Microsoft (NASDAQ:MSFT) and the rest of the Magnificent Seven are off to a relatively slow start to 2024. Undoubtedly, the “Mag 7” has been referred to by some outlets as the “Lag 7,” a name I do not believe is warranted in the slightest. It’s only been one week of trading, after all. And though a weak start isn’t a great indicator of what’s to come for the rest of the year, I do think the stage could be set for continued gains going into year’s end.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Undoubtedly, Microsoft stock is hardly the biggest laggard of the “Mag 7” cohort. The unenviable title of biggest 2024 laggard goes to Apple (NASDAQ:AAPL) so far, thanks to two untimely downgrades from big-name analysts on Wall Street.

Though some investors may be inclined to think Apple, the world’s largest company, stands to drag down the rest of the market, I’m inclined to believe that AI-savvy firms, like Microsoft, have what it takes to roll with the punches and perhaps maintain its magnificence in the early innings of this mildly bearish start to the year. For this reason, I’m staying bullish on MSFT stock.

Microsoft: AI is Still the Name of the Game in 2024

Through 2023, Microsoft has stood tall, delivering AI news and innovations that investors applauded throughout the year. Indeed, Microsoft Copilot (the firm’s AI assistant) has proven quite useful. With new Windows PCs to sport the “Copilot” key, users have never been this close to a powerful generative AI.

This year, I believe Microsoft (and other tech firms) will try to remove even more friction between users and their generative AI platforms to help entice greater usage from those who would have otherwise gravitated toward a search engine.

Indeed, it’s hard to break a habit of going straight to a search engine with one’s questions. Whether a physical button on new devices and the inclusion of Copilot on Windows operating systems change this remains to be seen. Personally, I believe a strong case can be made for the new Copilot button being as useful as the Netflix (NASDAQ:NFLX) button on modern-day television remote controls.

In any case, don’t expect Microsoft to pull its foot off the AI gas in the new year.

Microsoft Stock: What About Its Valuation?

Though the AI narrative has been priced in for a while now, I think there’s room for Microsoft to deliver a bit more in the way of surprises, especially when it comes to the actual numbers themselves. This year, we’ll get a glimpse of just how much AI can add to the bottom line and perhaps more guidance on what to expect over the longer term. The trillion-dollar question remains: can Microsoft grow into its swollen valuation with its impressive slate of AI tech and talent? Many analysts think it can.

At writing, shares of MSFT go for just shy of 36 times trailing price-to-earnings (P/E). That’s a nearly 15% premium to the stock’s five-year historical average P/E of around 31.6 times. Given Microsoft’s AI edge, a premium is warranted. In my view, a premium north of 25% may not be all that absurd, given AI’s longer-term impact on the company’s bottom line.

Jefferies analyst Brent Thill thinks Microsoft could continue to gain this year, with his price target of $450.00 entailing more than 22% upside from Friday’s close. Thill went as far as to say that Microsoft boasts the “best AI lineup in software.” I couldn’t agree more. Microsoft pretty much kicked off the AI frenzy a year ago, after all, with its stake in OpenAI and the advent of Bing AI.

Is MSFT Stock a Buy, According to Analysts?

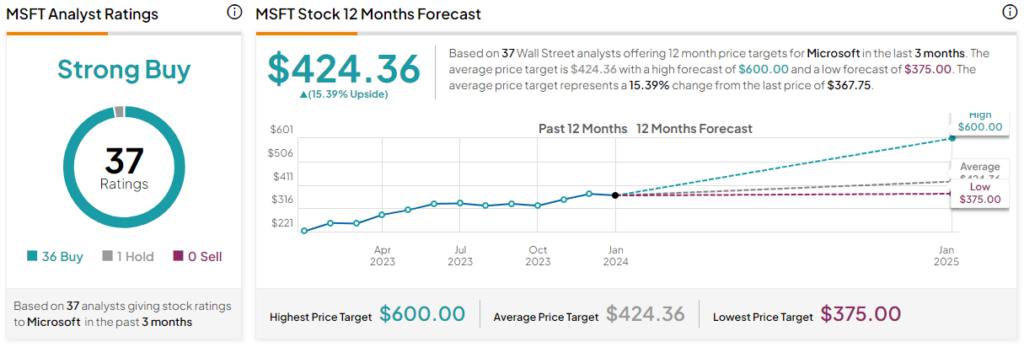

On TipRanks, MSFT stock comes in as a Strong Buy. Out of 37 analyst ratings, there are 36 Buys and one Hold recommendation. The average MSFT stock price target is $424.36, implying upside potential of 15.4%. Analyst price targets range from a low of $375.00 per share to a high of $600.00 per share.

Despite last year’s magnificent gains (MSFT soared around 60%, outperforming the Nasdaq (NDX)), Microsoft still seems primed for even more upside. The highest price target of $600.00 (entailing more than 63% gains from current levels) comes courtesy of Truist Financial’s Joel Fishbein.

Indeed, a lot needs to go right for Fishbein’s target to come true in 2024. As analysts rush to raise the bar on their price targets for the year, I don’t view the Street-high target as far-fetched in the slightest.

The Takeaway: MSFT Will Likely Stay Magnificent in 2024

As Microsoft continues adding to last year’s strengths, I expect it’s just a matter of time before the software giant snags the title of “world’s largest company by market cap” right out of Apple’s hands. Apple’s in a funk right now, with less clarity on its AI plans.

For Microsoft, it seems to have the clearest AI roadmap of the Magnificent Seven. And for that reason, I expect it to stay magnificent in 2024.