Shares of popular cruise line operator, Carnival Cruise Lines (CCL), have struggled to recover since the coronavirus crisis struck. Though shares partially recovered from the depths of early 2020, the rally has since faltered, and the stock is right back to where it was in April 2020.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Down around 88% from its all-time high and 67% off its 52-week high, Carnival faces a potential economic downturn, which may coincide with a resurgence of COVID-19. With BA.4 and BA.5 variants of Omicron threatening to cause an outbreak over the coming months, it’s unlikely to be smooth sailing for the cruise lines in the second half. Even if the market finds its footing, Carnival’s heavy debt load could ultimately sink it.

With more than $35 billion in debt weighing down the balance sheet of the $9.8 billion company, questions linger as to how much dilution existing shareholders could face. The prospect of higher interest rates makes Carnival’s debt feel that much heavier.

Indeed, for those who caught the bottom in 2020 and failed to get out at the peak in 2021, it’s a discouraging situation, as the shares run the risk of falling below those 2020 lows of $8 and change per share.

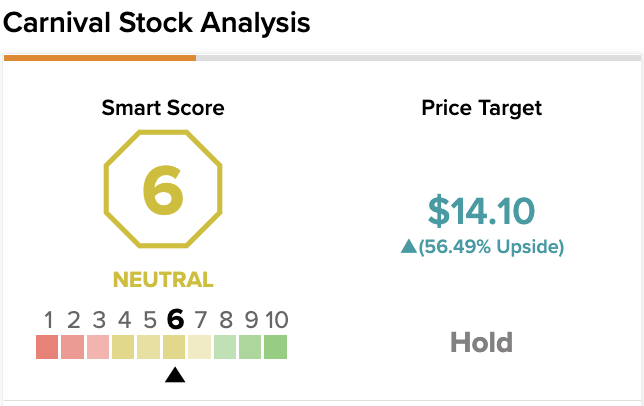

On TipRanks, CCL scores a 6 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Carnival Stock Sails into Trouble

Though the selling pressure on CCL stock is excessive, the magnitude of risks and uncertainties remain considerable.

High fuel prices and inflationary pressures have weighed heavily on its economics at the worst possible time. From COVID-19, to inflation, to a potential economic downturn, Carnival can’t catch any breaks. With a summer travel season ahead, it’s make or break for the cruise line as it contemplates the last resort of new share issuance.

Heavy debt loads can be dangerous going into a higher-rate world.

While many may view Carnival as a sinking ship, I’d argue that the potential upside is considerable for those who believe in management’s ability to cruise through another patch of rough waters. Summertime cruise demand could prove better than expected, but until inflationary pressures back down (possibly in a year from now), Carnival needs to trim away at costs across the board.

Though the medium-term future is hazy, I am bullish on the stock for its severely-depressed valuation. Simply put, it won’t take too much to propel the stock much higher, especially if Carnival can avoid diluting its shareholders.

The recent plunge in energy prices (to $98 per barrel from over $120) is encouraging, and could signal that some relief may be in sight. Management will have its hands full, but there is a way through the hurricane that doesn’t involve further shareholder destruction.

Carnival Stock: How Cheap is Cheap Enough to Compensate for the Risks?

Not to discount the risks, but a price exists where even a headwind-plagued firm like Carnival can be a great buy. At writing, shares of CCL trade at 1.3 times book value and 1.8 times sales. Assuming no further dilution and an economic soft landing, Carnival stock looks like a bargain.

There’s still pent-up demand for epic travel experiences. Millennials and Baby Boomers wish to cruise, once the time is right. Though pandemic-induced hardships or economic roadblocks may postpone cruise bookings until further out, I do think Carnival can improve operational efficiencies. Once inflationary pressures (like fuel costs) wind down, such efficiencies will likely remain. And once demand is ready to surge, Carnival may find itself en route to those seemingly distant pre-pandemic levels.

In any case, Carnival’s fate seems heavily tied to the outcome of exogenous events. The future of COVID-19, the economy, inflation, commodities, and the trajectory of rates will likely dictate where CCL stock goes next. Reliance on debt and new equity issuance can only get you so far. If the macro picture doesn’t improve over the next 18 months, Carnival may run out of options as the perfect storm hits.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, CCL stock comes in as a Hold. Out of 12 analyst ratings, there are four Buy recommendations, four Hold recommendations, and four Sell recommendations.

The average Carnival Cruise Lines price target is $14.10, implying an upside of 56.49%. Analyst price targets range from a low of $7 per share to a high of $29 per share.

The Bottom Line on Carnival Cruise Lines Stock

Carnival has been dealt a brutal hand. With so much negativity baked in, I think investors are discounting management’s ability to make it through the last barrage of headwinds.

Over the coming months, I’d look for fuel costs to retreat as demand looks to heat up for peak travel season. Though a consumer-facing recession may steer Carnival into trouble by the holidays, elevated fuel prices seem to be the more significant sore spot.

Read full Disclosure