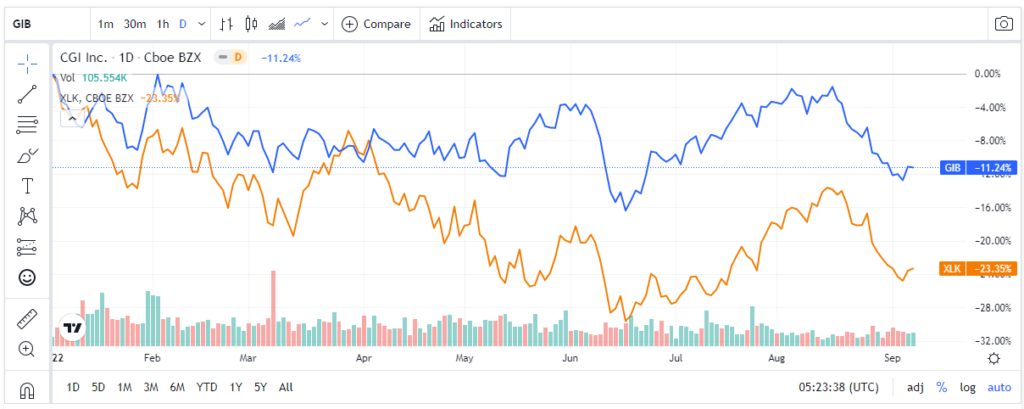

While CGI Group (NYSE: GIB) (TSE: GIB.A) has performed slightly better than the tech industry so far this year, I wouldn’t go above a Hold rating on this stock for now, despite it being a good company with solid fundamentals and a portfolio of high-demand services. That’s because these will not be the aspects that will affect the share price for the time being. I foresee more bearish sentiment affecting this stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in Montréal, Canada, CGI Group is an IT and business advisory services company – one of the largest in the world.

The company has 88,500 consultants and professionals who help clients around the world digitally transform their organizations and make these organizations more efficient. As a result, CGI Group’s services are crucial to its clients because the company helps them achieve maximum results with minimal effort.

Why GIB Stock Could Lose More Ground

CGI Group could continue to lose ground going forward; here’s why. The factors contributing to the fall in CGI Group shares were very strong, not just for technology stocks but for the stock market as a whole, except for energy and utilities, which benefited from record-high oil and gas prices.

As the causes of these headwinds are very serious, such as the war in Ukraine, a highly uncertain global monetary policy to tame record inflation, and geopolitical tensions, both CGI Group and most stocks are likely to continue their bearish momentum for some time.

Considering both its financial position and profitability, CGI Group appears to be a company with solid fundamentals, and its shares would likely rise if the market had to acknowledge both of these aspects in a non-risk-averse market.

However, as described above, investors view this market as too risky, leading to a wait-and-see attitude rather than an investing one, implying a lower valuation for CGI Group and other stocks.

GIB Stock Looks Inexpensive from a Technical Standpoint

The stock currently trades at $78.73 per share for a market cap of $18.8 billion and a 52-week range of $73.76 to $93.93. GIB stock doesn’t look expensive from a technical standpoint, as its share price is currently below its 200-day moving average of $82.76.

However, with continued market volatility seriously hurting technology stocks, it would probably be wise to hold the stock and refrain from buying for the time being.

Q3-2022 Results: Sales and Profits Saw Solid Growth

The company’s growth strategy, dubbed “Build & Buy Profitable,” delivered another strong quarter, with double-digit growth in both revenue and earnings.

For the third quarter of Fiscal 2022 ended June 30, 2022, revenue was approximately C$3.3 billion, an increase of nearly 8% year-over-year, or an increase of 11.5% year-over-year when excluding the impact of unfavorable exchange rates.

Meanwhile, earnings per share (EPS) were C$1.54 per diluted share, up 13.2% from the prior-year quarter.

Earnings before interest and taxes (EBIT) came in at approximately C$520 million, which was 9% higher than the ~C$477 million achieved in the third quarter of Fiscal 2021.

Its EBIT margin also improved, as it amounted to 16% of total revenue in Q3 compared to 15.8% in the same period last year.

CGI Group also reported an improvement in the number of consultants and professionals by over 10,500 year-over-year. However, operating cash flow was flat, at C$419 million.

Also, bookings declined to C$3.41 billion from C$3.63 billion in the third quarter of Fiscal 2021.

CGI’s Balance Sheet is Robust

As of June 30, 2022, the balance sheet reported C$805.4 million in cash and equivalents, which was 4.5 times lower than C$3.6 billion in total debt. However, its cash position should provide more than enough funds for the company’s operating and growth initiatives.

Total borrowings resulted in an interest expense of C$23 million in Q3, fully offset by the $520 million in operating income.

The interest coverage ratio (operating income divided by interest expense in a given period) is a leverage ratio, and at 22.6x in Q3, it shows that the company is not feeling the weight of its debt.

This gives the company a strong competitive advantage over many others in the industry, as the rise in borrowing costs due to the central bank’s tightening policies will affect other debt-burdened companies more than they affect CGI Group.

Is CGI Group a Good Stock to Buy?

In the past three months, five Wall Street analysts have issued a 12-month price target for GIB. The stock has a Strong Buy consensus rating based on five unanimous Buys. The average GIB stock price target is $98.63, implying 25.3% upside potential.

Conclusion: A Solid Stock, but Likely Isn’t a Buy

CGI Group is a good growth tech stock, but buying is probably not the right choice at this point. Shares are likely to continue to be affected by strong market headwinds from the war in Ukraine, tightening monetary policy, and geopolitical concerns.

However, the company is doing well, with a solid balance sheet and profitable operations, as sales, profits, and margins continue to improve. These will certainly have a positive impact on the stock price as bearish sentiment fades.