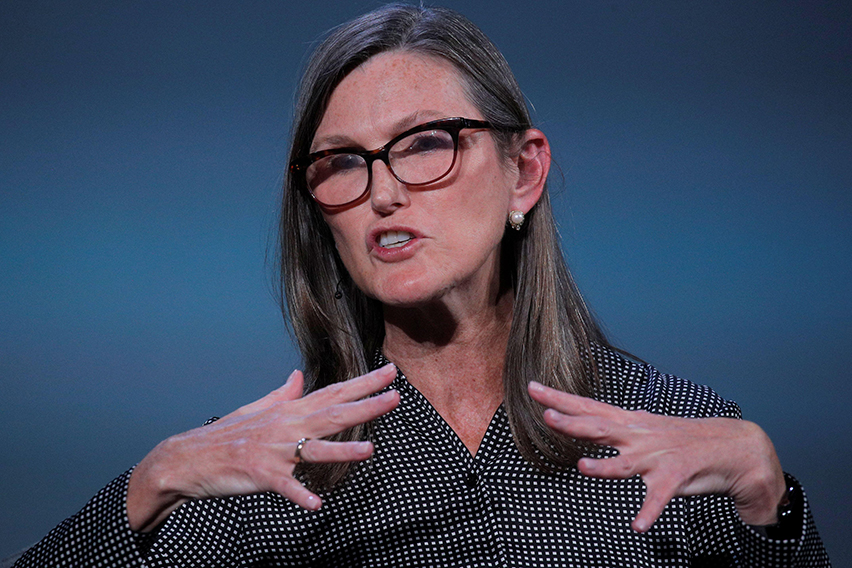

Not many hedge managers have ignited as much controversy as Cathie Wood. The founder of Ark Invest has built her brand on running against the crowd. From her early embrace of tech stocks to her outspoken political conservatism, Cathie Wood has always been something of a lightning rod.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wood is staking her reputation and fortune on a belief that new technologies, and especially the way that new technologies will interact with each other, are going to completely transform our world. In her view, sectors such as artificial intelligence, blockchain, genomic, and robotics can provide new ways of seeing the world, and their combinations may bring us new medical treatments or autonomous mobility systems.

“We believe — and just to give some numbers — that truly disruptive innovation will scale from $7 trillion in market cap today to $210 trillion by 2030, from less than 10% of the broad base public equity market to more than 60. And so if you’re short innovation, you’re going to be missing some of these unbelievable opportunities,” Wood opined.

Now to be fair, we should note that Wood flagship fund, the ARK Innovation ETF, peaked in February of 2021, and that it is down 78% since then. But we should also note that this same ETF surged over 300% in the year after the COVID-based market crash of March 2020. As Yogi Berra famously said: ‘Its tough to make predictions, especially about the future.’ Time will tell if Wood is right – but her track record shows that she can’t be ignored.

So let’s take a closer look at two innovation stocks that Wood has been buying lately. According to the TipRanks platform, Wood is not the only one singing these stocks’ praises. Wall Street’s analysts have also voiced approval of them, and they both feature plenty of upside potential.

UiPath Inc. (PATH)

We’ll start with UiPath, a company specializing in robotic process automation, RPA, using a combination of artificial intelligence and machine learning to create automated software bots to take over the digital world’s boring and repetitive ordinary tasks. UiPath’s products promise digital customers benefits from cost savings, resilience, higher accuracy, improved regulatory compliance, and increased productivity. The company counts such major names as Google, Airbus, and GE among its customer base.

A look at the company’s last quarterly financial release, from Q2 of fiscal year 2023 – the quarter ending on July 31 – shows the underlying strength of UiPath’s offerings. The company had a top line of $242.2 million, up 24% in 12 months, and increased its annual recurring revenue, ARR, by 44% year-over-year to $1.043 billion. While the company posted a net earnings loss of 2 cents per share in the quarter, and a cash burn of more than $23 million, it also reported having $1.7 billion in cash and liquid assets on hand as of July 31.

At the same time, PATH shares have fallen 74% so far this year. So what we have here is an innovative company, working in AI and software automation, currently trading at a steep discount – and Cathie Wood took notice. She had already bought into this stock, but in the September-October period this year, her five ARK ETF funds bought up another 10.6 million shares of PATH. This gives her a total of 42,759,557 shares in PATH, a stake that is worth well over $475 million at current prices.

