Canadian Tire (TSE: CTC.A) sells home goods, sporting equipment, apparel, footwear, automotive parts and accessories, and vehicle fuel through a 1,700-store network of company-, dealer-, and franchise-operated locations across Canada.

Aside from the namesake banner, stores operate primarily under the Mark’s, SportChek, Atmosphere, and PartSource brands.

Canadian Tire is a decent company that is very profitable and provides a nice dividend yield. However, it may not be the best opportunity out there during the current sell-off.

Measuring Efficiency

Canadian Tire needs to hold onto a lot of inventory in order to keep its business running. Therefore, the speed at which a company can move inventory and convert it into cash is very important in predicting its success. To measure its efficiency, we will use the cash conversion cycle, which shows how many days it takes to convert inventory into cash. It is calculated as follows:

CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

Canadian Tire’s cash conversion cycle is 37 days, meaning it takes the company 37 days for it to convert its inventory into cash. In the past several years, this number has trended upwards, indicating that the company’s efficiency has deteriorated.

In addition to the cash conversion cycle, let’s also take a look at Canadian Tire’s gross margin trend. Ideally, I would like to see a company’s gross margin expand each year. This is, of course, unless its margin is already very high, in which case it is acceptable for it to remain flat.

In Canadian Tire’s case, gross margins have increased slightly in the past several years, rising from 31.2% in Fiscal 2018 to 33.3% in the past 12 months. This is ideal because it allows the company the opportunity to increase free cash flow or reinvest a larger percentage of revenue into growth initiatives.

Dividend

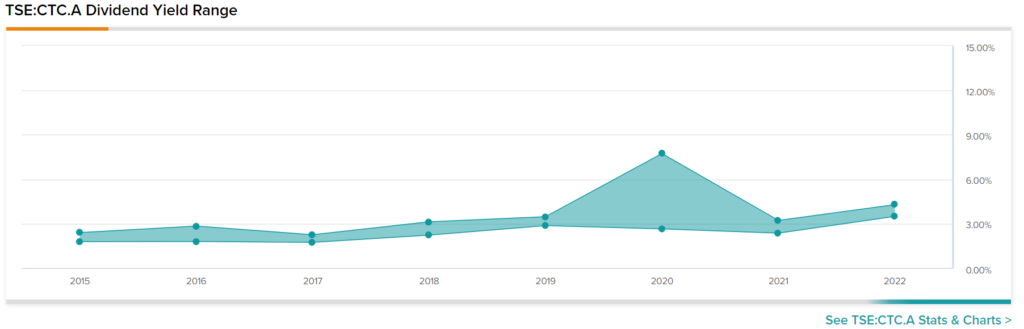

For investors that like dividends, Canadian Tire currently has a 3.23% dividend yield, which is above the sector average of 1.66%. Taking a look at its historical dividend payments, we can see that its yield range has trended upwards in the past several years:

At 3.23%, the company’s dividend is near the upper end of its range, implying that the stock price is trading at a discount relative to the yields investors have seen in the past.

Valuation

To value Canadian Tire, I will use a single-stage DCF model because its free cash flows are volatile and difficult to predict. For the terminal growth rate, I will use the 30-year Government of Canada bond yield as a proxy for expected long-term GDP growth.

My calculation is as follows:

Fair Value = 10-Year Average FCF per share / (Discount Rate – Terminal Growth)

C$153.12 = C$10.32 / (0.1 – 0.0326)

As a result, we estimate that the fair value of Canadian Tire is approximately C$153.12 under current market conditions. With the stock trading around C$161.50 currently, it may be overvalued.

Analyst Recommendations

Canadian Tire has a Strong Buy consensus rating based on six Buys and one Hold assigned in the past three months. The average Canadian Tire price target of $224.43 implies 40.3% upside potential.

Final Thoughts

Canadian Tire is a good company with a decent dividend yield for income-oriented investors. In addition, analysts see strong upside potential for the next 12 months. However, analysts may be too optimistic since the stock is likely already trading above its fair value.