January has now been and gone and turned out to be a nice gift for investors. Battered by 2022’s bear, the tech-heavy Nasdaq, in particular, put in an excellent showing, seeing out the month ~11% into the green, in what amounted to its best start to a year since 2001.

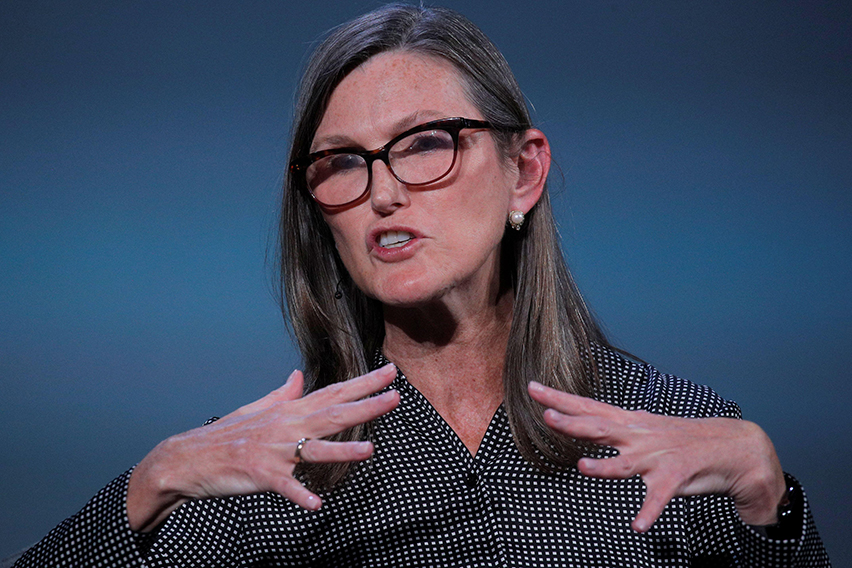

That signals the appetite for risk is on again and that will be good news for Cathie Wood, the ARK Investment CEO, whose investing style heavily favors disruptors – equities that are naturally positioned at the risky end of the scale.

Wood has shown a preference for names she considers game-changers, such as the ones that make up her ARK Genomic Revolution ETF, a fund that focuses on providing exposure to the advancements made in genomics – DNA sequencing tech, gene editing, CRISPR, and molecular diagnostics, are all represented here.

Wood has not been shy loading up the truck with names she believes in, both in difficult and better times, and during January she bought more shares of two stocks that make up a good chunk of the ARKG fund. We ran them through the TipRanks database to see what makes them appealing investment choices right now.

Beam Therapeutics Inc. (BEAM)

The first Wood-backed stock we’ll look at is Beam Therapeutics, a pioneer in the application of base editing. This is a potentially new class of precision genetic medicines, with the aim of providing life-long treatments to those suffering from crippling diseases. Base editing is cutting-edge tech that is intended to correct errors or mutations in intact cells’ DNA, allowing for “gene knockouts” and genetic changes.

It’s relatively early days for much of Beam’s pipeline, although some candidates have advanced to clinical trials. Leading the hematology portfolio, in November, Beam enrolled the first patient in its BEACON clinical study assessing BEAM-101, indicated to treat sickle cell disease (SCD). The company anticipates concluding enrollment in the sentinel cohort and kicking off enrollment in the expansion group of BEACON this year. The plan is to have a data readout from multiple patients from one or both groups in 2024.

In the immunology-oncology portfolio, the company has initiated a first-in-human Phase 1/2 clinical study to assess BEAM-201 in patients with relapsed/refractory T-cell acute lymphoblastic leukemia (T-ALL)/T-cell lymphoblastic lymphoma (T-LL) with the first patient expected to be dosed by mid-year.

Meanwhile, Cathie Wood has been adding more BEAM shares to the ARKG ETF. During January, she purchased 163,838 shares. The ETF now hold 2,126,439 shares in total, currently worth ~$92.4 million.

Of further interest to investors, Beam also has a strategic partnership with Verve Therapeutics, which dictates that the latter has exclusive access to Beam’s base editing, gene editing, and delivery tech. And it is from this partnership that BMO analyst Kostas Biliouris sees upcoming catalysts for Beam.

“In 2023, we expect two key updates from Beam’s partner Verve to drive upside in BEAM. Beam’s partner Verve is utilizing Beam’s base editing technology in its lead program (VERVE-101) for in vivo gene editing. In 2023, we expect Verve to provide updates on: (1) Management’s response to FDA on VERVE-101 clinical hold (potentially in ~mid-2023); and (2) The first clinical data from VERVE-101 that derisk base editing (in 2H23). We believe these catalysts will have a direct readthrough on BEAM, each driving a ~10%+ upside,” Biliouris opined.

To this end, Biliouris rates BEAM an Outperform (i.e. Buy), while his $66 price target provides room for 12-month gains of ~50%. (To watch Biliouris’ track record, click here)

So, that’s BMO’s view, how does the rest of the Street see the next 12 months panning out for BEAM? Based on 5 Buys and 4 Holds, the analyst consensus rates the stock a Moderate Buy. Going by the $70.89 average target, the shares will climb ~62% higher in the year ahead. (See BEAM stock forecast)

CareDx, Inc (CDNA)

The next Wood-endorsed stock also belongs in the healthcare sector, although it offers a different value proposition. CareDx is a commercial-stage diagnostics company that provides care for transplant patients, from finding the right match to follow-on surveillance post-transplant.

Its initial offering, the AlloMap heart transplant molecular test, is a non-invasive blood test that helps in identifying patients with stable graft function. These days, the company has a selection of products and services for transplanted hearts, lungs and kidneys with its AlloSure product being the first and sole non-invasive blood test that assesses allograft injury directly and determines the likelihood of active rejection in kidney transplant patients.

The company will report fourth-quarter and full year 2022 financial results later this month, but already provided a preliminary revenue update. For 4Q22, CareDx anticipates record revenues between $81.9 million to $82.2 million, amounting to a year-over-year increase of roughly 4%. Analysts were looking for Q4 revenue of $81.69 million. For the full-year, revenue is expected to grow by ~8% to the range between $321.3 million and $321.6 million (consensus has $321.09 million). The company also said it notched its highest ever cash collections at 110% of revenue for testing services, amounting to roughly a 10% year-over-year uptick.

With shares down 64% over the past 12 months, Wood must think they represent good value. Wood bought 241,234 shares in January via the ARK Genomic Revolution ETF. The fund now holds 6,404,090 shares overall, currently worth more than $96.4 million.

Wood is evidently a fan and so is Raymond James analyst Andrew Cooper. Assessing the path ahead, Cooper recently wrote: “CareDx remains well positioned as the leader in an attractive market and several catalysts are still on the table for 2023 (but not in our model) including AlloSure Lung, AlloMap Kidney, and UroMap coverage on top of the flip to EBITDA positivity and eventual mix and collections stabilization (particularly after collecting 110% of revenues in 4Q). We believe adjusting our 2023 model akin to how we suspect the company will guide (which we think likely proves conservative as the year plays out) is appropriate, and remain comfortable with our Strong Buy rating…”

The Strong Buy rating is accompanied by a $24 price target, which is expected to generate returns of ~60% over the one-year timeframe. (To watch Cooper’s track record, click here)

Looking at the consensus breakdown, based on 4 Buys vs. a solitary Hold, the stock claims a Strong Buy consensus rating. Shares are expected to change hands for a hefty 106% premium a year from now, considering the average target currently stands at $31. (See CareDx stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.