Everyone has different strategies they put to work in the stock market, but the goal for all remains the same: to maximize returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Of course, that applies to the big investing institutions too. The world’s biggest asset manager, BlackRock, boasting ~$9.43 trillion of total assets under management, uses a systematic investing method—an investment strategy that prioritizes the use of data-driven analysis, rigorous testing of investment concepts, and sophisticated computer modeling methods in its portfolio construction.

Cathie Wood’s ARK Investment Management firm also highlights its rigorous research methods but favors equities with disruptive qualities; its forte is to identify innovation before others eventually catch up.

However, that doesn’t mean the two paths do not converge at times. And when two investing powerhouses are seen making big bets on the same names, it’s worth finding out why institutions with differing investment philosophies have reached the same conclusion.

We’ve gotten this process started and have decided to take a closer look at two equities taking up prominent space in both BlackRock’s and Cathie Wood’s portfolios. We’ve used the TipRanks database to find out how the Street’s stock experts see the future panning out for these names.

UiPath Inc. (PATH)

Our first stop is the tech sector, where we’ll take a closer look at UiPath, a leading global provider of Robotic Process Automation (RPA) software and services. Established in 2005, UiPath has emerged as a major player in the automation tech sector, assisting organizations in automating their repetitive, rule-based tasks and processes. The company’s platform empowers businesses to create, manage, and deploy software robots – what we commonly refer to as ‘bots’ – that replicate human interactions with digital systems and applications.

The company’s suite of RPA solutions includes tools for process automation, document understanding, data extraction, and analytics, making it a comprehensive choice for enterprises seeking to streamline their operations.

With a strong presence in various industries, including finance, healthcare, manufacturing, among others, UiPath has been displaying robust growth. There was more on tap in the most recent financial readout for the second quarter of fiscal 2024 (July quarter). Revenue increased by 18.6% year-over-year to $287.3 million, beating the Street’s call by $5.23 million. Adj. EPS of $0.09 also came in ahead of expectations, by $0.06.

Moving forward, the company sees F3Q revenue hitting the range between $313 million to $318 million, with the midpoint slightly above consensus at $315.16 million.

As for the bigwigs’ holdings, Cathie Wood’s Ark Invest is the biggest UiPath shareholder, owning 48,280,787 shares, which command a market value of $782.63 million. BlackRock’s stake is substantial as well, with its 23,376,854 shares worth almost $379 million.

The company also has the endorsement of Canaccord analyst Kingsley Crane, who thinks the threat posed by one tech giant does not affect the bull thesis.

“The competitive environment appears to be stable to improving for the company,” the analyst said. “Microsoft has existed as a competitive threat, at least in narrative, for some time. While Microsoft’s recent developments in AI including its Power Automate product are significant, we aren’t expecting a sea change within the enterprise segment which is increasingly PATH’s core competency.”

“Taking this to the stock,” the analyst added, “Metrics have steadily improved over the past few quarters. One way or another, PATH now screens as a Rule of 40 business with ~20% ARR guidance and ~20% FCF margin guidance. Valuation of ~5x CY24E sales is simply too cheap for a company with that profile.”

These comments underpin Crane’s Buy rating while his $21 price target implies share appreciation of ~30% for the coming year. (To watch Crane’s track record, click here)

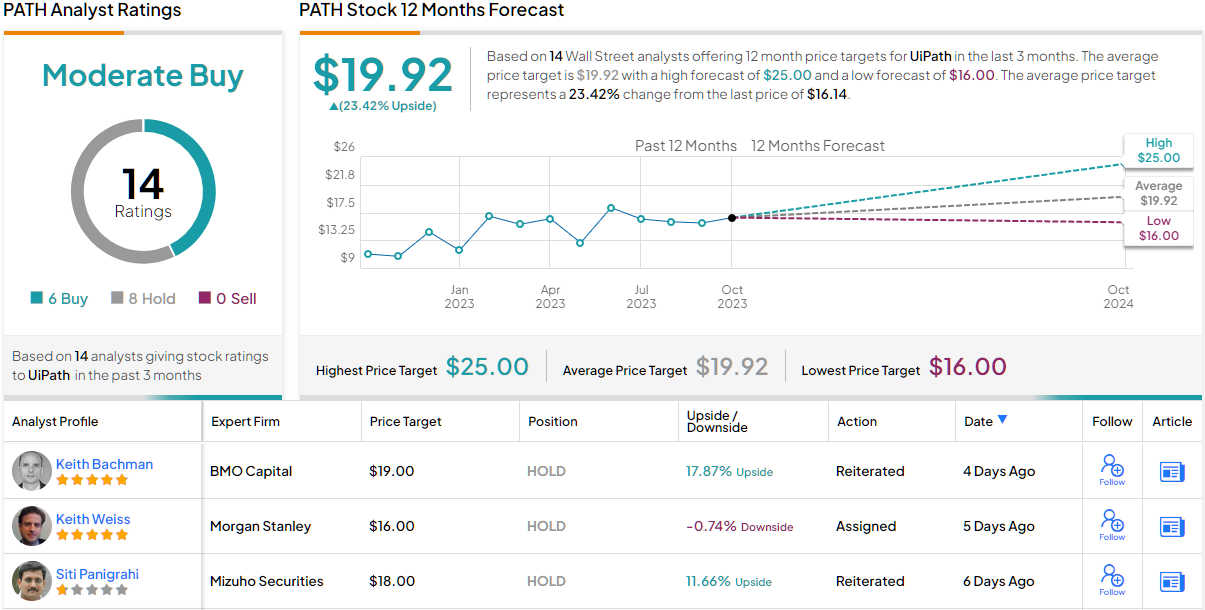

Turning now to the rest of the Street, where based on an additional 5 Buys and 8 Holds, the stock ekes out a Moderate Buy consensus rating. Going by the $19.92 average target, a year from now, investors will be sitting on returns of ~23%. (See PATH stock forecast)

Teradyne, Inc. (TER)

We’ll stay in the tech industry for our next name and delve into the details of Teradyne, an American corporation specializing in the field of automated test equipment (ATE) and industrial automation.

