The recent chaos in the banking sector, the Fed’s credit tightening, and deposit outflows weighed on the shares of financial services giant Charles Schwab (NYSE:SCHW). It has lost over 42% of its value year-to-date. Despite the significant pullback in SCHW stock, its technical indicators confirm a bearish trend, signaling further downside ahead.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Per TipRanks’ easy-to-understand technical analysis tool, SCHW stock is in a downtrend. Its 50-Day EMA (exponential moving average) is $56.67, while its price is $47.73, implying a bearish signal. Furthermore, its shorter-duration EMA (20 days) also indicates a downtrend.

Given the recent selloff in SCHW stock, its RSI (Relative Strength Index) has decreased to 36.86. However, the RSI still doesn’t signal an oversold condition. While Charles Schwab stock is in a downtrend, the stock could find immediate support near $45.23. A breakdown from this level could lead to a further decline in SCHW stock. GOOGL stock has a swing low near $27.86. (See the graph below.)

What’s the Prediction for SCHW Stock?

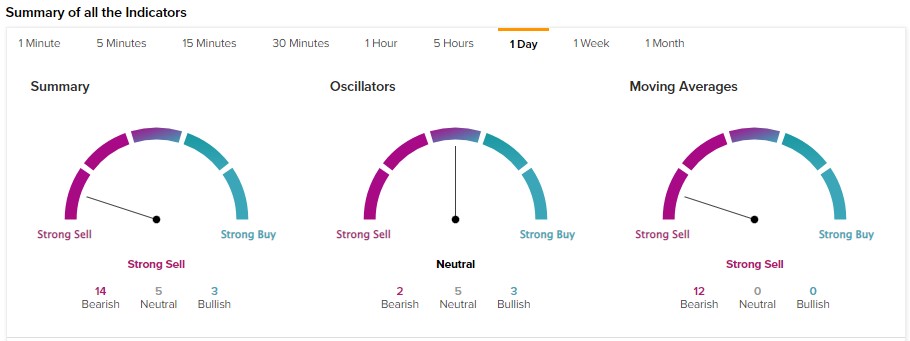

Overall, SCHW is a Sell based on our summary of all the technical indicators (which combine the moving averages and the technical indicators to offer a summarized signal).

Last month (April 20), Redburn Partners analyst Nicholas Watts downgraded SCHW stock to Sell from Hold. The analyst sees headwinds from the use of higher-cost funding, the re-regulation of mid-sized banks, and the Fed’s credit tightening.

While SCHW faces near-term headwinds, its CFO, Peter Crawford, recently updated that the pace of deposit outflows has slowed. Crawford is upbeat and expects a “resumption in growth of client cash on the balance sheet.”

Due to the short-term headwinds, Wall Street analysts are cautiously optimistic about SCHW stock. It has 11 Buy, four Hold, and two Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $64.35 implies 34.82% upside potential.

Bottom Line

SCHW stock has a bearish signal from TipRanks’ technical analysis tool. Further, it faces near-term challenges from deposit outflows. However, stabilization in deposit trends and growth in new brokerage accounts could lead to a recovery in its stock price.