Zoom Video Communications (ZOOM) was one of the biggest winners during the pandemic. However, in the last few months, the stock has dramatically lost its momentum and has continuously been losing its value. Zoom has lost almost 61% in the past six months and its declining trend is such that even when the Omicron variant of the Coronavirus flared across the globe, the stock couldn’t recover.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yet, the market has not lost its complete faith in the stock. This is because it is believed remote work is here to stay longer and products like Zoom Phone and Zoom Rooms, which provide the company with a significant upselling opportunity, can possibly also catalyze its rate of growth.

Zoom Video Communications is a United States-based communications technology company that provides video telephone and online chat services using a cloud-based peer-to-peer software platform. Its services are used around the world for a multitude of purposes such as teleconferencing, telecommuting, distance education, and social relations, both business as well as non-business.

Zoom has an outstanding business model and its sticky product has given it much-needed pricing power. Therefore, even after facing such severe competition from established giants like Alphabet (GOOGL), Microsoft (MSFT), and Salesforce.com (CRM), the company has clearly been able to maintain its leadership position in the videoconferencing segment. As per a survey by the EmailToolTester, Zoom roughly holds a 51% share in the global videoconferencing market, much ahead of Microsoft Teams, which is in the second position, holding 45% of the market share. Moreover, the hold over pricing power signifies the company will be able to grow both by adding new products and customers to its kitty as well as by raising the price of its offerings.

Good Fundamentals

For Zoom, the last few years have been truly exceptional. The company had boasted an incredible three-year revenue compound annual growth rate of 160%. Though this high growth rate has largely slowed down these days, the company has still managed to post revenue of $1.05 billion in the third quarter of the Fiscal year 2022, showing a 35% increment year-over-year.

Besides, it has also seen a great increase in the number of customers, recording over $100,000 in the TTM revenue from customers, thereby representing a massive 94% year-over-year increment.

Also, during that period the operating income of the company came in at $290.9 million, up from the $192.2 million it had achieved during the same period just a year ago. Further, Zoom’s overall balance sheet is quite impressive in general. The company has successfully maintained a solid liquidity position, with $5.4 billion in cash and cash equivalents and $374.8 million in free cash flow.

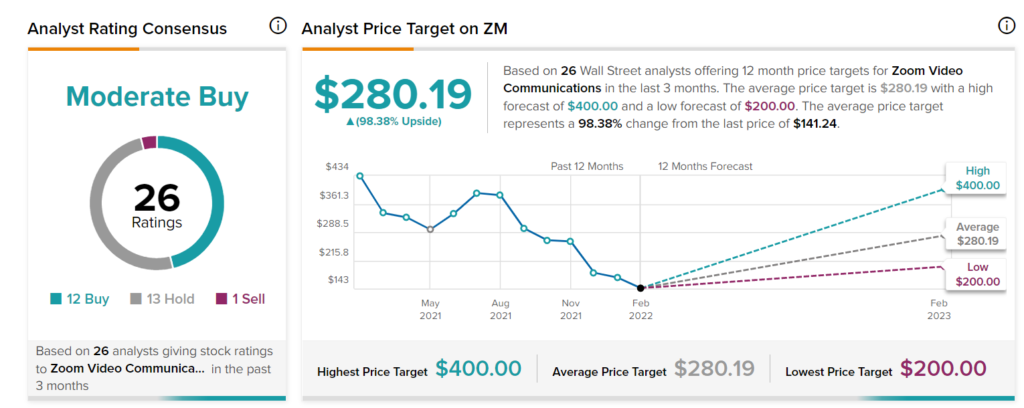

The Tipranks Stock Forecast Tool indicates 12 out of 26 Analysts have given Zoom a Buy Rating, whereas another 13 of them have suggested a Hold on its shares. However, one of them has suggested a Sell. The highest price target for the stock is $400, which is a potential upside of a little over 183% from its February 11th closing price of $141.24. The average Zoom price target is $280.19, which implies a healthy 98.4% upside on the stock.

Several Growth Opportunities

Though Zoom’s growth rate has reduced, the company still has a long way to go. This is mostly because the remote work structure is not likely to go away soon and the company will be able to continue finding customers subscribing to its services. Back in September 2021, a poll by Gallup showed around 45% of the United States’ population were still working from their respective homes, at least for some of the time. Moreover, 91% of them intend to continue working remotely even after the pandemic comes to an end and 54% of them would prefer a hybrid work structure in the future. Zoom, being a leader in the video conferencing segment, is in a perfect position to reap benefits from such a situation.

Also, other than the standard video-conferencing tool, Zoom has two other products: Zoom Phone and Zoom Rooms. Those offer several long-term opportunities to the company. While Zoom Phone updates the internal phone infrastructure, Zoom Rooms can give a modern conference room feeling over the internet. Both these products offer a huge upselling opportunity to the company, as until September 2021, only 4% and 5% of Zoom customers had opted for the services of Zoom Phone and Zoom Rooms.

Moreover, strategies like the integration of video calls into Meta’s Portal (FB), Google’s Nest Hub Max, and Amazon’s Fire TV devices (AMZN) could also bring in lots of benefits to the company. Furthermore, in the future, Zoom could monetize the tens of millions of free users it has gained over time, through post-video ads on its free tier.

Conclusion

Zoom is a good company in general, with some solid fundamentals. It might not be posting triple-digit growths as it did back in 2020, but one can’t deny that the company still holds a lot of potential. Taking initiatives, like the launching of new products, to evolve into a more diversified cloud-based operator, will allow Zoom to successfully capitalize on the momentum and brand recognition it had achieved during the pandemic.

The steady competition might also pose certain challenges, but with proper strategies, it will be able to sail through all the hurdles. So, at the current price level, Zoom seems like quite a good bargain.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure