After a stellar rally, shares of the financial technology company SoFi Technologies (NASDAQ:SOFI) relinquished some of its gains. Nonetheless, Mizuho Securities analyst Dan Dolev expects SoFi stock to more than double over the next 12 months, implying it could reach $15. While Dolev is optimistic about SOFI stock, the higher interest rate environment poses challenges and could restrict the upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s dig deeper.

SoFi Stock – The Bull Case

Dolev is encouraged by the strength of SoFi’s Tech Platform and Financial Services business. The analyst expects the momentum in these businesses to drive overall growth in the coming quarters. Further, the analyst remains upbeat about SoFi’s loan sales and high execution levels. Dolev recommends buying SoFi on the dip and reiterated a Buy rating on November 9.

Notably, SoFi continues to deliver solid financials despite macro headwinds. Excluding the last quarter, the company has consistently exceeded analysts’ expectations on the bottom line front over the past several quarters. Further, during the Stephens Annual Investment Conference on November 15, SoFI’s CFO, Christopher Lapointe, highlighted that all its businesses are performing well.

He added that the company’s Lending business has been “growing quite nicely and is delivering 60-plus percent margins today.” Moreover, Lapointe pointed out that its Tech Platform business is generating approximately $100 million of net revenue and 36% contribution margins. Further, the firm’s Financial Services segment, which consists of its checking and savings business, has grown significantly to 2 million accounts.

Loan Valuation Concerns Ease

What stands out is that the concerns about SoFi’s loan valuations were adequately addressed during the Q3 conference call. SoFi highlighted that it sold personal and home loans at a premium compared to its fair valuation, which is a positive. Further, the management said that the same buyer will purchase an additional $100 million of loans at a similar 105.1% rate in Q4.

Moreover, the buyer committed to buying $2 billion worth of loans in the future at the same rates. SoFi said it is also in discussion with funds and accounts managed by BlackRock (NYSE:BLK) to carry out a $375 million securitization of loans.

These measures will likely increase investors’ confidence in SoFi’s asset quality.

SoFi – The Bear Case

Despite SoFi’s overall strong performance, there is a potential risk to its loan origination and overall performance in a high-interest rate environment. On October 30, Goldman Sachs analyst Mike Ng expressed similar concerns, reiterating a Hold rating on SoFi stock. Ng specifically highlighted worries about the demand for SoFi’s loan origination and the lack of profitability in the Financial Services segment.

What is the Prediction for SoFi Stock?

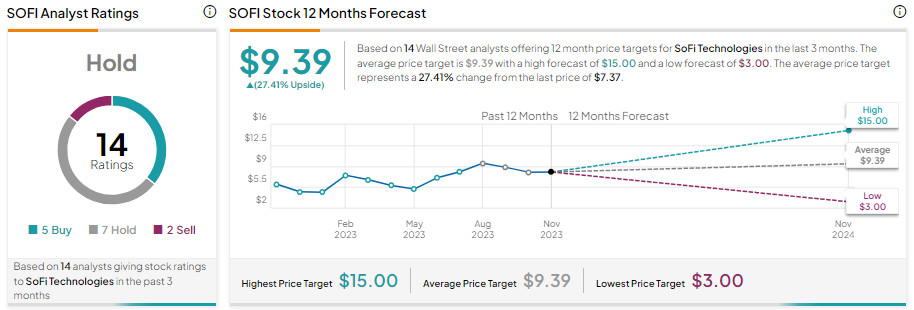

Given the near-term concerns about loan originations, analysts remain sidelined on SoFi stock. With five Buy, seven Hold, and two Sell, SOFI stock has a Hold consensus rating. Further, the average SOFI stock price target of $9.39 implies an upside potential of 27.41% from current levels.

Bottom Line

The ongoing strength of SoFi’s businesses is encouraging. However, the short-term concerns over loan origination remain a drag, which is reflected in analysts’ Hold consensus rating.