Wood is not the only bull on PATH. Wells Fargo analyst Michael Turrin has also taken an upbeat stance on this stock, writing of its prospects going forward: “Our main takeaway is that UiPath continues to make necessary changes to adapt to the current environment (+ prior period of hyper-growth) and maintain share within the burgeoning automation market. While the sharply decelerating profile is likely to keep PATH in the ‘show-me’ camp and shares volatile in the NT, suggestions automation remains a spend priority and the muted 2H/FY24 outlook present room for improvement well-beyond current expectations…”

To this end, Turrin rates PATH an Overweight (i.e. Buy), and sets a $16 price target to suggest an upside potential of ~44% over the course of the next 12 months. (To watch Turrin’s track record, click here)

Overall, PATH shares have a Moderate Buy rating from the analyst consensus. This is based on 17 recent reviews, which break down to 9 Buys and 8 Holds. The stock has a current trading price of $11.12 and its average price target of $18.38, more bullish than the Wells Fargo view, implies ~65% upside on the one-year horizon. (See PATH stock forecast on TipRanks)

Verve Therapeutics (VERV)

The second ‘Wood-pick’ we’ll look at is Verve Therapeutics, an early-clinical stage biopharma firm with a focus on cardiovascular disease. According to the World Health Organization, cardiovascular disease, which kills almost 18 million people globally every year, is the world’s leading cause of premature death. In the US, it is responsible for more than 610,000 deaths annually. Verve Therapeutics has taken aim at this collection of conditions, and is working on new medicines to bring new approaches to the treatment of coronary problems.

The company currently has two drug candidates in its pipeline. The first of these, VERVE-101, has recently entered the clinical trial stage, and patient dosing has begun in the heart-1 clinical trial in New Zealand. The drug candidate is a novel agent, a gene editing medicine designed to turn off the PCSK9 gene in the liver and reduce the production of the disease-driving low-density lipoprotein cholesterol (LDL-C). VERVE-101 has recently received clearance from the UK medicine and healthcare products regulatory agency for the clinical trial application in that country. The clearance is for heterozygous familial hypercholesterolemia, and the trial will be part of the recently begun heart-1 testing in New Zealand.

The second drug candidate, VERVE-201, is a proposed treatment for improving the body’s natural regulation of cholesterol and triglycerides through targeting of the ANGPT3 gene. This gene is involved in regulation of lipids, and offers a potential pathway for the treatment of hyperlipidemia. The company has recently released pre-clinical data at the European Society of Cardiology’s 2022 Congress, supporting the drug candidate’s nomination for clinical trials.

On the financial front, Verve is still pre-revenue, and in 2Q22 the company ran a net loss of $40.9 million, or 84 cents per share. Verve reported having $595 million in cash on hand, giving it a clear runway to conduct operations into 2H25.

In the meantime, Cathie Wood has been making large purchases of VERV shares. In September, she bought 831,145 shares through her ARK Innovation ETF, and another 321,630 shares through the ARK Genomic Revolution ETF. She now holds more than 859K shares through ARK Innovation, and about 2.37 million shares through ARK Genomic. Wood’s total VERV holding, of 3,229,636 shares between the two funds, is worth over $98 million.

Is it a good buy? Stifel analyst Dae Gon Ha believes so, basing his bullish stance on the potential upcoming catalysts in the pipeline.

“We think catalysts like VERVE-101 IND and its clinical data (2023) will drive shares. We plan on reassessing our long-term theses in due time but for now, our diligence on the upcoming catalysts (conversations with three ex-FDA KOLs and management, and IND clinical hold precedents) adds optimism to VERV’s 1-2 year outlook,” Ha noted.

“Even under a bear case of no IND for VERVE-101, NTLA-2001 precedent suggests that positive Ph.1 heart-1 data, irrespective of geography, may present meaningful upside from current levels. Admittedly, regulatory decisions are hard to handicap but given VERV’s extensive foundational work supporting VERVE-101, we think positive updates are more likely (than not),” the analyst added.

In line with his comments, Ha rates VERV shares a Buy, with a $56 target price that implies an 83% one-year upside potential. (To watch Ha’s track record, click here)

Overall, there are 9 recent analyst reviews of this stock on record and they break down 7 to 2 in favor of Buys over Holds, for a Strong Buy consensus rating. The shares are currently priced at $30.56 and the $53.13 average price target suggests a 12-year gain of ~74% lies ahead. (See VERV stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.