It’s been a good year so far for Cathie Wood. Representing a meaningful turnaround after what can be described as a two-year post-pandemic comedown, her flagship ARKK Innovation fund (ARKK) is up by 46% year-to-date, putting the main indexes’ performances in the shade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That said, given Wood’s penchant for the risky and outré, not all the stocks that make up the various funds under the Ark Invest banner are doing well right now. Some have underperformed recently and look a bit rough around the edges.

But it’s not as if Wood is known for lacking conviction in her stock picks. Even during periods when her innovation-focused investing style has been out of favor, she has still doubled down on the stocks she believes in.

And it looks like that’s what she’s been doing. Recently, she has been loading up on a pair of beaten-down names that sit among her holdings. But Wood is not the only one who sees better days ahead for these equities. Certain Street analysts also appear to think they are ready to bounce back. We decided to take a closer look at these stocks, and for a more comprehensive view of their prospects, we ran them through the TipRanks database. Here’s what we found.

Recursion Pharmaceuticals (RXRX)

It’s well-known that Wood favors a forward-looking approach, and the first stock we’ll check out has plenty of that to offer. Recursion Pharmaceuticals is a biotech firm that leverages cutting-edge artificial intelligence and machine learning technologies to accelerate the drug discovery and development process.

The company’s unique platform combines high-throughput automated biology, bioinformatics, and data analysis to rapidly screen and evaluate thousands of compounds, uncovering novel therapeutic targets and drug candidates much faster than traditional pharmaceutical methods.

This data-driven approach is applied across its pipeline. Recursion has several drugs in clinical testing, including REC-994 in a Phase 2 (SYCAMORE) clinical trial for cerebral cavernous malformation (CCM). As of June, the study was fully enrolled, and the company anticipates a Phase 2 proof-of-concept data readout in the second half of next year.

Additionally, Recursion is advancing the Phase 2/3 POPLAR clinical study of REC-2282 in patients with progressive NF2-mutated meningiomas. A Phase 2 safety, tolerability, pharmacokinetics, and preliminary efficacy readout is expected in the second half of next year, too.

More recently, earlier this month, the company announced the completion of the Phase 1 Study for REC-3964 for clostridioides difficile Infection, in which the drug was well tolerated with no serious adverse events reported. Recursion hopes to initiate a Phase 2 proof-of-concept study in 2024.

The stock had been making good use of the AI-fueled 2023 rally until the run-up hit a brick wall. The strong performance reached a peak in July, since when the shares have retreated by 47%.

Meanwhile, during the pullback period, Wood has been busy adding shares to her position. Over the past 3 months, she has purchased 1,900,644 RXRX shares via her ARKG ETF, and her overall holdings now stands at 6,192,719 shares. These are currently worth almost $51.6 million.

The company is also collaborating with some industry giants both in the pharmaceutical and AI world, as pointed out by Berenberg analyst Gaurav Goparaju.

“In addition to its active drug discovery collaborations with Roche-Genentech and Bayer, which, when combined entitle RXRX to up to ~$13bn+ in milestone payments, RXRX entered into a technology-focused collaboration with NVIDIA in Q2. This unique collaboration leverages RXRX’s proprietary data with NVIDIA’s computing prowess to develop AI foundation models in biology and chemistry. We believe this collaboration complements RXRX’s existing blue chip partnerships, providing cross-industry validation of its platform,” Goparaju noted.

“In our view,” Goparaju went on to add, “RXRX’s ongoing progress across its wholly owned pipeline (five in clinic) and commitment to platform development – as evidenced by recent acquisitions (i.e., Cyclica) and the new partnership with NVIDIA – support our thesis that the company’s platform, which uniquely leverages both digital biology and digital chemistry approaches, is highly differentiated in the drug discovery space.”

These comments underpin Goparaju’s Buy rating while his $35 price target suggests shares will post gains of a robust 318% in the year ahead. (To watch Goparaju’s track record, click here)

Overall, RXRX claims a Moderate Buy consensus rating, based on an even 3 Buys and Holds, each. There are plenty of gains projected here; the $16.83 average target implies shares will more than double in value over the coming months. (See RXRX stock forecast)

Roblox Corporation (RBLX)

The AI trend has driven 2023’s bullish market sentiment, but one previously anticipated trend has failed to materialize. Not long ago, all the talk was about the metaverse, and one of the companies that stood to benefit the most from its adoption was Roblox.

