The Capital Group Dividend Growers ETF (NYSEARCA:CGDG) is a promising new ETF from renowned asset manager Capital Group that just launched in September with a focus on dividend growth stocks. While it’s still in its early days, I’m bullish on CGCG, given its comprehensive portfolio of top dividend growth stocks and Capital Group’s strong track record.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What is the CGDG ETF’s Strategy?

According to Capital Group, CGDG “invests primarily in common stocks of companies around the world that the investment adviser believes have the potential to provide combinations of current yield and dividend growth over the long-term.”

This is a fairly generic statement, so it’s worth digging in further to see what makes CGDG stand out. For one thing, saying that this actively-managed ETF’s team of portfolio managers is experienced would be an understatement. Collectively, CGDG’s three portfolio managers, Grant Cambridge, Steve Watson, and Philip Winston, collectively boast over 100 years of experience in the investment industry between them.

Capital Group’s approach to portfolio management is also interesting. Each of these portfolio managers has a different background and area of expertise, and each invests in their highest-conviction ideas, giving the fund the upside of top ideas while also providing a diverse range of perspectives.

For example, among CGDG’s portfolio managers, Grant Cambridge has covered everything from airlines and air freight to software, Steve Watson has covered both Europe and Asia, and Philip Winston has covered industries ranging from property to media in the U.K. and Europe.

Additionally, while Capital Group is relatively new to ETFs and CGDG itself is brand new, Capital Group itself has a long and storied track record as an asset manager. The firm has been around since the 1930s and runs the American Funds family of mutual funds. All five of its U.S. equity-focused American Funds have outperformed the S&P 500 (SPX) since 1976.

A Powerhouse Portfolio

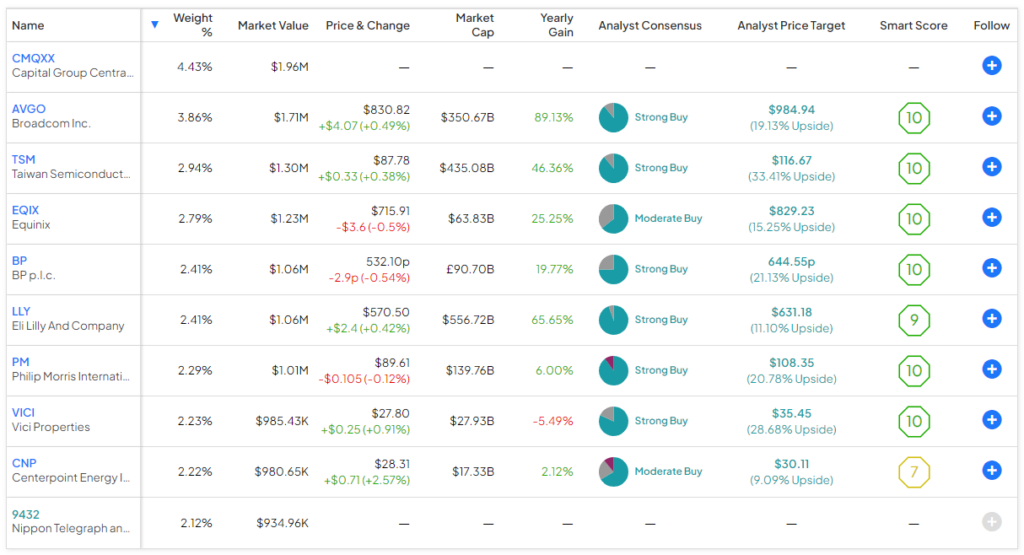

CGDG holds 78 stocks, and its top 10 holdings make up just 28.3% of assets. Below, you’ll find an overview of CGDG’s top 10 holdings using TipRanks’ holdings tool.

CGDG owns a formidable portfolio of dividend growth stocks. Top holding Broadcom (NASDAQ:AVGO) is a good representative of the types of stocks that CGDG owns. Broadcom’s dividend yield of 2.2% may not jump off the page at you. However, the company has increased its dividend payout for 12 years in a row. Furthermore, this semiconductor powerhouse has given its shareholders plenty to cheer about. Shares have almost doubled in the past year.

