Does the ongoing auto workers’ strike have any potential winners? The Big Three automakers in Detroit – General Motors (NYSE:GM), Ford (NYSE:F), and Stellantis (NYSE:STLA) — probably won’t be the big winners, but Carvana (NYSE:CVNA) might be. I am moderately bullish on CVNA stock because a recent analyst upgrade sheds light on the bull case for Carvana, although I do recognize that the stock is risky.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Carvana hails from Arizona and is a pioneer in combining e-commerce and car sales. The company’s online platform makes it easy for automotive buyers to purchase used vehicles and for sellers to get a reasonable price for them.

I even remember hearing about Carvana setting up vending machines to sell cars, which is an intriguing concept. On the other hand, Wall Street isn’t overwhelmingly bullish on CVNA stock. Still, Carvana did get an upgrade not long ago. Plus, a shortage of automotive workers may be the catalyst that puts Carvana in the fast lane in 2023.

A New Carvana Price Target Suggests Upside

Here’s a fresh news item about Carvana. The company’s shares just got an upgrade from Wedbush Securities analyst Seth Basham. The analyst raised his rating on CVNA from Underperform to Neutral and lifted his price target on the shares from $40 to $48.

That’s a hefty price-target raise, percentage-wise, and it implies decent upside from the current Carvana stock price. Basham contends that Carvana’s recently completed debt exchange and improving profitability could drive upside in the third and fourth quarters, as well as “give the company at least two years of breathing room to execute,” the analyst tells investors.

That’s encouraging, as after a bankruptcy scare, Carvana could definitely use some “breathing room.” Furthermore, Basham sees Carvana benefiting from more favorable industry pricing conditions, loan sales that are on pace to “greatly exceed originations,” and favorable pricing in the auto asset-backed securities (ABS) market. Additionally, the analyst feels that Carvana also has made “significant progress” on initiatives that should contribute to a sustainably higher retail gross profit per unit.

Granted, Basham’s upgrade might not have kept CVNA stock afloat for very long. Nonetheless, the analysts’ arguments hold weight and point to a possible recovery for Carvana in the coming quarters.

Auto Workers’ Strike Could Benefit Carvana

Currently, the United Auto Workers (UAW) strike against the aforementioned Big Three automakers is still happening. Investors in General Motors, Ford, and Stellantis probably hoped that the strike wouldn’t go on for this long. Yet, here we are, and the workers haven’t ironed out agreements with the Big Three.

Is this a reason to panic sell CVNA stock? On the contrary, a prolonged auto workers’ strike could provide benefits to Carvana and its stakeholders. If workers aren’t working and new cars aren’t being manufactured in a timely manner, a supply deficit could push vehicle prices much higher. This, in turn, might disincentivize people from buying a new car now.

Even worse, they might not even be able to buy a new car soon, or at least not the car they want. All of this is massively bullish for the used vehicle market, and online shoppers often turn to Carvana’s app to browse for a good-condition, pre-inspected used car.

It’s possible that the UAW strike will persist for so long that even the used vehicle supply might dry up. That’s a long way off, though, so CVNA stock theoretically should at least get a short-term boost if the strike continues.

Is CVNA Stock a Buy, According to Analysts?

I’ll admit that Carvana isn’t a darling in the analyst community. On TipRanks, CVNA comes in as a Hold based on one Buy rating, 11 Holds, and four Sell ratings assigned by analysts in the past three months. The average Carvana stock price target is $41, implying 4.4% upside potential.

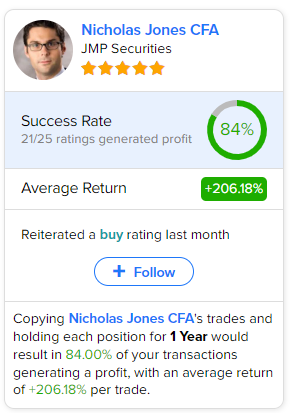

If you’re wondering which analyst you should follow if you want to buy and sell CVNA stock, the most accurate analyst covering the stock (on a one-year timeframe) is Nicholas Jones, CFA of JMP Securities, with an astounding average return of 206.18% per rating and an impressive 84% success rate. Click on the image below to learn more.

Conclusion: Should You Consider CVNA Stock?

Carvana stock is susceptible to rapid price swings, so I definitely don’t think it’s a good idea to overload your account with CVNA shares. However, Basham’s upgrade and persuasive arguments suggest that a small share position in Carvana may be appropriate.

Besides, the ongoing auto workers’ strike could tip the vehicle supply-demand balance in Carvana’s favor. Therefore, I feel that risk-tolerant investors should consider CVNA stock.