Carvana (NYSE:CVNA) stock is buzzing on the social media platform Reddit. While CVNA, which has registered massive gains on a year-to-date basis (see the image below), is among the most discussed stocks on Reddit, analysts’ average price target suggests a significant downside potential from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this backdrop, let’s delve deeper into this buzzing Reddit stock.

Is Carvana a Buy, Sell, or Hold?

Carvana provides an online platform for buying and selling used cars, and its stock has witnessed a stellar recovery year-to-date. The company took out costs, improved GPU (Gross Profit per Unit), and is focusing on driving sustainable positive adjusted EBITDA. This led to a rally in its share price. Further, Carvana reached a debt restructuring agreement to lower its outstanding debt and interest costs, which significantly boosted its share price.

The lower reconditioning and inbound transport costs and management’s upbeat Q3 GPU and adjusted EBITDA guidance are encouraging. Carvana expects to deliver adjusted EBITDA of over $75 million in Q3. Earlier, the company expected to generate positive adjusted EBITDA. Moreover, it expects a GPU of above $5,500 in Q3, compared to its previous guidance of over $5,000. In addition, the United Auto Workers strike is a positive development for the used car market and Carvana, as it could help the price momentum to sustain.

Acknowledging the company’s recent efforts to improve financial performance and updated Q3 guidance, Robert W. Baird analyst Colin Sebastian increased CVNA’s price target to $45 from $25 on August 9. However, the analyst has a Hold recommendation on Carvana. Meanwhile, Jefferies analyst John Colantuoni reiterated a Sell rating on the same day, stating that the “Upside to GPU appears primarily driven by additional loan sales from a backlog of receivables, which we consider a transitory tailwind rather than a sustainable improvement in economics.”

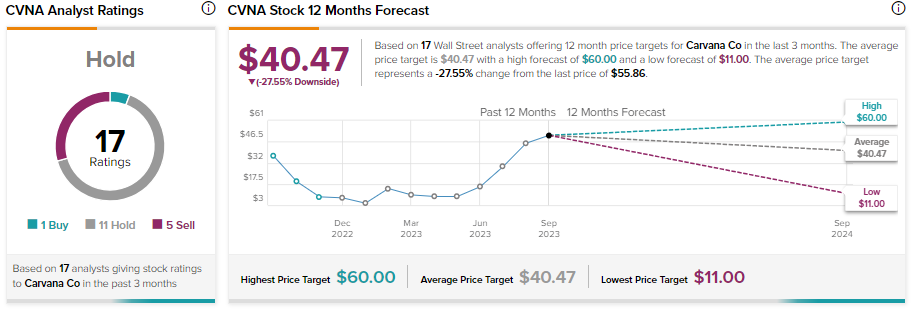

Overall, Carvana stock has one Buy, 11 Hold, and five Sell recommendations for a Hold consensus rating on TipRanks. Meanwhile, analysts’ average price target of $40.47, implies 27.55% downside potential from current levels.

Bottom Line

Carvana has taken steps to improve its unit economics and deliver sustainable positive adjusted EBITDA. Moreover, the upward revision in Q3 guidance is favorable. However, its stock has risen significantly on a year-to-date basis, which could restrict further upside potential. Supporting this view is the analysts’ average 12-month price target, which indicates a downside potential in CVNA stock.