The online platform combines elements of gaming, social networking, and user-generated content creation. Founded in 2006, Roblox has evolved into a vast virtual world where millions of users, predominantly children and teenagers, can play, create, and share their own games and experiences. At the heart of Roblox is its game creation system, which allows users to design and build their own games using Roblox Studio, a user-friendly development environment.

RBLX stock was actually enjoying 2023’s market spoils but has come undone recently, having posted a 37% drop since its recent July peak. The bulk of the decline came in the wake of the company’s Q2 report.

While bookings of $780.69 million showed a 22% year-over-year increase and beat the forecast by $2.72 million, there were disappointing metrics elsewhere. Average daily active users rose 25% year-over-year to 65.5 million but came in just under the analysts’ forecast of 65.8 million. Average bookings per daily active user notched a 3% decline to $11.92, also falling just short of consensus expectations. Moreover, the net loss widened from a loss of $176.4 million in the year-ago period to $282.8 million.

None of that appears to have deterred Wood. Via her ARKF, ARKK, and ARKW ETFs, she bought 1,188,771 shares over the past 2 months, and her total holdings now amount to 9,205,770 shares, commanding a market worth of nearly $263 million.

Piper Sandler analyst Thomas Champion is also cognizant of current issues, but believes the recent drop represents an opportunity.

“Unfortunately, earnings misses will not be treated lightly in this market, especially given valuation. But, we remain believers in the story & now see shares as de-risked following the sell-off… We continue to view RBLX as a unique asset investing into a large market & opportunity. Bookings & engagement trends in 2Q were generally positive. That said we would have liked a greater commitment to leverage in ’24 versus the low-double digit margins from the call. We are constructive on the advertising opportunity and view as a near-term catalyst with nearly ~20% of the Top 100 experiences incorporating ads. We like the growth in older cohorts & improvements in COGS,” Champion opined.

To this end, Champion rates RBLX shares an Overweight (i.e. Buy), backed by a $45 price target. Should the figure be met, a year from now, investors will be sitting on gains of 53%. (To watch Champion’s track record, click here)

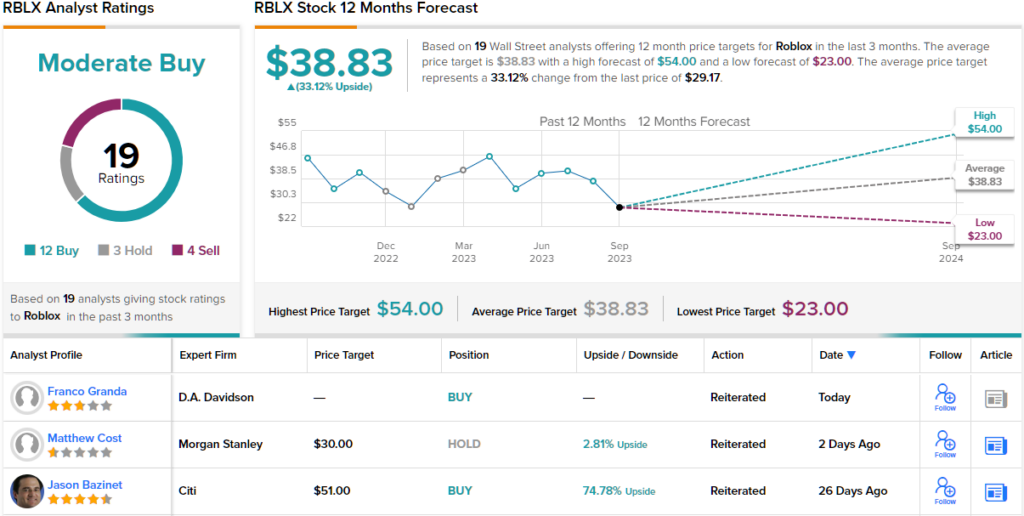

Most analysts agree with Champion’s assessment, although not all are on board. Based on 12 Buys, 3 Holds and 4 Sells, the stock receives a Moderate Buy consensus rating. The average target stands at $38.83, making room for 12-month returns of 33%. (See Roblox stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.