Bears have been eating a lot of hats this year, especially those who bet against Carvana (NYSE:CVNA). Laden with substantial debt and facing operational challenges, the future seemed bleak for the well-known used car seller famous for its car ‘vending machines.’ The possibility of bankruptcy became an all too real concern. Yet, here we are with more than half of 2023 done and dusted, and the shares are up 860% year-to-date.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

40% of those gains were recorded on Wednesday after the company delivered its Q2 readout. While revenue dropped by 23.5% from the same period a year ago to $2.97 billion, the figure came in $360 million above expectations. Total gross profit per unit reached $6,520, a 94% year-over-year improvement and overtaking Carvana’s previous best quarter by 27%.

Cost reducing endeavors saw the company narrow the net loss from $439 million a year ago, or -$2.35 per share, to $105 million (-$0.55 per share), while easily outpacing the Street’s forecast for -$1.15 per share.

Further pleasing investors, Carvana struck a debt restructuring deal that will lower its total debt by $1.2 billion, whilst the agreement will also reduce its annual interest expenses by $430 million over the next couple of years.

Assessing the latest developments, Baird analyst Colin Sebastian says it’s the restructuring deal that is the real boon here.

“While structural improvements to GPU (gross profit per unit) and a return to positive adjusted non-GAAP EBITDA are noteworthy milestones in Q2, we believe the more important update was an agreement with bondholders (including Apollo) that will reduce the company’s annual interest expenses by $430 million annually for the next two years, with new notes secured against real estate and other assets,” the 5-star analyst explained. “As a reminder, our previous liquidity model for Carvana from May 2022 suggested the company would have enough liquidity through late 2023/early 2024. We believe this model has proven accurate, and will update to reflect the updated financing in due course.”

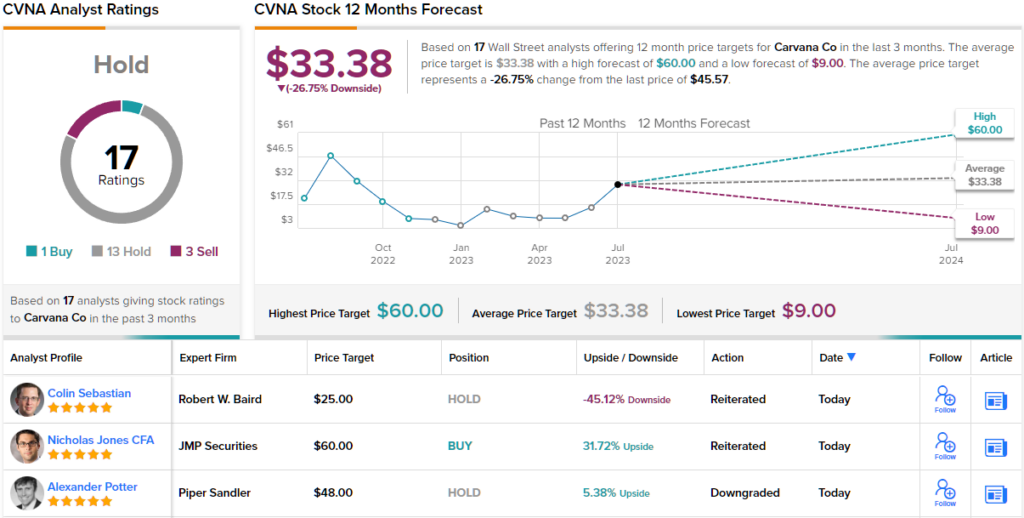

For now, however, Sebastian remains on the sidelines with a Neutral rating and $25 price target. Sebastian might as well have said Sell, though, as the figure implies shares are trading a 45% above their fair value. (To watch Sebastian’s track record, click here)

It’s a similar story for the rest of the Street. The stock claims a Hold consensus rating, based on 13 Holds, 1 Buys and 2 Sells. Yet, the $33.38 average target represents downside of ~27% from current levels. (See Carvana stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.