Given the cyclical nature of its industry, Caterpillar (NYSE:CAT) is often expected to bear the brunt of a recession, leading to a significant impact on its financial performance. With market uncertainty remaining elevated against the backdrop of a tumultuous macroeconomic environment, it makes sense for investors to consider Caterpillar as a rather risky investment these days. While this is technically true, Caterpillar is more recession-resistant than most investors realize.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Planned infrastructure spending remains elevated, benefiting Caterpillar’s results, while its backlog continues to grow, shielding the company against short-term uncertainties. Furthermore, the company’s focus on services is gradually transitioning its revenue mix to a more predictable one, strengthening its position and making it more resilient to potential market downturns.

Coupled with its commitment to rewarding shareholders and the fact that the stock is trading at a reasonable valuation, I am bullish on Caterpillar.

Strong Infrastructure Spending Drives Solid Results

Caterpillar is enjoying a significant boost in demand thanks to record-high infrastructure spending that stems from the 2021 bipartisan Infrastructure Investment and Jobs Act. The legislation provides $1.2 trillion in funding expected to be spent over a five-year period, with a primary focus on road, bridge, and large-scale projects. In fact, as of October 2022, approximately 60% of the $185 billion infrastructure spending was attributed to these key areas.

Given Caterpillar’s leadership in the production of construction equipment and heavy machinery needed to complete these projects, the company is among the top beneficiaries of the bill. This is evidenced by its recent financial performance.

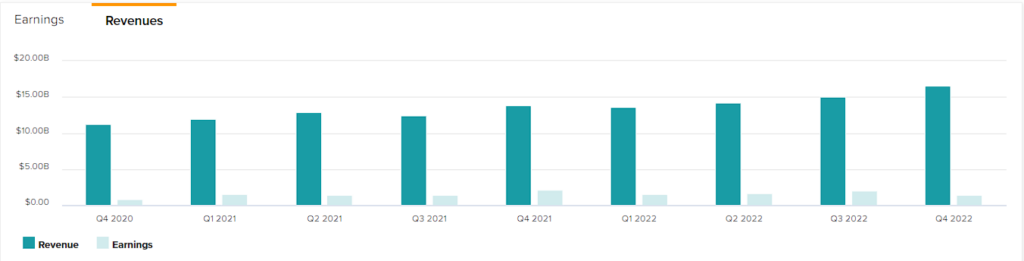

Caterpillar’s 2022 revenues saw a substantial increase of 17% from the previous year, reaching $59.4 billion. The growth can be attributed to higher sales volumes, boosted by favorable price realization and the impact of changes in dealer inventory.

Importantly, the company’s Q4 revenue growth of 20.3% indicates strong upward momentum for upcoming quarters. This is further evidenced by the fact that the company’s backlog rose by $400 million in Q4, bringing the year-end total to $30.4 billion, a 32% increase from the previous year.

These figures should sufficiently exemplify the company’s continued success in a favorable market environment and potential for sustained growth. Regardless, a potential recession is unlikely to result in worsening financials in the short term, given the planned infrastructure spending and growing backlog.

Growth in Services to Enhance Revenue Mix

Caterpillar has taken another strategic step by focusing on the growth of its Services segment. Growing Services revenues should have a positive impact on the company’s revenue mix and improve cash-flow predictability. This is because, through this initiative, Caterpillar is essentially attempting to convert its equipment sales into a source of recurring revenue. This should enhance Caterpillar’s ability to withstand potential economic downturns, further strengthening its resilience to a potential market downturn.

Last year, Caterpillar experienced a noteworthy surge in its Services revenues, reaching $22 billion, marking a 17% increase from the previous year. This growth was propelled by the company’s persistent drive to promote its services through strategic initiatives and investments, as well as effective price realization.

Caterpillar’s assets also grew, having 1.4 million connected assets, up from 1.2 million in 2021. The launch of the company’s new e-commerce app, Cat Central, further amplified its growth in this area. With the highest level of parts availability to date, along with a robust Services segment, the company projects that its Services revenues will hit $28 billion by 2026.

Strong Profitability Boosts Dividends, Buybacks

With strong revenue growth following favorable pricing and sales volumes, Caterpillar has been able to record a strong boost in its profitability. This growth has allowed the company to achieve impressive economies of scale, reflected in an adjusted operating margin of 15.4% in 2022 compared to 13.7% in 2021. The combination of higher revenues and margins has led to even more impressive earnings growth, with adjusted earnings per share skyrocketing by 28% to $13.84.

Thus, Caterpillar was able to increase its rewards to shareholders rather comfortably. In 2022, the company demonstrated its commitment to creating shareholder value by increasing its dividend for the 29th consecutive year. The noteworthy 8.1% hike led to an annualized dividend rate of $4.80, which currently translates to a yield of 2.2%.

The company also took advantage of its boosted profitability to buy back $4.2 billion worth of stock, significantly more than the $2.7 billion repurchased in 2021. Growing capital returns, coupled with strong revenue and earnings growth visibility, should keep stimulating investor interest in the stock. This is also likely to contribute to the stock potentially outperforming the market in the event of a market downturn.

Is CAT Stock a Buy, According to Analysts?

Turning to Wall Street, Caterpillar has a Hold consensus rating based on five Buys, seven Holds, and three Sells assigned in the past three months. At $243.07, the average Caterpillar stock price target implies 10.2% upside potential.

The Takeaway

Caterpillar is currently benefiting from record infrastructure spending, which has led to growing revenues, expanding margins, and record profits. This trend is expected to last over the next few years, which should shield the company from a potential recession in the near term. In the meantime, Caterpillar’s focus on growing its Services segment should improve its revenue mix, making it a more resilient company to potential market downturns further down the future.

Overall, Caterpillar’s ongoing momentum, strong capital returns, and the fact that shares are trading at about 13.85x this year’s projected earnings (about 22% lower than its five-year average forward earnings multiple) form a bullish blend for the stock, in my view.