There are different ways to assess whether it’s time to lean heavily into a certain class of stocks, and according to Oppenheimer’s head of Technical Analysis Ari H. Wald, the charts right now are pointing toward a resurgence in growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

“Recent points of market discussion have included incremental cracks in value and concurrent relative strength in growth,” Wald noted. “Breaking down the components and their influence on the market, we see growth in a stronger position to the lead the S&P 500 higher than we do value’s current condition to drag it lower.”

Furthermore, adds Wald, relative strength in growth aside, the analyst believes it’s not out of the question that cyclical value has become “tactically attractive vs. defensive value too.”

“These are reasons we think the weight of the market evidence argues for higher highs over the coming months,” Wald went on to add.

Meanwhile, against this backdrop, Oppenheimer has been busy finding the stocks that are primed for some serious growth; the investment firm has clocked an opportunity in one name in particular it sees generating gains of over 100% upside from current levels. Let’s take a closer look.

ORIC Pharmaceuticals (ORIC)

Investors on the lookout for triple-digit gains will often head to the biotech space. ORIC Pharmaceuticals is a clinical-stage biopharma focused on discovering and developing cancer treatments. In fact, its moniker stands for Overcoming Resistance In Cancer.

As with any clinical-stage biotech, it’s the pipeline that matters and ORIC currently has three drugs undergoing Phase 1b trials; ORIC-533 for multiple myeloma, ORIC-114 for EGFR/HER2-mutated cancers, and ORIC-944 for prostate cancer patients. Dosing for all three trials began last year and a data readout from all is anticipated sometime during the second half of the year.

The catalysts ahead offer a turnaround for ORIC. The shares were under pressure last year after the a company announced the development of its experimental cancer drug ORIC-101 was being discontinued.

With all 3 current programs piquing the interest of Oppenheimer’s Matthew Biegler, the analyst believes it’s time for investors to “reacquaint” themselves with ORIC.

“Now is the time things could get interesting,” Biegler says. “We view ORIC as an investment in a differentiated pipeline of early-stage oncology assets, backed by a strong leadership team with a prior history of successfully developing clinically important cancer drugs… ORIC’s pipeline is differentiated and well-diversified, yet the stock currently trades below cash—which we believe essentially gives investors free options on each of ORIC’s novel Phase 1 assets.”

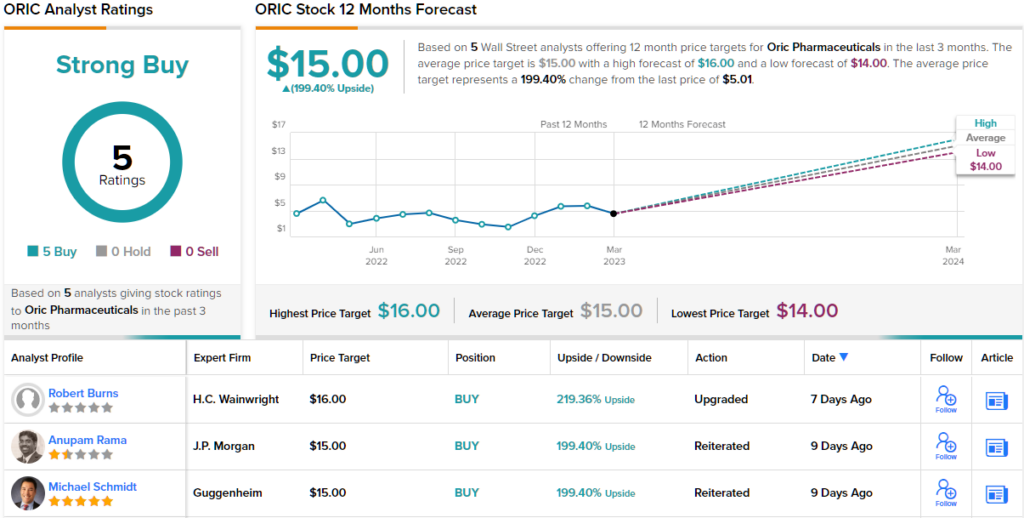

Biegler is bullish indeed. Based on the above, the analyst rates ORIC an Outperform (i.e. Buy) while his $14 price target suggests the shares will climb 179% higher in the year ahead. (To watch Biegler’s track record, click here)

Wall Street’s analysts can be a contentious lot – but when they agree on a stock, it’s a positive sign for investors to take note. That’s the case here, as all of the recent reviews on ORIC are Buys, making the consensus rating a unanimous Strong Buy. The analysts have given an average price target of $15, slightly more bullish than Biegler’s above, and indicating ~200% upside from the current share price of $5.01. (See ORIC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.