This combination of capital appreciation and dividend yield is exactly what CGDG is shooting for with this fund, and it’s almost surely a better strategy than just blindly investing in stocks with high yields that offer little in the way of growth or capital appreciation. Furthermore, Broadcom looks well-positioned for the future, as semiconductor demand is projected to continue to grow at a rapid pace in the years to come.

Taiwan Semiconductor (NYSE:TSM) doesn’t have quite the same dividend growth track record as Broadcom at this point in time, but it’s a blue-chip company that has generated solid returns in recent years and should benefit from the same semiconductor-industry tailwinds as Broadcom.

Shares of CGDG’s third-largest holding, Equinix (NASDAQ:EQIX), only yield 2%, but this data center REIT looks well-positioned to grow its payout in the years to come as some experts expect that companies will collectively invest over $1 trillion over the next five years to upgrade their data infrastructure.

In addition to strong long-term growth outlooks, another thing that these three top holdings have in common is impeccable ‘Perfect 10’ Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks and ETFs a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Two of CGDG’s other top 10 holdings, international tobacco giant Philip Morris International (NYSE:PM), which recently reported earnings, and gaming and Vici Properties (NYSE:VICI), one of the largest REITs focused on gaming and hospitality, also feature ‘Perfect 10’ Smart Scores. These are strong dividend stocks that yield 5.7% and 5.8%, respectively.

Drug maker Eli Lilly (NYSE:LLY) is another prominent holding that has taken the market by storm with its Mounjaro weight loss drug. Eli Lilly has a Smart Score of 9 out of 10.

Is CGDG Stock a Buy, According to Analysts?

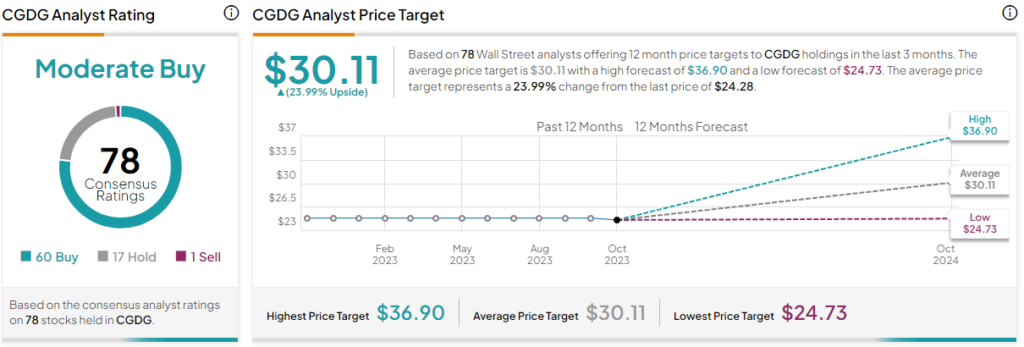

Turning to Wall Street, CGDG earns a Moderate Buy consensus rating based on 60 Buys, 17 Holds, and one Sell rating assigned in the past three months. The average CGDG stock price target of $30.11 implies 24% upside potential.

A Reasonable Expense Ratio

One downside of CGDG is that its expense ratio of 0.47% is a bit high at first glance. This expense ratio means that an investor allocating $10,000 into CGDG will pay $47 in fees in year one. Over the course of three years, assuming the fund returns 5% per year, this investor would pay $151 in fees.

On the other hand, it’s important to remember that CGDG is an actively-managed fund, so its expense ratio is naturally going to be higher than what you typically see from run-of-the-mill index funds. Compared to many other actively-managed ETFs, not to mention some passive ETFs, CGDG’s expense ratio actually appears fairly reasonable.

Looking Ahead

It’s still early days in the CGDG story. The fund has not even declared its first dividend yet, so we do not yet know what its dividend yield will be. However, given the strong stocks it invests in, like Broadcom, it seems likely that it will be able to grow its payout over time and offer a nice mix of dividend growth and capital appreciation for its investors.

There isn’t a long track record to go on yet, but the fund looks promising, and I’m bullish on its long-term prospects. It features a carefully-selected portfolio of top dividend growth stocks with some of the best Smart Scores you will find and a strong and experienced team of portfolio managers at the helm.