The recent meme stock rally has taken many retail investor favorites to the moon of late. Shares of various trending stocks on Reddit and other forums are skyrocketing right now. However, it appears the preferences of retail investors are shifting somewhat of late.

One stock which appeared to enjoy meme stock status previously was Palantir Technologies (PLTR). Recently, though, it that appears the retail investor crowd has steered clear of this name. At least, the volumes and stock chart of PLTR stock don’t indicate there’s a short squeeze on the table right now.

Perhaps for longer-term investors in Palantir it’s better this way. Many view this company as a long-term investment rather than a short-term gamble. With volatility in PLTR stock much lower than we’ve seen in some time, perhaps a consistent move higher can be made. (See Palantir stock chart on TipRanks)

Let’s discuss where this stock may be headed.

A Volatile Journey Leads to Calmness

Palantir’s journey as a publicly-traded company began way back when, in September 2020. The company came to public via a direct listing at an initial reference price of $7.75 per share.

Now, for investors who got in at the IPO, congratulations. This stock currently trades at nearly $25 per share at the time of writing.

The situation changed as Palantir garnered favor among retail investors to a great degree. During the SPAC boom and incidental meme stock rally earlier this year, shares of PLTR stock fetched $45 at their peak. That’s a near-6 bagger for investors who held for just a few months. Not bad.

Since then, shares of PLTR stock have come back down to earth. One month ago, investors could scoop up shares around $18 apiece. Since mid-May, however, shares have climbed back to the $25 level.

That’s quite the rollercoaster ride for investors.

Indeed, this company’s allure with retail investors has ebbed and flowed along with the range of options investors have considered of late. With new potential short squeezes making the list on a seemingly daily basis, it appears the “old guard” is out, and fresh blood is in.

Palantir does have a relatively high amount of short interest presently. Accordingly, there may be room for another squeeze down the road. Nonetheless, for now, it appears investors are lying content with the slow-and-steady gains PLTR stock has posted this past month.

There are a couple of other catalysts that could get retail investors excited about this stock again.

Bitcoin Possibilities and Contract Extension Bullish for Retail Investors

During Palantir’s recent earnings call, the decent numbers the company posted weren’t the headline. Rather, some comments made by CFO Dave Glazer stole the show.

Mr. Glazer indicated to investors that the company may include Bitcoin as part of its longer-term plans. He said he’s “open to business” when it comes to exploring how Bitcoin might fit into the company’s plans. Whether that meant holding Bitcoin, or accepting Bitcoin as payment, it’s clear the company’s executives are thinking about how cryptocurrency might play into the corporate strategy.

Now, given the turmoil in Bitcoin markets in recent days, it’s unclear whether or not Palantir will follow through on officially implementing specific strategies. Large companies like Palantir tend to prioritize capital preservation over what’s trendy. However, with the vast majority of Palantir’s shareholder base contributing non-institutional money, perhaps the company should consider being a friend of the retail investor right now.

Another catalyst retail investors may want to take a look at is the recent extension the CDC granted Palantir to continue the company’s work on disease monitoring and outbreak response. While small potatoes relative to other key contracts on the company’s books ($7.4 million for one more year), a contract is a contract. And building strong relationships with government agencies is key to Palantir’s cash flow growth prospects.

Accordingly, there’s seemingly a lot to like about PLTR stock for the stereotypical retail investor. What ultimately transpires from here remains to be seen. However, this will certainly be an interesting stock for retail investors to watch.

What Analysts Are Saying About PLTR Stock

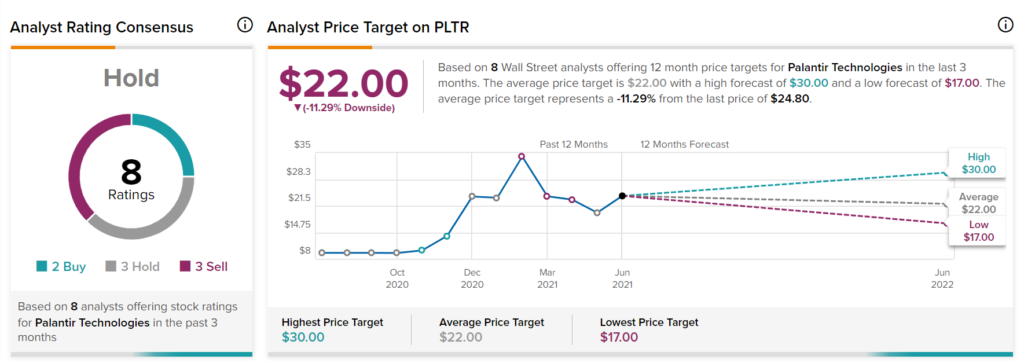

According to TipRanks’ analyst rating consensus, PLTR stock comes in as a Hold. Out of 2 analyst ratings, there are 2 Buy recommendations, 3 Hold recommendations, and 3 Sell recommendations.

As for price targets, the average analyst price target is $22.00. Analyst price targets range from a low of $17.00 per share to a high of $30.00 per share.

Bottom Line

As a big data player focusing on long-term government contracts, Palantir’s allure is mainly with investors seeking stable growth plays in the technology space. Palantir’s fundamentals don’t look particularly appealing at the moment, so this stock appears to be more of a long-term investment for investors on the more aggressive end of the spectrum.

Whether or not retail investors show up en masse to support PLTR stock in the future remains to be seen. However, investors interested in PLTR stock will want to assess this company on the basis of its fundamentals first. On that count, it may make more sense to wait on the sidelines with this one right now.

Disclosure: Chris MacDonald held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.