Cenovus Energy (NYSE:CVE) (TSE:CVE) is a Canadian oil and gas company, with the majority of its production in the oil sands of Alberta. The company trades at 28.7x my estimate of normalized earnings, higher than its current P/E ratio. And with WTI Crude Oil (CM:CL) prices far above their inflation-adjusted average, I believe caution is warranted. A supply windfall or demand shock could send Cenvous’ profits tumbling. Consequently, I’m bearish on CVE.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Oil Sands are High-Cost and High-Risk

I’ve been investing in oil stocks since 2020. When investing in commodity companies, I prefer to own shares in the low-cost producer. The reason is that when commodity prices fall, the low-cost producer can usually turn a profit and avoid bankruptcy.

The problem with Cenovus is that it’s a high-cost producer. The Canadian oil sands are known for being an expensive location to extract oil. Not only this, but Canadian oil is often more expensive to refine, resulting in lower selling prices. Cenovus expects 76% of its 2024 production to come from the Canadian oil sands. See below.

In addition, Cenovus expects that it would take oil prices of $45 USD per barrel WTI to cover its C$3 billion of “sustaining capital,” A.K.A. its minimum capital expenditures. I worry the company’s true breakeven oil price is much higher because the company’s “depreciation, depletion and amortization” was C$4.64 billion in 2023.

If you look at CapEx over a long period of time, it tends to average a number that’s close to depreciation and amortization (in most industries). Cenovus’ CapEx will likely drift higher because it has some catching up to do.

What all of this means is that Cenovus is a fairly high-risk investment, especially if oil prices crash. In this scenario, the company’s cash reserves may begin to dwindle as it struggles to fund its dividend and invest in its business.

Why Oil Prices Could Fall

From 1970 to today, inflation-adjusted WTI oil prices have averaged about $65 USD. Currently, they are at $79 per barrel USD, meaning there’s more downside than upside.

So, why bother looking back to the 1970s? Because OPEC really got going in the 1960s, and by 1970, it had substantial power. OPEC is a cartel that controls the supply of oil and influences its price. Its goal is to maximize long-term profits for oil-producing countries. The result? We have an awful lot of profitable oil companies, and oil has been a great place to invest since the 1970s.

Without OPEC, high-cost producers like Cenovus Energy would likely earn zero profits over the economic cycle. You see, in commodity markets, where there’s no product differentiation, high-cost producers tend to make money in booms and lose money in busts, breaking even overall. Luckily for Cenvous, OPEC exists and will likely continue to do so.

The problem I see going forward is that we have this huge transition to renewable energy going on, which includes a slow and steady transition to hybrid and electric cars. Meanwhile, it seems everyone is bullish on oil and gas companies, which have benefited from conflict in the Middle East and Eastern Europe. But what happens if these conflicts end? And what happens if there’s a recession in North America? History shows that either event could send oil prices tumbling.

Cenovus’ Normalized Earnings Are Lower Than Current Earnings

Cenovus has averaged US$955 million of net income over the past 10 years, and its average asset base over this time was US$29.5 billion. This compares to US$40.7 billion in total assets today. Cenovus increased its asset base by acquiring Husky Energy in 2021. Since Cenovus now has 38% more assets, I think its normalized earnings power has increased from US$955 million to US$1.32 billion, giving it a normalized P/E ratio of 28.7x, which is notably higher than its current P/E ratio of 13.1x.

Cenovus’s Capital Allocation May Not be Ideal

While I generally like Cenovus’ management and think they acquired Husky Energy at a favorable time, recent trends have been worrying. The company has a long history of diluting shareholders in order to grow. However, in recent years, the company has been buying back a lot of shares at high, top-of-cycle price levels. I worry that the company will have no cash leftover to repurchase shares at low, bottom-of-cycle price levels, which would be more beneficial to shareholders.

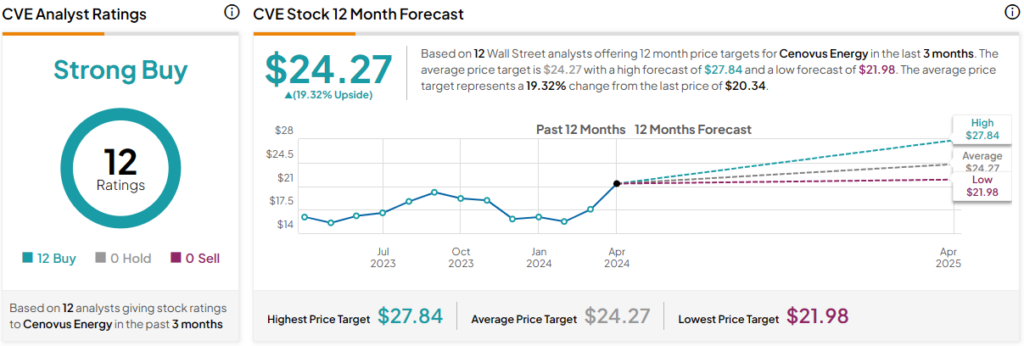

Is CVE Stock a Buy, According to Analysts?

Currently, 12 out of 12 analysts covering CVE give it a Buy rating, resulting in a Strong Buy consensus rating. The average Cenovus Energy stock price target is $24.27, implying upside potential of 19.3%. Analyst price targets range from a low of $21.98 per share to a high of $27.84 per share.

The Bottom Line on CVE Stock

CVE is making a lot of money now, but it is a high-cost producer, and its normalized earnings could be far less. Oil prices are significantly above their inflation-adjusted average, meaning there’s a lot of downside if global conflicts are resolved or North America goes into recession. Cenovus reported negative net income in three of the past 10 years, and given its high-cost oil sands assets, it could again.