Founded back in 1960, Teradyne has played a big role in advancing technology by providing innovative solutions for testing and optimizing complex electronic systems. The company’s extensive product portfolio includes a wide range of ATE solutions, such as semiconductor test equipment, printed circuit board test systems, and industrial automation solutions for applications in industries like automotive, telecommunications, and aerospace.

That said, with all that on offer, the company has seen revenue mostly trend lower over the past couple of years, as was the case again in Q2. Revenue fell by 18.7% from the same period a year ago to $684 million, although that figure exceeded the consensus estimate by $25.89 million. Adj. EPS of $0.79 also came in lower than the $1.21 delivered in the year-ago quarter, but it should also be mentioned that the figure managed to beat Street expectations by $0.13.

Meanwhile, BlackRock remains long and strong here. It is Teradyne’s 2nd biggest shareholder, currently owning 13,906,746 shares. At the current price, these are valued at almost $1.32 billion. As for Cathie Wood, she’s not sitting on the sidelines either, with ARK Investment’s stake coming in at $111 million, based on holdings of 1,172,220 shares.

Teradyne has garnered fans within the analyst community as well, including Craig Hallum analyst Christian Schwab, whose bullish thesis is based on the company’s positioning in an industry expected to pick up the pace again.

“We remain encouraged with the company’s opportunity as the market eventually reaccelerates,” says the 5-star analyst. “We continue to believe the company is positioned well with secular trends for increasing test demand for increasingly complex devices, including recent AI related demand upticks for semi-test to support cloud compute and high-bandwidth memory, as well as continued strength for the company’s automotive semi-test business. The auto semitest market is expected to grow faster than the broader SoC test market with tailwinds from ADAS and EV expansion, which have roughly twice as many semiconductors as ICE vehicles.”

Quantifying his bullish stance, Schwab’s Buy rating on TER is backed by a $131 price target, indicating shares will deliver upside of ~39% in the year ahead. (To watch Schwab’s track record, click here)

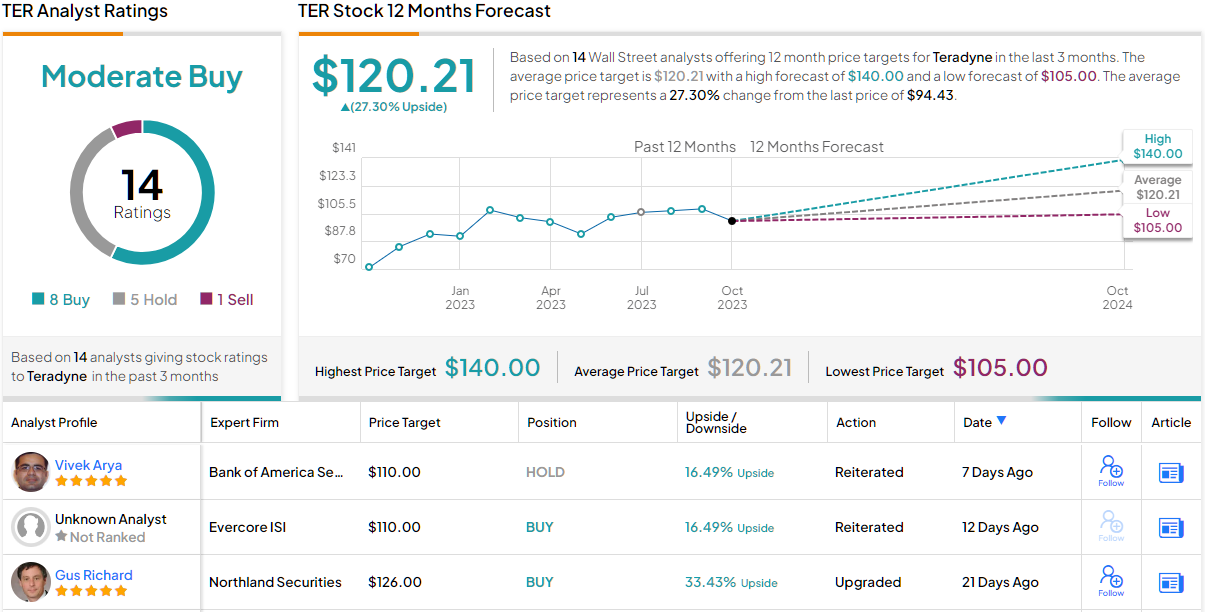

Overall, the Street’s analysts have differing opinions regarding TER’s trajectory, although the majority fall into the bull camp. All told, the stock gets a Moderate Buy consensus rating, based on 8 Buys, 5 Holds and 1 Sell. The forecast calls for one-year gains of 27%, considering the average target stands at $120.21. (See Teradyne stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.