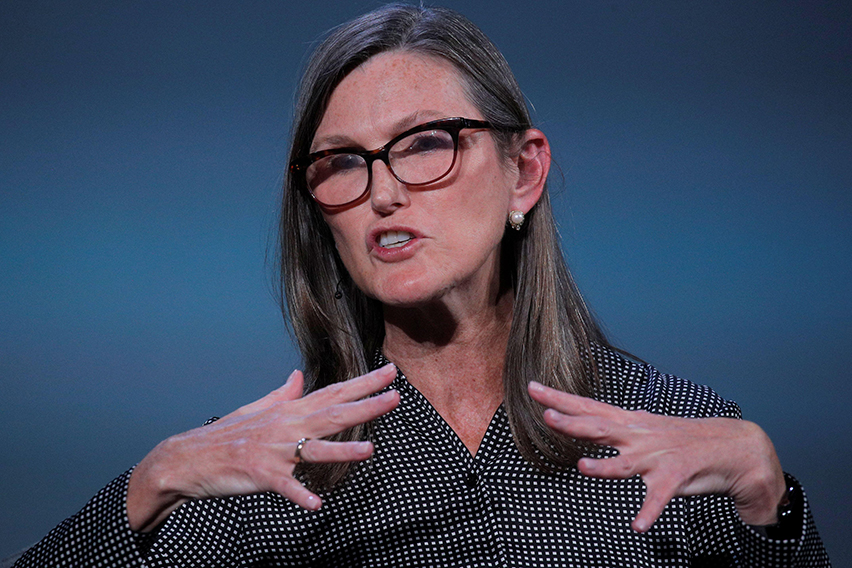

There’s no getting away from it, given the Fed’s policy of aggressive rate hikes, a soft landing for the U.S. economy appears out of the question. That at least is the opinion of Cathie Wood, who is therefore readying for a hard landing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“Money velocity is flattening,” the ARK Investment Management CEO said recently in reference to the recent banking mess while Wood also expects a marked deceleration in nominal gross domestic product. However, these are all blind spots for the Fed, she believes, as they’re still “looking at lagging indicators.”

Whether a soft or hard landing is coming, in the meantime, Wood has not been shy on loading up on the equities she believes in, whatever the macro backdrop. The risk tolerant Wood has been known to stick to her guns even when the chips are down and has often gone against the grain with a singular approach to investing.

Her recent buying activities have included a pair of names going for under $5. Let’s find out why Wood thinks these picks are primed to deliver the goods.

Genius Sports Limited (GENI)

The first stock Wood is betting on is fittingly Genius Sports, a company that operates at the intersection where sports, betting and media meet. The company offers tech products that connect the entire sports ecosystem – from data management to video streaming to betting technology and content, amongst other services. Genius has built relationships with more than 400 sports leagues and federations and 300+ sportsbook brands while it covers over 285,000 sports events annually.

Since going public via the SPAC route in April 2021, the shares have mostly been on the backfoot as the market has turned on loss-making companies. However, the company posted robust revenue growth in its most recent report, for 4Q22.

Boosted by its media technology segment, revenue grew by 25% year-over-year to $105.3 million. At the same time, the cost of revenue actually declined and helped the company generate a gross profit of $3.2 million, a big turnaround from a gross loss of $(25.4) million in the same period a year ago. And while the revenue outlook for FY23 factors in a slowdown to growth of 14.7%, adjusted EBITDA is anticipated to show a big improvement of 160% and reach $41 million.

Wood must like what she sees here. She bought 385,001 shares in Q1 via the ARKW (ARK Next Generation Internet) ETF. Her total holdings now stand at 5,106,674 shares, currently worth over $20 million.

Reflecting Wood’s positive stance, JMP analyst Jordan Bender lays out the bull-case.

“Genius sits between several business models in the online ecosystem. We liken it to online gaming in the U.S and Europe, but it carries characteristics of Info and Data Analytics companies trading at 21x EBITDA. We view the latter as the bull case for valuation as the business model proves itself to investors. Trading at 12x 2024E consensus EBITDA, we view this as an attractive opportunity for investors to own a profitable and diverse online business,” Bender opined.

Translating these thoughts into ratings and numbers, Bender rates the shares an Outperform (i.e. Buy) while his $7 price target makes room for 12-month returns of 70%. (To watch Bender’s track record, click here)

