Energy major Chevron Corporation (NYSE:CVX) is slated to release its third quarter Fiscal 2022 results on October 28, before the market opens.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With the persistently high oil and gas prices and burgeoning demand alongside the war-led constrained supply, CVX stock has gained 52.7% so far this year. Despite the strength in the energy sector this year, Chevron has missed earnings expectations three out of seven times since 2021.

The Street expects Chevron to post an adjusted profit of $4.85 per share in Q3, significantly higher than the prior-year period figure of $2.96 per share. Meanwhile, revenue is pegged at $61.44 billion, representing a whopping year-over-year jump of 37.4%.

Nonetheless, the consensus estimates for Q3 are meaningfully below the Q2FY22 adjusted earnings of $5.82 per share and the revenue figure of $68.76 billion. Amid the geopolitical tensions and demand-supply imbalance, the energy sector remains under duress. The jump in oil and gas prices between Q2 and Q3 has not been as much as it was between Q1 and Q2 when prices reached their 13-year highs. Thus, there is a modest decline in analysts’ expectations for Q3 for the overall energy sector.

Notably, ahead of its Q3 results, Chevron announced a regular quarterly common stock dividend of $1.42 per share, reflecting a current yield of 3.23%. The company also rewards shareholders with regular share buybacks.

Is Chevron a Good Stock to Buy Now?

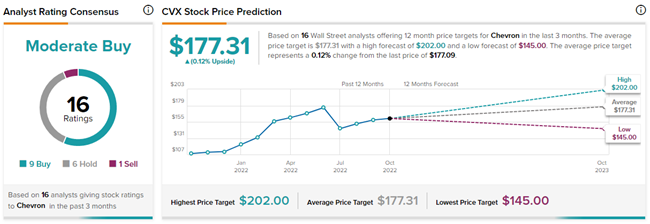

Wall Street analysts are split about Chevron’s stock trajectory. On TipRanks, CVX stock has a Moderate Buy consensus rating. This is based on nine Buys, six Holds, and one Sell rating. The average Chevron price target of $177.31 implies that shares are fairly traded at current levels.

Ending Thoughts

Chevron has seen its earnings and cash flows balloon over the past couple of quarters, thanks to the high energy prices. The third quarter will also be marked by solid year-over-year growth across various metrics. However, analysts are cautious about the trajectory of the energy sector as a whole and have accordingly set modest forecasts.