Shares of the candy makers, including Hershey (NYSE:HSY) and Tootsie Roll Industries (NYSE:TR), have outperformed the broader market averages in the past six months on the back of strong consumer demand. However, higher ingredients, packaging materials, and manufacturing costs have taken a toll on their margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The graph below shows the six-month performance of HSY (+7.3%) and TR (+15.6%) stocks. The S&P 500 Index (SPX) is down over 8%.

While both these companies have increased prices to counter inflation, significantly higher input unit costs remain a drag on their margins. Hershey’s Q2 adjusted gross margin fell 250 basis points due to higher costs. Meanwhile, the company expects the full-year gross margin to decline by 120 to 140 basis points even with increased pricing.

As for Tootsie Roll, the company stated that its input unit costs had increased significantly in the first nine months of 2022.

Against this background, should you bet on these candy makers ahead of Halloween and the holiday season? Let’s find out.

Is HSY Stock a Buy?

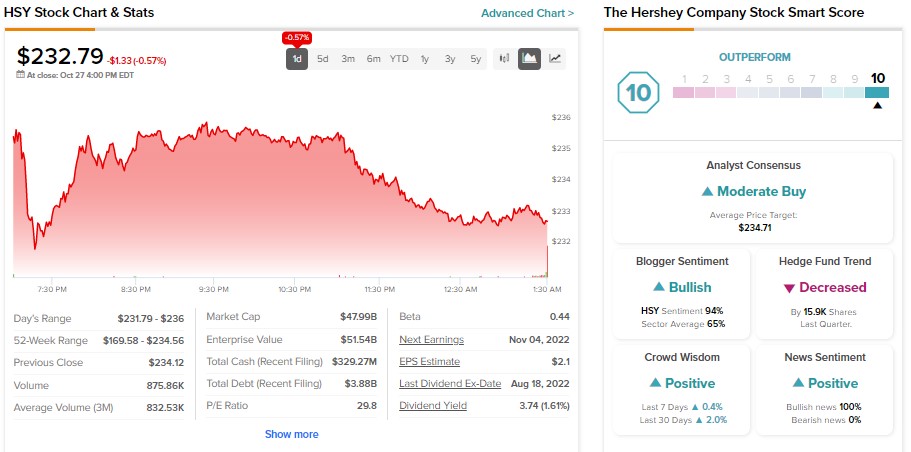

On TipRanks, Hershey stock has a Moderate Buy consensus rating based on three Buys and four Holds. Further, analysts’ average price target of $234.71 is roughly at par with its closing price on October 26.

HSY stock has positive signals from retail investors (2% of these investors increased their holdings in HSY stock last month) and bloggers. However, hedge funds sold 15.9K Hershey shares in three months. Overall, HSY stock has a “Perfect 10” Smart Score, implying it could outperform the broader market.

Is Tootsie Roll Stock a Buy?

Tootsie Roll stock is not rated on TipRanks. However, TipRanks’ data shows that TR stock has a negative signal from investors, with 1.5% of them reducing their exposure in the last 30 days. Meanwhile, TR stock scores a five on 10 on TipRanks’ Smart Scoring system, implying its performance could be tied to broader market averages.

Bottom Line

Sales-driving events like Halloween and the holiday season will likely boost the top-line numbers of these companies. Further, higher pricing could support earnings. However, escalated costs are expected to remain a short-term drag on margins. Moreover, increased candy pricing (due to the pricing action taken by these companies) may hurt demand.