Cathie Wood has never been shy about going against the grain. The ARK Invest founder and CEO has always had a singular approach to investing, sticking to her methods even through difficult times.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Her innovation-focused and growth-oriented strategy has yielded big returns in boom times. However, that game plan has not always been successful, particularly when sentiment toward growth is depressed during risk-averse periods. Her ideas have often seen her at odds with the general mood on Wall Street, and that appears true right now regarding one particular name.

Wood seems to be especially keen on Palantir (NYSE:PLTR), placing a big bet on the big data company. During Q3, her ARK Investment Management firm bought 2,580,638 shares, increasing her total stake by 38%. Wood currently owns 9,423,627 PLTR shares, which at the current share price command a market value of ~$165 million.

So, Wood is evidently bullish, but Morgan Stanley analyst Keith Weiss has a less upbeat take.

Weiss applauds the inroads the company has been making in its Commercial business, noting that on the back of US Commercial strength, the segment outperformed expectations in Q3, delivering year-over-year growth of 23%.

“However,” the 5-star analyst goes on to say, “while not dismissing the positive signs of early momentum, we believe this is generally reflected in estimates, which remain largely unchanged coming out of this quarter while weakness in other parts of the business continues to rear its head.”

Specifically, Weiss points to the US Government business, which showing only 10% y/y growth, “continues to remain a weak spot.” This is despite Palantir reportedly being involved in a number of the ongoing geopolitical conflicts and in the face of “broad-based Federal sector strength in other Software prints.”

As a result, considering the early US Commercial momentum is already factored into the equation and the valuation presents a downside skew in the risk-reward profile, Weiss maintains an Underweight rating (i.e. Sell), with a target price of $9. This projection implies a significant 49% decline from the current market levels. (To watch Weiss’ track record, click here)

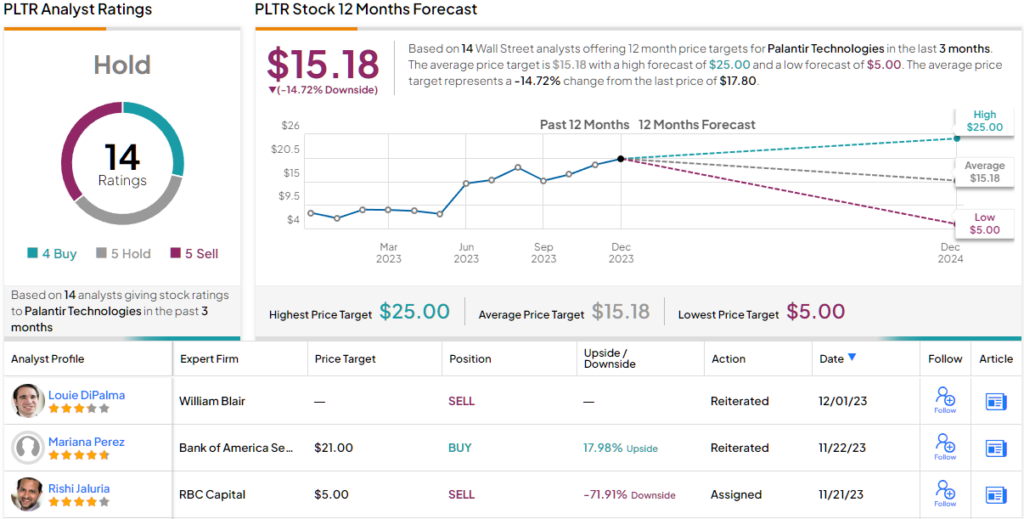

It should be noted that Palantir stock has been one of this year’s big winners, notching year-to-date gains of 177%, and while Wood evidently thinks more juice can be squeezed here, the stock seems to be out of favor amongst quite a few analysts. Looking at the consensus breakdown, based on a mix of 4 Buys, 5 Holds and 5 Sells, the analysts’ view is that this stock is a Hold. A year from now, the stock is expected to be changing hands for ~15% discount, considering the average target currently stands at $15.18. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.