This year has been difficult for most industries, but the technology sector has been hit especially hard. The U.S. technology sector has lost more than a quarter of its value so far this year, with major companies losing considerable valuation over the months. However, the fourth quarter can open up great “buy-the-dip” opportunities on some high-quality tech stocks, such as Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN), keeping the longer-term view in mind.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

How the Technology Sector Looks Presently

The pandemic-led recession in 2020 had led to a rise in tech shopping among investors, and expectedly, the post-pandemic boom led to massive returns on investment through 2021. However, this year has been challenging. Elevated costs, shortages of key components and other supply-chain snags, loss of business due to geopolitical tensions, and the added woe of rising interest rates have crippled the technology sector.

The tech sector is heavily dependent on constant expensive upgrades and innovations to stay relevant. The Fed’s crackdown on inflation has pushed interest rates up, making the tech sector take the double whammy of high borrowing costs and even higher input costs.

Sadly, more pain is on the way, given that the Fed took any chance of turning dovish on its fight against inflation off the table. This means that interest rates are likely to keep rising at an aggressive rate until inflation is brought down to its knees.

More rate hikes may lead to further valuation erosion in tech stocks in the last few months that are left in 2022, but that also comes with an opportunity to accumulate more shares of tech bigwigs.

What Percentage of the U.S. Economy Is Technology?

The technology sector makes up between 9% and 10% of the total U.S. GDP. Microsoft constitutes roughly 7.7% of the U.S. economy by market cap, while Amazon constitutes about 5.1%, making them the undisputed leaders of the tech world.

Given the resources, expertise, and manpower of these two stalwarts, it is safe to say that Microsoft and Amazon could be great portfolio additions and could lead to massive returns for investors who don’t suffer from recency bias.

Amazon Stock Looks Historically Cheap

With a current P/E ratio at around 111.9x, Amazon appears to be trading at an attractive discount, considering it is currently trading massively below its 10-year average of over 1,600x. Notably, the P/E of a profitable company tells us how investors value the stock based on the earnings per share generated by the company during a specified time period.

Bernstein analyst Mark Shmulik agrees that Amazon is an excellent stock to buy right now. Analyzing the trends from Prime Day sales, the analyst believes that the company will regain e-commerce market share in the second half of 2022.

Moreover, Amazon’s diverse SKU mix gives it an advantage over other e-commerce sites as economies reopen and consumers’ time for checking any site other than Amazon shrinks. On the operating performance front, Shmulik is impressed with Amazon’s steps to rectify its poor decisions and expects continued operating margin improvement to be a key growth factor in 2H 2022.

Moreover, Robert W. Baird analyst Colin Sebastian expects e-commerce stocks, including Amazon, to grow 12%–13% year-over-year in 2H, considering a 10% growth rate in domestic e-commerce revenues.

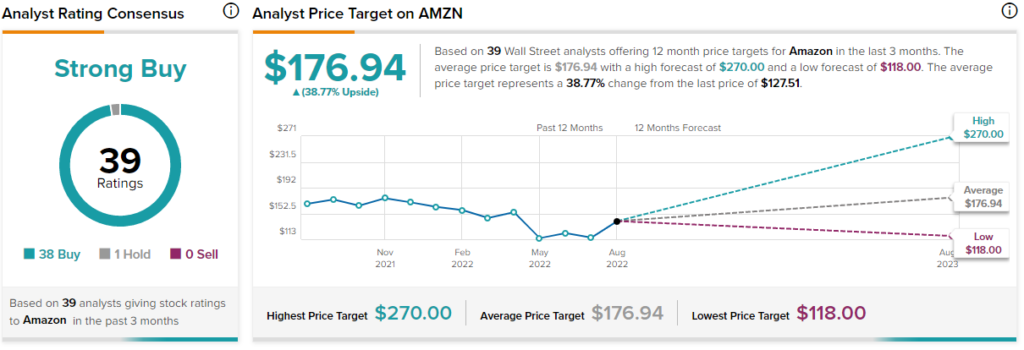

Is Amazon a Buy, Hold, or Sell?

