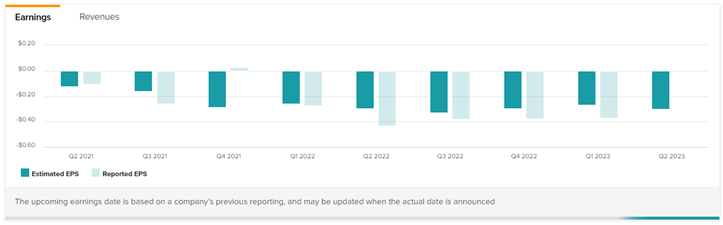

Chinese electric vehicle (EV) maker XPeng (NYSE:XPEV) is set to report its second quarter Fiscal 2023 results on August 18, before the market opens. Analysts expect XPeng to report an adjusted loss of $0.30 per share on revenues of $693.18 million. In Fiscal Q2 2022, XPeng posted an adjusted loss of $0.43 per share on revenues of $1.11 billion. The smart EV maker has consistently underperformed analysts’ expectations in six out of the past eight quarters, and it could fail to surpass estimates again.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The EV Sector Faces a Slew of Challenges

The EV sector is already facing several headwinds owing to rising interest rates, supply constraints, and the price war started by rival Tesla (NASDAQ:TSLA). Meanwhile, the Chinese economy is showing signs of deflationary pressure, with both exports and imports facing challenges and consumer spending power diminishing.

Amid the chaos, XPeng has been facing a slew of challenges of its own alongside stringent competition. Recently, Dr. Xinzhou Wu, Vice President of Autonomous Driving, resigned from his position, dragging down XPEV shares. The company even failed to impress with its July vehicle delivery numbers. Even so, the EV maker is hoping to improve its delivery average to 15,000 units in Q3 and 20,000 units in Q4.

On the bright side, auto behemoth Volkswagen (DE:VOW) recently announced a $700 million investment in XPEV, gobbling up a 4.99% stake in the EV maker. Plus, both companies entered into a partnership to produce two B-class BEVs (battery electric vehicles) for the Chinese market. The news was received with open arms by Wall Street and was followed by a series of price target upgrades and revised views on XPEV shares.

What is the Price Target of XPeng?

On TipRanks, the average XPeng price target is $15.66, implying 2.1% downside potential. With seven Buys, four Holds, and three Sell ratings, the stock has a Moderate Buy consensus rating. Year-to-date, XPEV stock has gained 53.1%.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in XPEV stock to move by +/-8.08% after reporting earnings. Last quarter, the stock fell by 5.05% following the Q1-2023 results, which fell short of analysts’ estimates.

The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Key Takeaways

XPeng is trying to bolster its EV deliveries despite macro challenges. However, it may take a while before the Chinese economy overcomes the current downtrend. The Chinese authorities are also considering imposing measures that will bolster the overall domestic demand and EV consumption. These dynamics leave Wall Street with mixed feelings, with analysts maintaining a measured optimism regarding XPeng’s future performance.