Once left for dead, one of the most remarkable comeback efforts in recent memory belongs to online used-auto retailer Carvana (NYSE:CVNA). While it’s a natural human reaction to want more, options traders (often referred to as the smart money) may be giving off a worrying signal for this high-flying entity. Given the smart money’s access to premium resources and information, retail investors should at least consider the warning. Therefore, I am bearish on CVNA stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s Look at the Positives, First

Of course, it’s easy to appreciate the ongoing robust sentiment for CVNA stock. Since the beginning of the year, shares have gained almost 1,000%. That’s an 11-bagger to use the pop-culture lexicon. Because of this enormous rally, many retail market participants may be feeling FOMO or the fear of missing out.

Looking at TipRanks’ technical analysis screener – which aggregates various chart indicators to determine a profile for the underlying security – CVNA stock achieves an overall Buy consensus rating. Both the aggregation of technical tools and moving averages point to a Buy assessment.

Further, a brief glance at other investment resources aligns with TipRanks’ technical view. Fundamentally, Carvana has also posted encouraging results. For example, in its most recent second Q2-2023 earnings report, management disclosed a loss of 55 cents per share. While sitting in red ink, the company still beat the consensus target, which called for a loss of $1.18 per share. On the top line, Carvana rang up sales of $2.97 billion, beating the consensus estimate of $2.59 billion.

What’s more, TipRanks reporter Vince Condarcuri mentioned late last month that Carvana CEO Ernest Garcia picked up over three million Class A Units at a per-unit price of $37.048 on August 18. “In a move that sweetened the deal, he was handed more than 2.5 million Class B Shares at no extra cost,” wrote Condarcuri.

On the whole, CVNA stock seems an easy buy. However, the derivatives market might be saying differently.

The Smart Money Issues a Warning About Carvana

Although the immediacy bias of the moment appears to favor CVNA stock, it may be helpful to take a step back. Just like in baseball, when a manager pulls a starting pitcher from the mound and goes to the bullpen, investors shouldn’t assume that previously rallying enterprises will continue marching northward. You’ve got to read the game situation.

To set up the context, investors must realize that implied volatility (IV) – or the market’s forecast of an anticipated movement in the share price – accelerates sharply upward in the lower extremes of CVNA’s strike price range. To be fair, IV also rises in the higher strike price range but in a gradual manner. Essentially, options traders anticipate greater market movement at the strike prices where IV is especially heightened.

Typically, all other things being equal, market participants have an economic incentive to sell high IV options contracts, whether they be puts or calls. To use another baseball analogy, an option with high IV is similar to a player with sterling performance stats. When a player becomes too valuable, a weaker team is incentivized to trade one player for a boatload of near-prime-time-ready minor-league prospects.

And that’s exactly what’s happening. Looking at options flow data that filters for big block trades likely made by institutions, traders are selling both puts and calls. However, the warning is that they’re also buying high-IV puts, which may symbolize high-conviction bearish sentiment.

For instance, open interest for the CVNA Oct 20 ’23 25.00 put has been steadily rising since July 23 of this year. Right now, this contract features a lofty IV of 100.5%. Per options flow data, institutional traders are also buying the CVNA Nov 17 ’23 40.00 put, despite its present IV of 108.2%.

What is the Stock Price Prediction for CVNA in 2023?

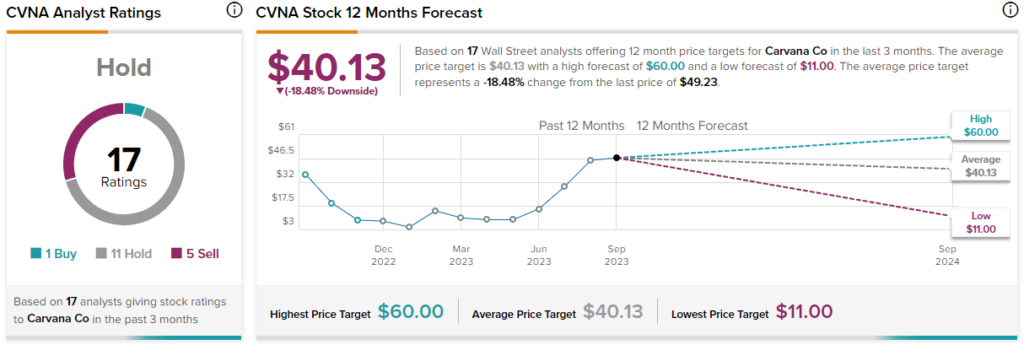

Turning to Wall Street, CVNA stock has a Hold consensus rating based on one Buy, 11 Holds, and five Sell ratings. The average CVNA stock price target is $40.13, implying 18.5% downside risk.

The Takeaway: CVNA Stock May be on the Cusp of Pivoting

While no one wants to spoil the party, it’s vital that investors approach the equities sector with some skepticism. Just like a manager wouldn’t ignore injuries to their key players, market participants must read the game and make decisions. Sometimes, these decisions may go against popular sentiment.

Yes, CVNA reported better-than-expected results recently and has seen some insider buying. Plus, it’s technicals are bullish, according to TipRanks. However, riding the rally without at least peeking at the options market would be imprudent. Circumstances can always change, and the derivatives arena may be tipping off that something isn’t quite right.