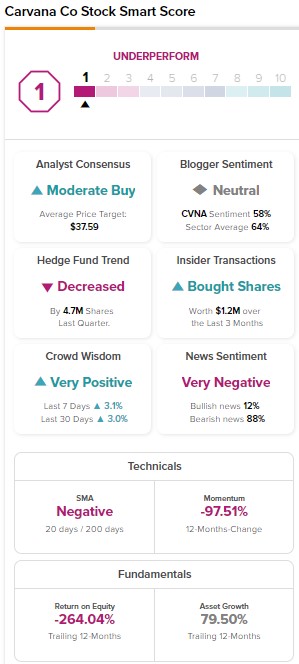

Investing in stocks purely based on their dollar price is not advisable, as there could be solid reasons behind a stock’s low price. This is the case with Carvana (NYSE:CVNA), an online platform for buying and selling used cars. CVNA stock has dropped about 98% from its 52-week high and is trading at a price-to-sales multiple of 0.07 (incredibly cheap). Despite the significant correction and low valuation, CVNA stock has an Underperform Smart Score on TipRanks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Why Did the Price of Carvana Drop So Much?

CVNA stock lost significant value due to the headwinds stemming from lower demand, rising interest rates, and vehicle price depreciation. Further, its problems aren’t likely to end soon, as current weakness, continued cash burn, and higher debt could limit the upside.

CVNA’s CEO Ernie Garcia said during the Q3 conference call that industry-level demand remains weak, which will hurt its prospects. Highlighting industry-level data, Garcia stated that new sales were down about 10-15% in Q3. Meanwhile, the company’s forward-looking indicators reveal a further slowdown.

While industry-level demand remains weak, higher interest rates drive financing costs and hurt used car sales. Moreover, vehicle price depreciation poses challenges for the gross profit per unit.

In response to CVNA’s recent financial results and management’s outlook, Wells Fargo analyst Zachary Fadem said, “We view CVNA’s path to profitability and easing cash burn the primary levers toward improving share price performance today. But with the FY23 outlook increasingly murky (despite evidence of progress) and a considerable debt (and interest expense) burden, we see few NT (near term) catalysts to send shares higher.”

CVNA’s total debt stood at $6.83 billion at the end of Q3, while its cash and cash equivalents were $316 million. This raises concerns, especially amid a weak sales environment.

Bottom Line

Carvana stock is trading cheap, and Wall Street analysts are cautiously optimistic about its prospects. It has received eight Buy and 10 Hold recommendations, for a Moderate Buy consensus rating. Moreover, analysts’ average price target of $37.59 implies a significant upside potential of 410.7%.

It’s worth highlighting that insiders have bought CVNA stock on the dip. TipRanks’ data shows insiders bought 1.2M CVNA stock last quarter.

While CVNA stock has positive signals from analysts and insiders, sales and margin headwinds and higher debt could continue to hurt its prospects. Overall, CVNA stock has a Smart Score of one out 10 on TipRanks, implying weak prospects ahead.