Rail freight is big business. Globally, the market size was $273.23 billion in 2023 and is expected to grow by 21.75% to $332.67 billion by 2027. This type of growth often benefits just a handful of companies, as the industry has a high degree of concentration, which in turn benefits the dominators in the space. For this reason, I am bullish on Canadian National Railway (NYSE:CNI) (TSE:CNR) stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Montreal-based company, which was founded in 1919, is Canada’s largest railway in terms of both revenue (C$4.47 billion or about $3.3 billion in Q4 2023) and physical rail network. That network spans nearly 20,400 miles across the Great White North, throughout the American Midwest and East Coast, and south to the Gulf of Mexico. In total, the company transports over 300 million tons of cargo annually.

That dominance has been reflected in the performance of its shares, which have increased by 1,102% over the past 20 years and 131.1% over the past decade, not including dividends. Meanwhile, the company has continued to reward loyal shareholders. According to its 2023 Investor Fact Book, Canadian National Railway has returned $32 billion over the last 10 years via share repurchases and dividends.

How Were Canadian National Railway’s Recent Earnings Results?

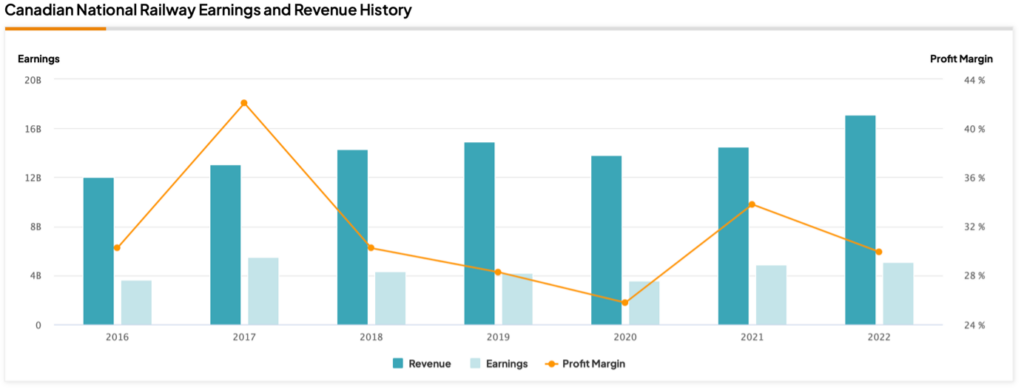

CNI reported Q4 and full-year earnings on (January 23). The results were a mixed bag. For the fourth quarter, compared to the same period a year earlier, diluted earnings per share (EPS) increased by 57% to C$3.29, while adjusted diluted EPS decreased by 4% to C$2.02. Revenue decreased by 2%, operating income decreased by 5%, and its operating ratio — operating expenses as a percentage of revenues – grew by 1.4 points to 59.3%.

Full-year financial results saw revenues decrease by 2% to C$16.828 billion, diluted EPS grew by 15%, and adjusted diluted EPS decreased by 2%. Meanwhile, net income increased 10% versus 2022 to C$5.625 billion, but free cash flow fell by 9% to C$3.887 billion.

This marked the first time in three years the company was unable to grow its full-year revenues.

Nonetheless, the company offered strong guidance for 2024. Canadian National Railway expects diluted adjusted EPS to increase by about 10% and a return on invested capital in the target range of 15%-17%.

CNI reiterated its commitment to targeting annual diluted EPS growth from 2024–2026 in the range of 10%–15% with the help of growing volumes, pricing above rail inflation, and continuously improving efficiency, an area where it excelled last year.

In 2023, the company was able to achieve the following:

- Lower its injury frequency rate to a record low of 0.96 per 200,000 person hours, good for an improvement of 13%

- Improve its accident rate by 17% to 1.74 per one million train miles

- Increase “through network train speed” by 5% to 19.8 mph

Despite the earnings misses, Canadian National Railway’s shares continue to perform well and are currently trading 17.68% higher than their one-year low on October 27, 2023, finding themselves well above the stock’s 50-day and 200-day moving averages of 120.19 and 115.29, respectively.

New Share Buyback Program and Dividend Hike

CNI’s current share buyback program expires at the end of this month. Under that program, through January 18, 2024, the company repurchased 27.831 million shares for a weighted-average price of C$156.25 per share.

The new buyback program, which has already been approved by the company’s board, permits the purchase of up to 32 million common shares over the following 12 months. Those 32 million shares represent 5.63% of the CNI’s float.

Additionally, the board of directors approved a 7% increase to its quarterly cash dividend. This represents the 29th consecutive year the company has raised its dividend, dating back to its IPO in 1995. More recently, the dividend has seen a compound annual growth rate (CAGR) of 12.5% since 2013. At present, CNI shares have a forward dividend yield of 1.9% or C$3.16 (about $2.34) per share annually.

Technical Sentiment is Positive

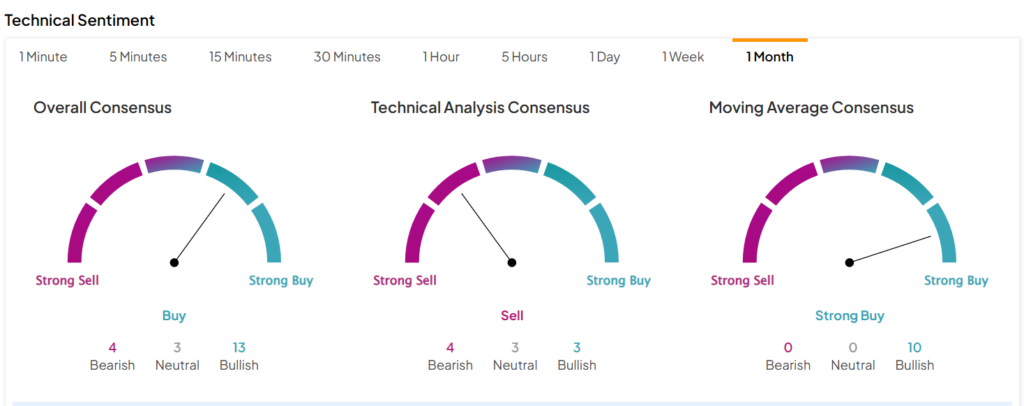

Supporting the bullish thesis is the technical sentiment. One-month technical sentiment for CNI is mostly positive, with the overall consensus and moving average consensus being bullish.

That bullish sentiment is being echoed by insiders and institutional investors alike. At writing, insiders hold a collective 12.6 million shares of Canadian National Railway stock.

However, that figure is dwarfed by the number of shares institutional investors hold, including 54.83 million shares owned by the Bill & Melinda Gates Foundation, 40.89 million shares owned by TCI Fund Management, and 29.09 million owned by the Royal Bank of Canada (NYSE:RY) (TSE:RY). Another 23.98 million shares of CNI valued at over $2.947 billion are held in four Vanguard mutual funds.

Is CNI Stock a Buy, According to Analysts?

Based on 21 Wall Street analysts rating CNI in the past three months, the one-year average price target for CNI stock is $129.78, implying 5.5% upside potential. The stock earns a Hold rating based on three Buys, 17 Holds, and one Sell.

The Takeaway

Despite mixed Q4 and full-year financial results, guidance for CNI remains strong. Bolstered by a substantial growth forecast for the rail freight industry, a new share buyback program, and a dividend that’s been raised for 29 consecutive years, Canadian National Railway is poised to perform well in 2024 and continue to deliver returns for shareholders.