Shares of microblogging firm Twitter (NYSE: TWTR) have been on quite a rollercoaster ride over the past year, surging and slumping based on Elon Musk deal expectations. As Elon Musk readies to close a deal over at Twitter, questions linger as to whether the visionary leader behind the EV boom can turn the tides over at the imperfect social media firm.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Indeed, Musk had a change of heart, bringing up concerns over bots. The lofty $44 billion price tag (implying an acquisition at $54.20 per share) amid plunging stock markets seems to be another reason Musk may have had a bit of buyer’s remorse. Regardless, a Musk-Twitter deal appears to be a go after many months of drama, if only to avoid further drama in court. That said, other unexpected factors may still cause the deal to fall through.

If the Twitter deal closes (it looks very likely at this juncture), Musk will have his hands full, with yet another company to worry about alongside EV juggernaut Tesla (NASDAQ: TSLA) and his private rocket firm SpaceX. Let’s not forget about his involvement at SolarCity and Neuralink.

Undoubtedly, Musk has done a fantastic job of juggling multiple companies. Many skeptics may slam Musk for overpaying for Twitter. However, they may be too quick to discount Musk’s abilities to turn the ship around.

Indeed, Twitter has issues, but Musk has always been a man with solutions. In any case, Elon Musk has made it clear that he’s an innovator, not a value investor like Warren Buffett, a legendary manager that Musk snarkily commented about in the past. At around $50 per share, TWTR stock is not cheap. It could take years before Musk can justify the hefty price he’ll pay.

Primarily due to valuation concerns and risks that could prevent a deal closure, I remain neutral on TWTR stock.

Twitter: How Will the Elon Musk Era Look?

Twitter has some baggage that Elon Musk will need to deal with, most notably the bot concerns. In an interview conducted by CNBC, Jamie Dimon expressed hope that Elon Musk would “clean up Twitter” amid bot concerns, also noting that the removal of anonymous accounts would be something to consider. Undoubtedly, Twitter could evolve with a new top boss and a different perspective.

With many potential levers to pull and the boldness to pull them, Musk seems to be the man to drag Twitter out of the gutter with major wide-sweeping changes.

Rising interest rates and a Fed-induced recession have been a travesty for the broader markets, especially unprofitable tech companies with no means to move into the green. That said, times of turmoil are great times to take market share away from industry rivals. With Musk ready to close, I think Twitter will be made better with changes that he, as a user, sees fit. Indeed, Musk is a big fan of tweeting, and he’s sure to shift things to improve the user experience.

Though it’s unclear as to how he’ll get Twitter back into growth by innovation mode, there are a lot of things Musk can test with the massive network. Sure, Musk may scoff at the concept of an economic moat, but there’s no doubt that the firm he’s closing in on has a pretty wide one within the social media scene.

Ad growth over at Twitter has stayed robust, even amid slumps in user growth. A recession will act as a larger drag on the ad business but may also pave the way for increased user engagement as people ditch paid subscriptions for free, ad-based forms of passing the time.

Though the Twitter Blue monthly subscription service was an intriguing concept to help the company improve its profitability prospects, it’s clear Twitter needs to make much larger changes if it’s to entice its users to open up their wallets and increase their time spent on the platform. Fortunately, Musk is the ultimate catalyst for Twitter to flex its muscles again, even as ads fall under increasing pressure.

Under the Musk era, expect major change and a pick-up in the magnitude of risk-taking. Musk knows better than most how to take calculated risks for a shot at massive long-term rewards. Though there’s a chance that Twitter under Musk could go wrong, it’s hard to believe things could get much worse, given the trajectory of the broader social media scene of late.

Is TWTR Stock a Buy?

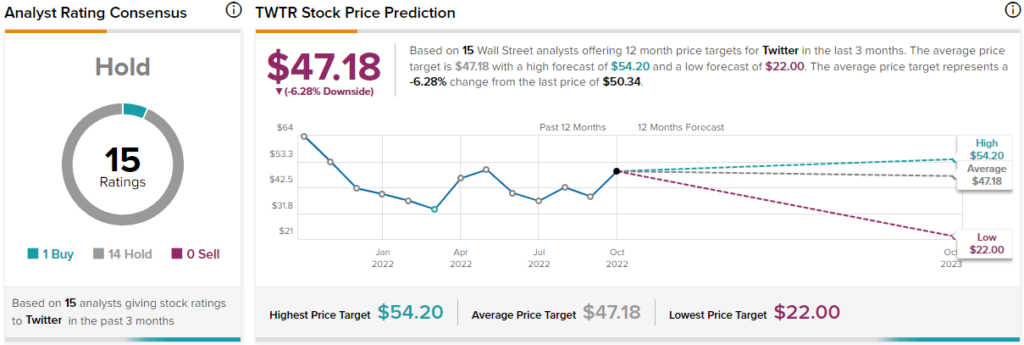

Turning to Wall Street, TWTR stock comes in as a Hold. Out of 15 analyst ratings, there is one Buy rating and 14 Holds. The average Twitter price target is $47.18, implying downside potential of 6.3%. Analyst price targets range from a low of $22.00 per share to a high of $54.20 per share.

Conclusion: Pay Close Attention to Twitter

The social media scene should pay close attention to Twitter during the Musk era. The company could easily become the hottest social media play again if Musk can “clean up” Twitter and improve it with the addition of new innovative features.

For now, the stock seems way too rich for new money. With only one Buy rating and a negative expected year-ahead return, almost every analyst thinks Musk overpaid.