Interestingly, 38 analysts covering Amazon have a Buy rating on the stock, whereas one has a Hold rating, giving the stock a Strong Buy consensus rating. The average Amazon stock price prediction of $176.94 presents 38.8% upside potential.

Microsoft Stock Also Looks Inexpensive

Microsoft is another growth stock that looks relatively cheap right now. Its P/E ratio of around 26.3x is very close to its two-year low of 25.7x. Given that the ratio had reached over 40x in 2020, MSFT stock appears to have strong upside potential. Nonetheless, taking the looming possibility of a recession into account, the valuation may depreciate some more going into the final quarter of the year, giving rise to a solid investment opportunity.

The company’s exposure to the Metaverse through Microsoft Mesh and its efforts to incorporate interactive technology into several of its offerings are expected to forge a smooth path for growth in the long run.

Moreover, if the company’s proposed acquisition of video-game developer Activision Blizzard (NASDAQ: ATVI) manages to resolve its antitrust issues in the U.K., Microsoft might be able to expand its footing in the metaverse gaming space manifold.

Oppenheimer analyst Timothy Horan believes that rapid digital transformation is helping Microsoft overpower macroeconomic challenges and gain market share in information technology.

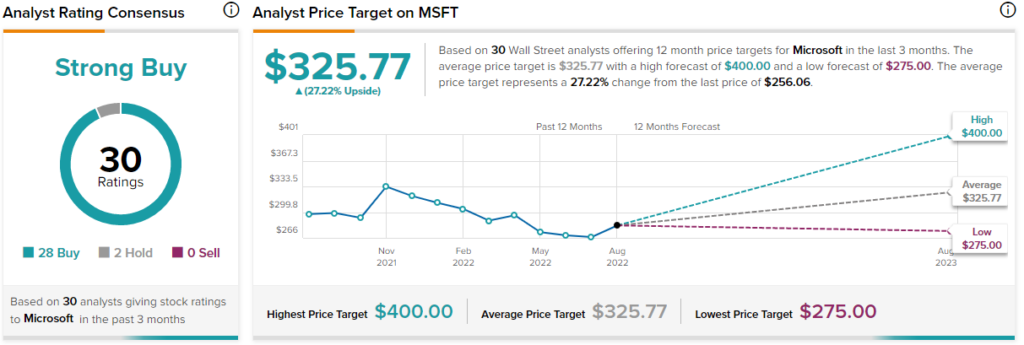

What Is the Future of MSFT Stock?

Horan also believes that Microsoft’s stock price can go up to $300 in the next 12 months. Wall Street has a firm conviction about MSFT stock, which has a Strong Buy consensus rating supported by 28 Buys and two Holds. Microsoft’s average price forecast of $325.77 reflects upside potential of 27.2% from current levels.

An Alternative to Individual Stock Picking

When the economic outlook is uncertain and the market is volatile, it can get difficult to choose the right stocks. In this regard, investing in indexes can be ideal, as this will spread the risk profile among a handful of the top tech companies in the U.S.

The Nasdaq 100 (NDX) is a tech-heavy subset of the broader Nasdaq Composite, tracking the top 100 non-financial companies trading on the Nasdaq stock exchange. There are various ETFs that are linked with this average that can be considered, like the Nasdaq Next Generation 100 Index, the Nasdaq-100 ESG Index, the Nasdaq-100 Volatility Index, and others.

In the past five years, the Nasdaq 100 has appreciated more than 100%, giving us all the more reason to have faith in the index.

Conclusion: Technology Stocks Should Thrive in the Long Term

Technology stocks have immense potential to benefit from secular growth opportunities. Amazon and Microsoft are among those running the show, making them look like ideal investment options for investors with a long-term view.