I am neutral on ChemoCentryx (CCXI) because the upside potential embedded in its development pipeline is offset by the speculative nature of the business, and its lack of profitability at present.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ChemoCentryx is a biopharmaceutical corporation that manufactures and markets innovative orally administered therapeutic medication for autoimmune and inflammatory diseases and cancers. (See Insiders’ Hot Stocks on TipRanks)

Strengths

ChemoCentryx’s lead drug candidate, Avacopan (CCX168), has successfully completed its ANCA-associated vasculitis Phase 3 trial, and has entered its late-stage clinical development to treat severe cases of Hidradenitis Suppurativa and C3G (C3 glomerulopathy).

The European Medicine Agency and the Japan Pharmaceuticals and Medical Devices Agency have also received applications for regulatory approval for the lead candidate.

ChemoCentryx has also initiated the clinical development of the next-gen checkpoint inhibitor CCX559, which was featured in abstract at the Annual Meeting of the American Association for Cancer Research.

Recent Results

ChemoCentryx reported revenues of $1.8 million in its second quarter of 2021 as compared to $49.4 million for Q2 2020. The drastic decrease was attributed to accelerated revenue recognition with the company’s decision to discontinue the development of CCX140 in Focal Segmental Glomerulosclerosis (FSGS).

The company saw a net loss of $0.56 per share, a higher loss than the $0.56 predicted by consensus estimates.

ChemoCentryx also reported research and development expenses of $20.9 million for Q2 2021 as compared to $18.8 million for the same period in 2020.

The increase in R&D costs was primarily a result of manufacturing commercial drug supply in anticipation of the launch of avacopan as well as higher drug discovery expenses, including with the development of the checkpoint inhibitor, CCX559.

The increased expenses were partially offset by the completion of avacopan Phase 11b clinical trial in patients and the discontinuation of the development of CCX140 in FSGS in the previous year.

ChemoCentryx has also filed a major amendment of its NDA for avacopan and extended its PDUFA review period to October 7, 2021. The company saw a net loss of $39.2 million in Q2 2021, compared to a net income of $20.3 million in Q2 2020, and has not been able to surpass EPS estimates since Q1 2020. As of June 30, 2021, the company had $402.6 million in cash and investments.

Wall Street’s Take

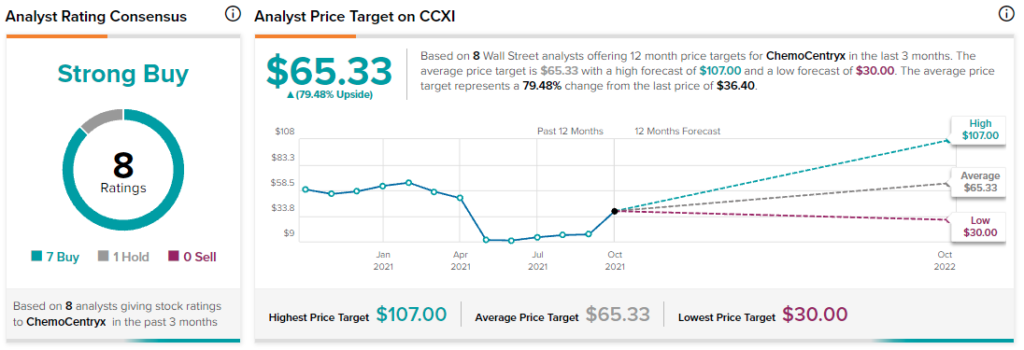

From Wall Street analysts, ChemoCentryx earns a Strong Buy analyst consensus based on seven Buy ratings, one Hold rating, and zero Sell ratings in the past three months. Additionally, the average ChemoCentryx price target of $65.33 puts the upside potential at 79.5%.

Summary and Conclusions

ChemoCentryx continues to run up losses as it is investing aggressively in developing its medication products.

While the fact that it is not profitable yet makes it a bit speculative, the stock price looks pretty attractive compared to its upside potential.

In fact, Wall Street analysts are overwhelmingly bullish on the stock at current levels and there are some potential catalysts to the upside working their way through its development pipeline.

Disclosure: At the time of publication, Samuel Smith did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.