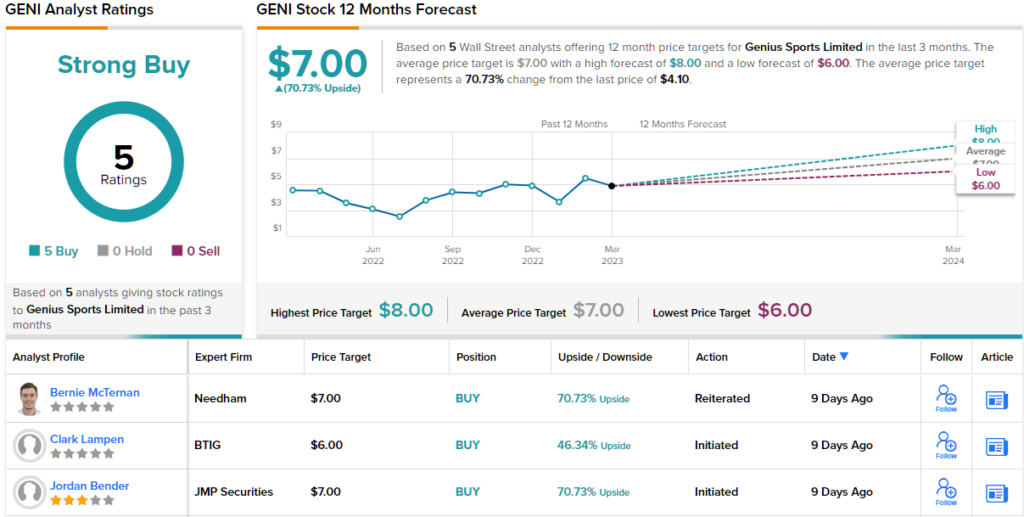

It looks like the Street’s analysts are in complete agreement here; all 5 recent reviews are positive, naturally providing this stock with a Strong Buy consensus rating. At $7, the average target is identical to Bender’s objective. (See GENI stock forecast)

JOBY Aviation (JOBY)

It’s well-known that Wood favors cutting edge disruptors and the next stock we’ll look at definitely offers that. Joby is a proponent of electric aerial ridesharing. What does that mean? Well, the aviation company with a difference is developing an electric vertical takeoff and landing (eVTOL) aircraft. In layman’s terms – an air taxi service. The idea is simple: ride sharing by flight, thereby skipping traffic and offering a green alternative to driving.

This futuristic vision is not yet a reality, but it is getting closer. In mid-February, the company announced that final assembly of its first eVTOL conforming (and piloted) aircraft has kicked off at its pilot manufacturing facility in Marina, California. JOBY anticipates being the first firm to construct a conforming eVTOL aircraft. Flight testing is expected to begin sometime during 1H23.

And earlier in February, the company said it had completed stage 2 (of 5) needed to achieve FAA certification, making it the first eVTOL company to achieve this milestone and bringing it one step closer to its aim of launching a commercial passenger service by 2025.

In the meantime, Wood has been getting ready for lift off. She purchased 574,301 shares in Q1 via ARKQ (ARK Autonomous Technology & Robotics ETF) & ARKX (ARK Space Exploration & Innovation ETF). Her total holdings now stand at 447,648 shares in ARKQ and 1,286,772 share in ARKX. Combined, these are now worth $6.6 million.

This disruptor has also caught the attention of Cantor analyst Andres Sheppard, who believes Joby is on track to reach its goals.

“We remain bullish on JOBY over the long term, and we are encouraged by the company’s progress toward achieving FAA certification and commercialization in 2025,” Sheppard said. “We are also encouraged by the recent visit of acting FAA Administrator Billy Nolen to JOBY’s headquarters, which we believe is indicative of regulators being supportive in helping to bring these aircraft to market. JOBY is planning on working on the different remaining certification stages simultaneously, and we expect continuous progress throughout 2023 and 2024.”

“More importantly,” the analyst added, “we believe JOBY has a very strong liquidity position with ~$1.1B in total liquidity (as of 4Q), which we believe is not only the highest in the industry, but also sufficient to fund the business through both certification and commercialization.”

To this end, Sheppard rates JOBY an Overweight (i.e. Buy), along with a $9 price target. Should that figure be met, investors will be pocketing big gains of 136% a year from now. (To watch Sheppard’s track record, click here)

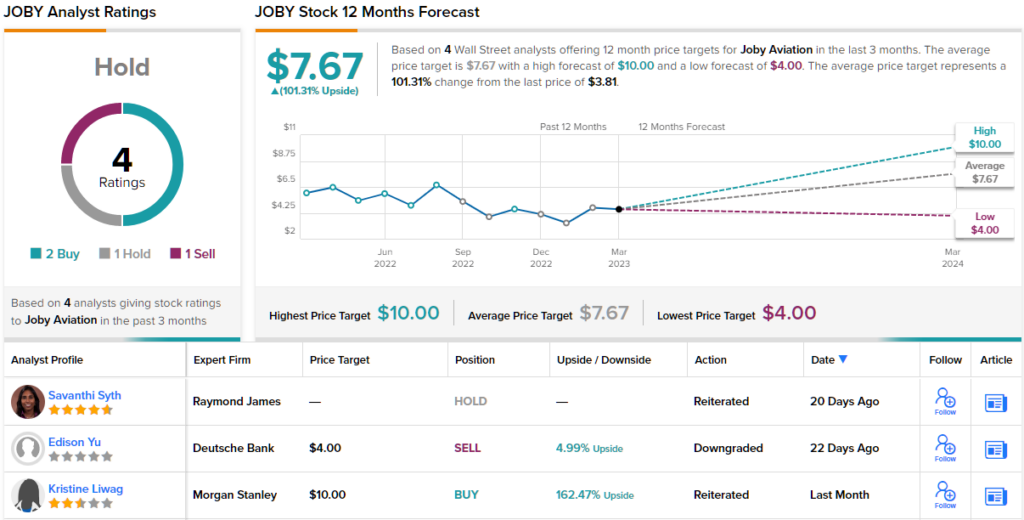

Not all, though, are quite as confident. Elsewhere on Wall Street, the stock garners an additional 1 Buy, Hold and Sell, each, for a Hold consensus rating. That said, the bulls here are very optimistic and the $7.67 average target suggests the shares will climb 101% higher in the months ahead. (See Joby stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.