Popular cruise line operator Carnival Corporation (NYSE:CCL) will release its third quarter (Q3) financial results on September 29. The company continues to benefit from solid demand and record bookings, which indicates that it could return to profitability in Q3. However, the surge in fuel prices could weigh on its Q3 financials and Fiscal Year guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Keeping this in mind, let’s explore the Q3 expectations.

Here’s What Consensus Estimates Reveal

Carnival Corporation experienced exceptional demand in Q2, with total bookings reaching a new all-time high. The momentum has sustained in Q3, which will likely support the revenue growth. Additionally, the company’s management highlighted during the Q2 conference call that its cumulative advanced bookings for 2H23 are at higher ticket prices, which augurs well for top-line growth. Moreover, Carnival Corporation expects occupancy to remain very high. Collectively, these factors suggest that the company is poised to deliver solid revenues in Q3.

Wall Street analysts anticipate Carnival to post revenues of $6.71 billion in Q3, much higher than the revenue of $4.31 in the prior-year quarter. Furthermore, sales are projected to show sequential growth.

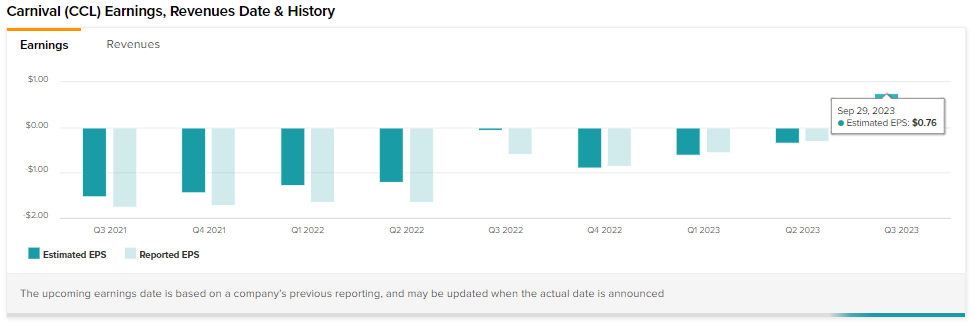

At the same time, solid bookings and higher pricing will cushion its bottom line, helping the company return to profitability in Q3. Analysts expect Carnival to post earnings of $0.76 per share compared to a loss of $0.58 in the prior-year quarter.

While Carnival could become profitable again, higher fuel costs could weigh on its bottom line and guidance. Echoing similar sentiments, Macquarie analyst Paul Golding, on September 26, lowered the price target on Carnival stock to $16 from $17. However, Golding maintained a Buy rating due to the solid bookings and pricing. With this backdrop, let’s look at what the Street recommends on CCL stock ahead of Q3 earnings.

Is Carnival Stock Expected to Rise?

Carnival stock has gained over 73% year-to-date. Despite this significant appreciation in value, analysts expect CCL stock to rise further.

Wall Street analysts are bullish about Carnival’s prospects. With 12 Buys and three Holds, Carnival stock has a Strong Buy consensus rating ahead of Q3 print. Meanwhile, analysts’ average price target of $20 implies 43.06% upside potential from current levels.

Insights from Options Trading Activity

Options traders are pricing in a +/- 8.80% move on earnings, greater than the previous quarter’s earnings-related move of -7.59%.