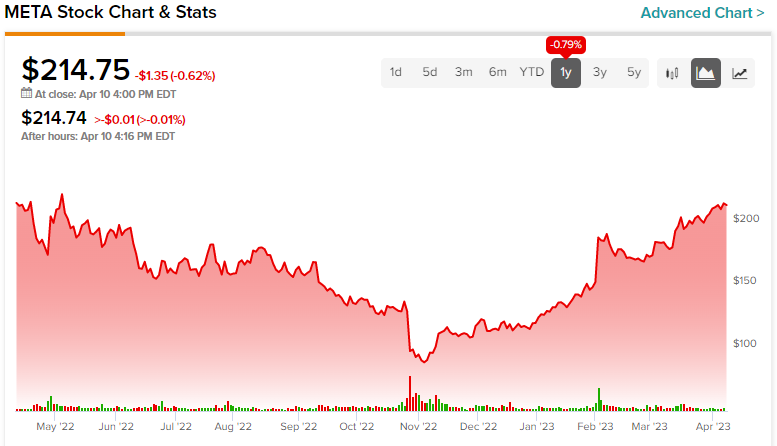

It’s been a blistering rally for Meta Platforms (NASDAQ:META) stock, which has gained more than 140% since bottoming out back in November 2022. Unless you reached out to catch the falling knife that was Meta Platforms stock, though, odds are you missed the exact moment when the momentum turned a corner. Though challenges are ahead with a recession approaching, I think Meta’s “year of efficiency” could help the firm top expectations in an “off” year for the economy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Count CEO Mark Zuckerberg out, if you will, but he’s still got the tools to drive Meta’s next leg higher. As such, I remain bullish.

Don’t Rule Out a March to New Highs

The stock hasn’t just ricocheted off the bottom in some sort of dead cat bounce. Meta has been one of this year’s top performers, with shares currently up around 72% year-to-date. Indeed, the easy gains seem to have already been made.

Still, there’s a lot of room to run if shares are to recover all of the ground lost (around 76% was wiped out) during the 2021-22 sell-off. As Meta inches closer to the halfway point between peak and trough, questions linger as to what the next big move will be. Personally, I think it will be higher as Meta looks to do its best to optimize margins in a rocky environment while being more prudent with forward-looking projects.

Undoubtedly, Meta’s layoffs have spread across various segments of the business. After its most recent round of cuts, Meta has now slashed around 20,000 jobs. That’s among the most of the FAANG cohort.

Even as ad growth slows at the hands of macro headwinds, considerable cost savings and the recession-resilient characteristics of the social-media Family of Apps could set the stage for a much brighter medium-term future than many expect.

Indeed, you can’t simply cost-cut your way to prosperity in a recession. In the meantime, however, I do think Meta is improving its chances of hitting profitability targets that may be a tad higher than that of analyst expectations.

Argus Research recently upgraded the name to a Buy, with a $270 price target. Argus is a fan of management’s “prudence” and its ability to “improve profitability.” Argus doesn’t stand alone, with several increasingly-bullish analysts raising the bar on their price targets over the past few weeks.

Meta Platforms Looks Well-Equipped to Weather a Recession

In the business of social media, the user is the product. In tougher times, I’d be willing to bet that consumers would much rather spare their data than pay a monthly subscription. Facebook, Instagram, and WhatsApp cost nothing to their users.

As a result, a recession shouldn’t severely impact use like with most other paid entertainment platforms. If anything, more pinch on wallets should lead to more use of “free” services as subscription cancellations become the new norm.

In prior pieces, I touted Meta Platforms as a recession-resilient tech company. I still think Meta is one of the best-positioned FAANG companies to weather a recession storm.

Sure, ads will continue to feel the pressure, but the firm may have the means to attract more users. And as it enhances its platform (with hot video-based features like Reels), new users could “stick” well after a recession ends.

As Zuckerberg and company move forward with their “year of efficiency” while regulators contemplate the ban of TikTok, I think Meta has a lot of levers it can pull to better thrive in a tougher economy.

From the Metaverse to AI

Meta is still setting its sights on the Metaverse, but it’s also getting in on the artificial intelligence (AI) action. Between now and the day the Metaverse takes off, there are significant opportunities to monetize through the effective use of AI.

Recently, Meta unveiled a new AI tool that can spot individual items in an image. The SAM (Segment Anything Model) could be a big deal for Meta as it could help reduce moderation costs over time and open new doors to better-tailor content to users.

Looking ahead, expect more such tools to be introduced over time. Meta is very much in the AI game, and it may be able to easily monetize its AI offerings across its vast network of billions of users.

Given the possibilities, I’d argue that META stock’s 22.35 times forward price-to-earnings (P/E) multiple — roughly in line with its five-year historical average P/E of 22.8 times — is worth the price of admission.

You’re getting a cash cow of a social-media business, a foot in the door of the Metaverse, and impressive AI talent. With its massive network, Meta can easily monetize its latest technologies more effectively than its peers.

Is META Stock a Buy, According to Analysts?

Turning to Wall Street, META stock comes in as a Strong Buy. Out of 49 analyst ratings, there are 40 Buys, six Holds, and three Sells.

The average META stock price target is $231.77, implying upside potential of 7.9%. Analyst price targets range from a low of $110.00 per share to a high of $305.00 per share.

The Bottom Line on META Stock

Meta’s run has been impressive, but it’s backed by improving fundamentals, making it attractive. As the firm — which could be as much of an AI play as a metaverse play — becomes more selective with its spending, it may be tough to stop Meta’s rally in its tracks.