Street analysts, Chevron scores a Moderate Buy consensus rating based on 10 Buys, four Holds, and one Sell. At $176.33, the average Chevron stock price target suggests nearly 12% upside potential from current levels. CVX stock has risen 34.3% year-to-date.

Conclusion

Oil prices have fallen from the elevated levels seen in June and could remain volatile over the near term. That said, supply constraints amid the Russia-Ukraine war and planned production cuts by OPEC+ could support high prices and benefit Chevron and its peers. Moreover, Chevron offers a dividend yield of 3.9%, which is higher than the sector average of 2.7%.

According to TipRanks’ Smart Score System, Chevron scores a “Perfect 10”, implying the stock could outperform market averages.